The West Texas Intermediate Crude Oil market went back and forth during the trading session on Thursday as we continue to simply kill time in order to figure out what to do next. Ultimately, this is a market that will have to make a bigger move sooner or later, because it cannot sit still forever. However, there are so many different crosswinds when it comes to the crude oil market that it is difficult to imagine that it is going to be a clean move one way or the other.

The US dollar falling has been a major driver of the crude oil markets rallying, because people are buying commodities instead of holding onto fiat currency which is currently falling apart. That being said, we also have to worry about the overall consumption of crude oil and whether or not people are actually going to use it. Right now, that seems to be very unlikely but at this point anything is possible. The economic recovery is slow to say the least, so I think that demand will continue to be a major problem. Ultimately, if we can break out to the upside, we will probably run into the $49.00 level which is significant resistance. That resistance extends to the $50 level, so you will need to pay close attention to that area if we do get up there.

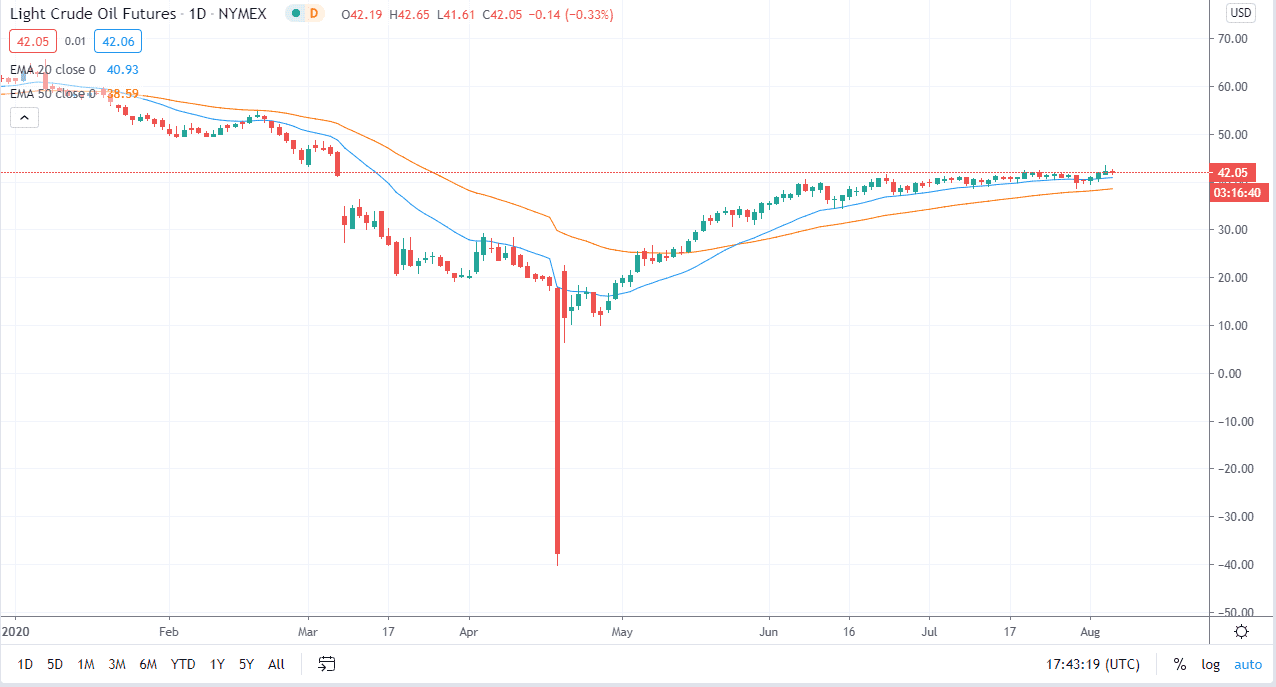

To the downside, the 20 day EMA should offer support, just as the day EMA will underneath. There is a significant amount of support between the two moving averages, so I think this continues to be a “buy on the dips” type of opportunity. All things being equal, this is a market that seems to fail to break down with any type of regularity, so therefore I think that the buyers are simply waiting to push higher. Having said that, there is no reason for it to rally other than the US dollar, which in and of itself is not reason enough to buy crude oil. What we need to see is economic expansion in order for the market to truly take off to the upside, and right now we simply do not have it. The market will continue to be very choppy back and forth, so keep that in mind. However, if you are a short-term trader you may be able to make a certain amount of money playing short-term charts. The Non-Farm Payroll announcement comes out during the day, so that of course could cause a lot of volatility.