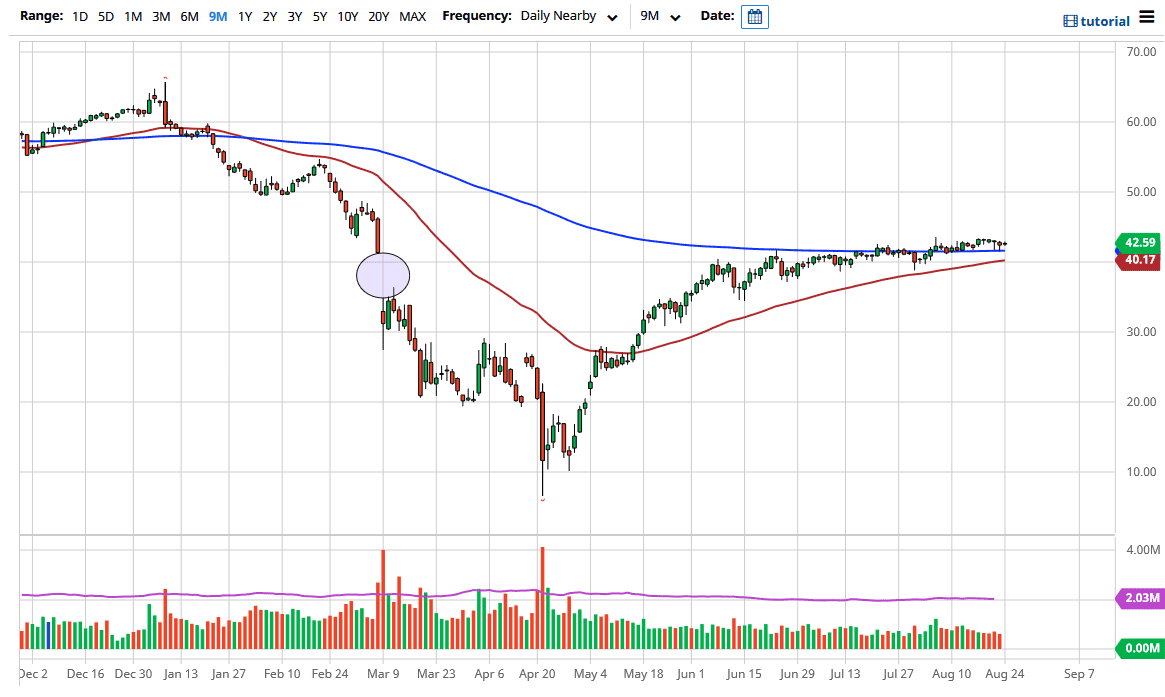

The West Texas Intermediate Crude Oil market continues to be very uninspiring, as we simply go sideways. At this point in time, it looks as if we simply grind higher, perhaps trying to break out to the upside but this could take quite some time. The 200 day EMA is sitting just below and it should continue to show plenty of support. Furthermore, I think there is support down at the 50 day EMA as well, which sits at the $40.17 level.

Ultimately, I believe that short-term pullbacks will continue to be attractive for short-term traders, but if you are looking for some type of bigger move, you might be waiting for a while. After all, there is a plethora of things moving the crude oil markets right now that are conflicting to say the least. The US dollar has been falling for some time, and that has lifted the crude oil market a bit. However, the same market has to deal with the fact that most of the economy is somewhat shut down, and demand just is not there.

However, you should also keep in mind that the Gulf of Mexico is dealing with a couple of tropical storms at the same time, shutting down massive amounts of production. Off the top of my head, I would say it somewhere near 30%. Again though, if nobody really wants crude oil, then it is somewhat limited in its upside. I think at this point in time we are more than likely going to see more of a “buy on the pullbacks” type of trading situation by with limited volatility.

If we were to break down below the 50 day EMA, then it is likely that the market may go a bit further to the downside, may be as low as $30 over the longer term, but I would think that there would probably be an attempt to save the market at the $35 level. However, if we do break out to the upside that is likely we go looking towards the $49 level, which is the beginning of significant resistance that extends to the $50 handle. Either way, in the short term I think you just simply go back and forth on five minute charts and collect what the markets willing to give you. I would look for much as we are in the midst of the vacation season anyway.