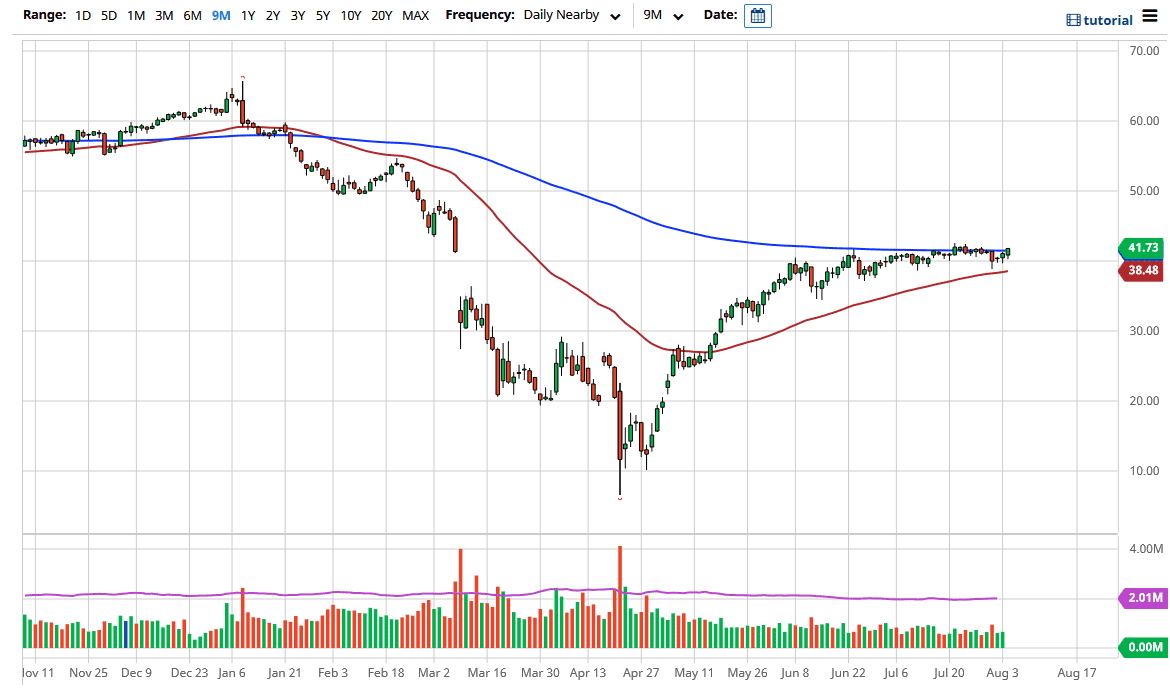

The West Texas Intermediate Crude Oil market initially pulled back during the trading session on Tuesday before turning around to show signs of strength. The $40 level looks to be very supportive, just as the 50 day EMA underneath would more than likely offer quite a bit of support as well. Short-term traders continue to look for opportunities on short-term charts, but we have not been able to take off to the upside. If we can finally break out to the upside, then it is likely that we will continue to go even higher.

In the short term though, it is likely that the market continues to see a lot of volatility going forward, and therefore you probably have to take these moves for short-term trade more than anything else. It is difficult to imagine a scenario where we simply buy-and-hold, although that could be coming. We need to see some type of impulsive candlestick to the upside that breaks to a fresh new high and perhaps closes towards the very top of the range of the day in order to feel comfortable. At this point, you have to look at the $40 level as being very important, as the market most certainly is. The question is not so much as to whether or not the market can continue to go higher, but whether or not the United States dollar is going to continue to lose value. If it does, then it is likely that the crude oil markets will continue going higher. The market breaking down below the 50 day EMA would be very negative, which is at the $38.49 level. If we do break down below there, then it is likely we go looking towards the $35 handle.

We are more likely to go up than down, but if we break higher than I think the target is likely to go looking towards the $49 level. The $49 level probably extends to the $50 level as far as resistance is concerned, and a break above that level would obviously be extraordinarily bullish. I do not see that happening anytime soon, and I think that we will probably continue to see a “buy on the dips” type of short-term market. That being said, the market is likely to continue to look bullish but sluggish at the same time.