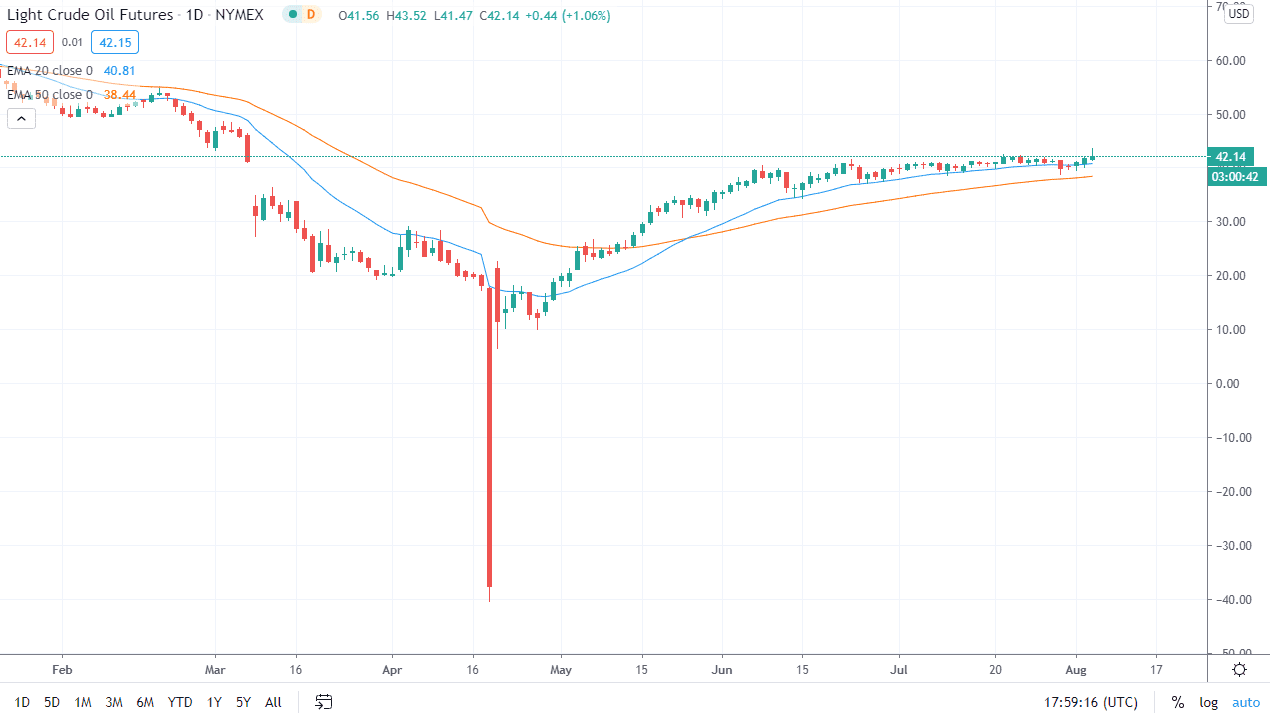

The West Texas Intermediate Crude Oil market rose during the trading session on Tuesday but gave back quite a bit of the gains to turnaround and form a bit of a shooting star. Ultimately, this is a market that I think will continue to go higher based upon the US dollar falling in value overall. After all, that is the absolute basis for inflation, which we are starting to see out there, despite the fact that central bankers will tell you otherwise. The falling value of the US dollar means that it costs more to buy a barrel of oil, at least in this case.

The shooting star is a negative candlestick, but ultimately there is a lot of support underneath that I think continues to come into play. The inventory number came out much better than anticipated during the trading session, with a drawdown of 7.4 million barrels, but at the same time, there are still concerns when it comes to usage and more importantly demand. If that is going to be the case, then it makes quite a bit of sense that we will see a lot of back-and-forth trading. Ultimately, this is a market that I think continues to grind higher, perhaps reaching towards the $49 level eventually. This takes a while to get there in my estimation, and I think we continue to look at a short-term “buy on the dips” type of mentality. We did see a lot of bullish pressure initially during the day but have also seen a lot of profit-taking.

Underneath we have the 20 day EMA offering support, and then after that, we have a significant amount of support at the 50 day EMA. There is probably a bit of a “zone of support” between the two, so at this point, I do not have any interest in trying to short this market. That will continue to be the case with this market because of the US dollar falling apart which continues to lift all commodities, not just this one. As far shorting is concerned, if we break down below the $30 level, I would be interested but we are light years away from that happening so I think that eventually we will test that major sell-off near the $49 level.