Today's Signals for the AUD/USD pair

- Risk 0.75%

- Trades must be taken between 08:00 New York time and 17:00 Tokyo time today.

Buy trading ideas:

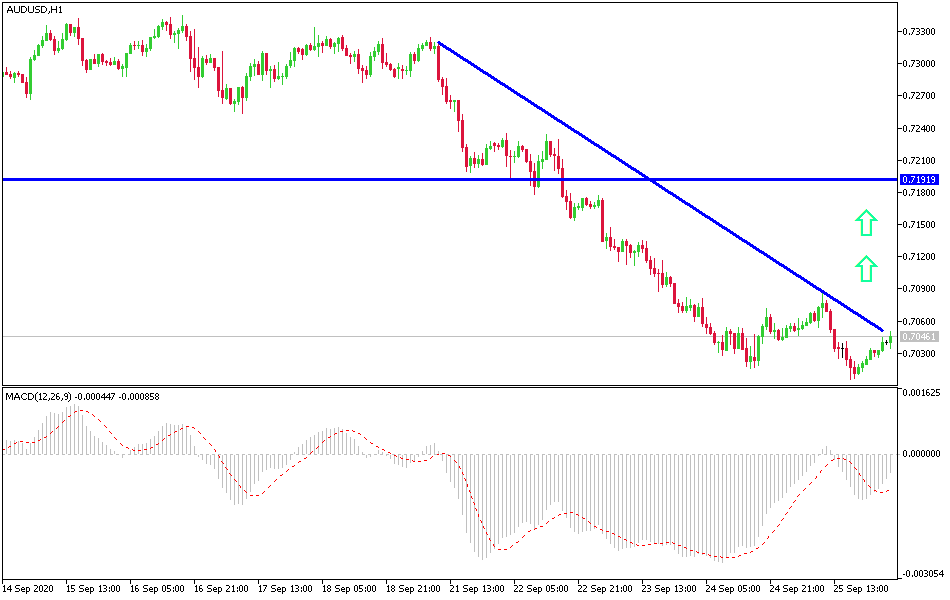

- Buying position after the bullish price action reversal on the H1 timeframe, immediately after the next touch of 0.7080 or 0.7140.

- Place stop losses at one point below the local swing low.

- Move your stop loss to break even when the trade is in 20 pips of profit.

- Take 50% of the position as profit when the trade is in 20 pips of profit and allow the remainder of the position to run.

Sell Trading Ideas:

- Sell position after bearish price action reversal on the H1 timeframe immediately upon the next touch of 0.7010 or 0.6960.

- Stop losses at one point above the local swing high.

- Move your stop loss to break even when the trade is in 20 pips of profit.

- Take 50% of the position as profit when the trade is in 20 pips of profit and allow the remainder of the position to run.

The best way to define a "price action reversal" is for an hourly candle, such as a pin, doji, outside or even a vertical candle, to close higher. You can take advantage of these levels or areas by observing the price action that occurs at these levels.

AUD/USD analysis

As I mentioned previously, risk aversion, restrictions to contain the new COVID-19 outbreak, and the drop in commodity prices are all combined factors that were a good reason to sell the AUD/USD during last week's trading, reaching the 0.7005 support, the lowest level for the pair in two months. The pair is struggling a lot to prevent the bears from crossing the 0.7000 psychological support, which is an important symbol of the extent of control over performance. The pair is stabilizing around 0.7045 at the time of writing.

We are 40 days away from the 2020 presidential election, with President Trump's popularity slowly increasing despite the increase in COVID-19 cases. Despite the rejection rating rose briefly when the rating rose briefly to a three-year high of 56.4%, this slowed down as the popularity rating slowly rose from the previous year's low from 40.2% to 42.8%.

Back to Australia, Victoria is the second largest Australian populous state and the epicenter of the country's coronavirus outbreak is working to accelerate the easing of social distancing restrictions as infections slow to less than 20 cases per day. Victoria reported 16 new cases of coronavirus on Saturday and placed nearly 5 million Victorian residents under one of the strictest lockdown restrictions since August. With cases falling below a one-day high of more than 700 reported in August, Daniel Andrews said some restrictions, including a night curfew, would be removed immediately.

The remaining restrictions will also be eased, with restrictions easing after cases reach specific triggers. Previously, the Australian prime minister said that many of the current restrictions will remain until November. The exact timetable for easing restrictions across Melbourne is a major boost to the ailing Australian economy. The COVID-19 crisis in Victoria has affected any hopes of a rapid economic downturn as Australia enters the first recession in 3 decades and the effective unemployment rate has surpassed 10%.

This is an immediate boost to the Australian economy, as the state indicated that 127,000 employees will be allowed to return to work on September 28, which is 30,000 more from the previous plan announced earlier this month.

From a technical perspective: Since the AUD/USD pair reached its highest level at the 0.7413 resistance, it recently fell by 5% and briefly tested the 0.7005 support. What happens here may be essential to the pair’s future. A breach of this barrier with following up is a signal to investors that the underlying confidence in the AUD/USD trend is lacking. Therefore, the bearish sentiment may start to increase and thus push the pair down further as silver and gold prices weaken due to the suspension of stimulus negotiations and the return of the US dollar's strength.

Also, a bounce from 0.7018 may send a confidence signal to a level that investors will interpret as signs that the pair is not ready to rise. In this case, the AUD/USD pair might rise, but gains could be concluded at a similar but very formidable resistance zone between 0.7181 to 0.7206 levels.

The pair is not expecting any economic data or important events during today's trading session.