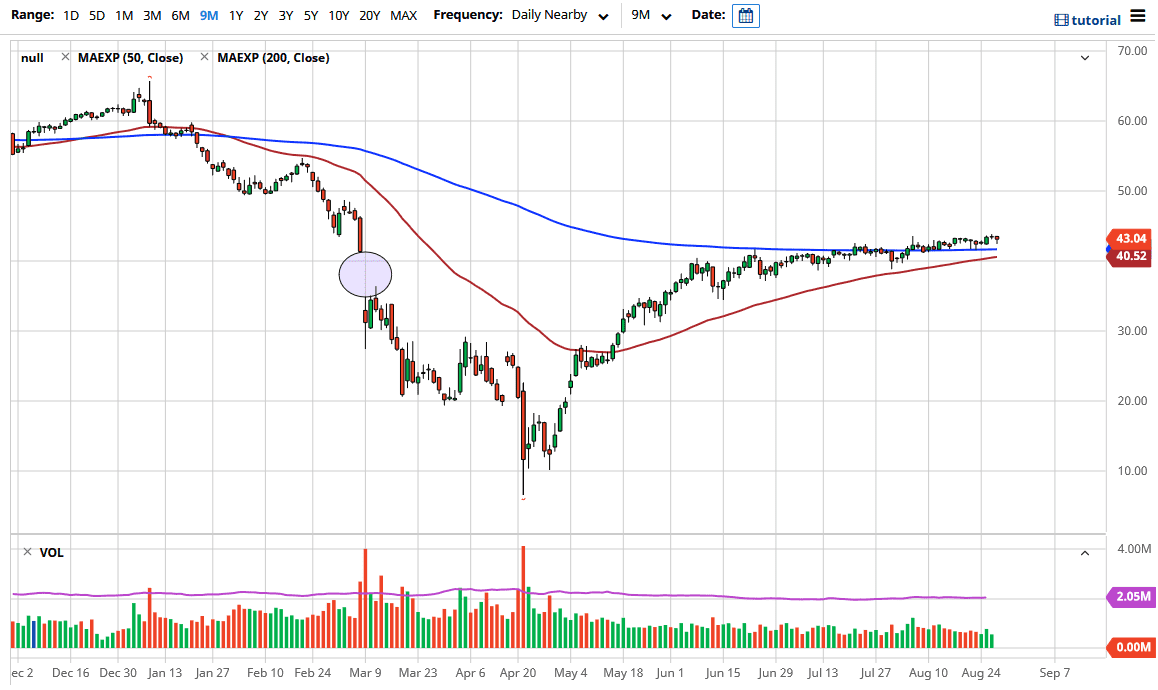

The West Texas Intermediate Crude Oil market has gone back and forth during the trading session on Thursday, bouncing enough to turn around and form a bit of a hammer. The hammer of course is a bullish sign and it is likely that we will continue to see plenty of interest in this market every time it dips on a short-term chart. I think that the 200 day EMA underneath will offer a significant amount of support as well, and one of the main drivers of this market is going to be the US dollar, probably more than anything else.

Looking at this chart, it has been a slight grind higher and I think it is only a matter of time before we continue to see this continue into what should be a bigger break out. However, this is a market that need some type of catalyst, and as we are in the midst of vacation season, there may be a serious lack of interest when it comes to trading in general. However, we have been grinding higher more than anything else, and I have made quite a few trades on short-term dips based upon the 15 minute timeframe. I find it difficult to put serious money to work though, so this is more or less just a scalping market at this point.

To the downside, the 50 day EMA is supported near the $40 level and therefore I think if we break down below there we need to start thinking about shorting. Until then though, there is no reason to. You can see that every time we have fallen just a little bit, the buyers have come back into pick this up. I think that will continue to be the case, because we have the hurricane that is shutting down production in the United States, but we have a falling US dollar which is probably even more important. After all, demand is something that just is not that strong currently.

To the upside, I believe that the $49 level will be a target, as it was an area of extreme supply. I think that supply extends to the $50 level, so it is can it take something rather special to break above there. In the meantime, I think that is probably where we find ourselves by the end of the year.