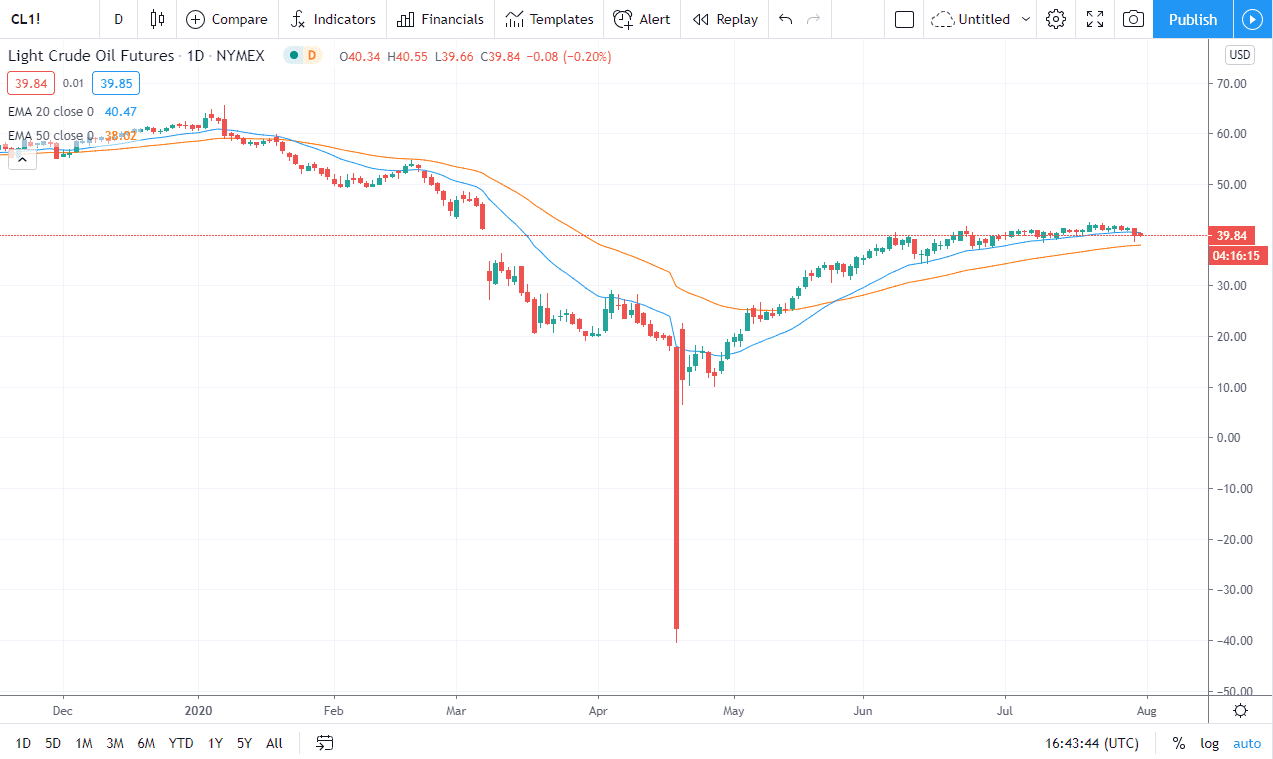

The West Texas Intermediate Crude Oil market dropped a bit during the trading session on Friday, as we continue to see a lot of noise. That being said, the market is likely to see a pullback towards the 50 day EMA where buyers would come back into play. There is a general amount of support between the 20 and the 50 day EMA that should continue to cause buying pressure. If we break down below the 50 day EMA, then it is likely that we go even further to the downside, perhaps reaching down towards the $35 level. Underneath, the $30 level is a level that of course will offer significant amount of support as well. Having said that, if we were to reach down towards that area it is likely that we will see a bit of a flush lower.

To the upside, if we can break above the recent highs from the previous week, then we could go looking towards the $49 level. The $49 level is the beginning of significant psychological resistance that extends to the $50 level, which of course catches a lot of attention. With this, the market is relatively quiet, but I have to start looking at this as to whether or not we are rolling over or perhaps even slumping? There are a lot of things to play right now, not the least of which is the US dollar.

With the Federal Reserve out there working against the value of the greenback, that has pushed up commodities in general, as it typically does over the longer term. While the central banks around the world refuse to use the word “inflation”, but the reality is that if the US dollar continues to get hammered, that will drive up the price of commodities, crude oil included. We have seen the US dollar gained a bit in strength over the last 48 hours, so that of course will put downward pressure in this market, not to mention the fact that there is probably still very anemic demand for the commodity as well. After all, airline travel alone being asked that as it is putting a significant drag on overall demand. All things being equal, I think we are still trying to figure out what to do with this market longer term, so I expect more range bound trading than anything else.