The West Texas Intermediate Crude market did fall initially during the trading session on Thursday but recovered after several OPEC oil ministers had positive comments for the outlook when it came to demand for the product. Obviously, they are talking their book, but the markets always do tend to react relatively positively to those types of comments. Beyond that, there are a multitude of crosswinds right now when it comes to the oil markets, so this explains a lot of the action we have seen as of late.

In Washington DC, they still are trying to kick around the idea of a “skinny deal” when it comes to the stimulus, which could drive up demand for crude oil. However, they have not accomplished anything quite yet, so it is still a slightly negative factor. Furthermore, the US dollar did recover a bit during the trading session on Wednesday, and that seems to be working against the short term value of crude oil as well.

On the other hand, there is talk of infection rates going lower, so in theory, the demand could go higher for crude oil, something that the market desperately needs. If we can get the economies to reopen to anything remotely close to previous levels, that should have crude oil rallying quite strong. However, the US and China are still deadlocked in tensions, and that could put a bit of an anchor around the neck of global growth in and of itself. Because of this, although oil does look positive in general, I have to say that I would tamper down any expectations of a big move.

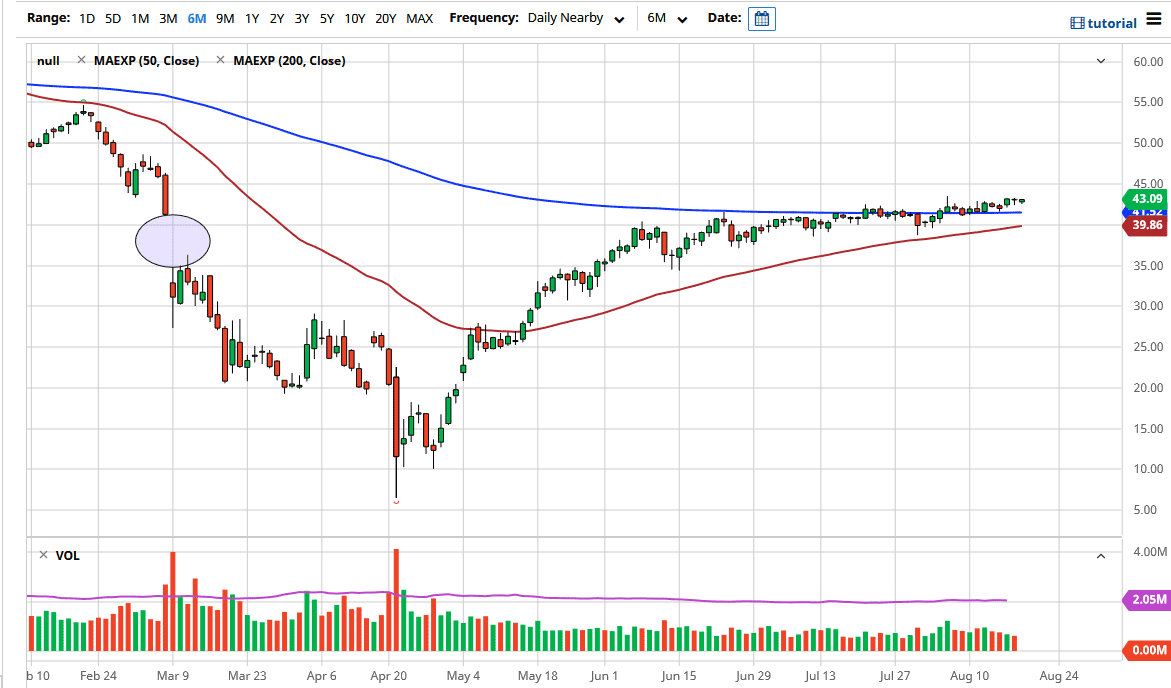

The 200 day EMA is down near the $41.50 level, and I think that offers a nice short-term floor in the marketplace. Below there, we have the 50 day EMA which is sitting just below the $40 handle as well. As long as we can stay above one or both of those moving averages, I believe that longer-term the market will probably try to go towards the $49 level above, which was the scene of significant selling previously. However, if we were to break down below the 50 day EMA and then by extension the $40 level, that could cause a little bit of selling pressure in this market to push towards the $35 level. In the short term though, we continue to see plenty of opportunities on short-term charts to buy the dips and take quick profits.