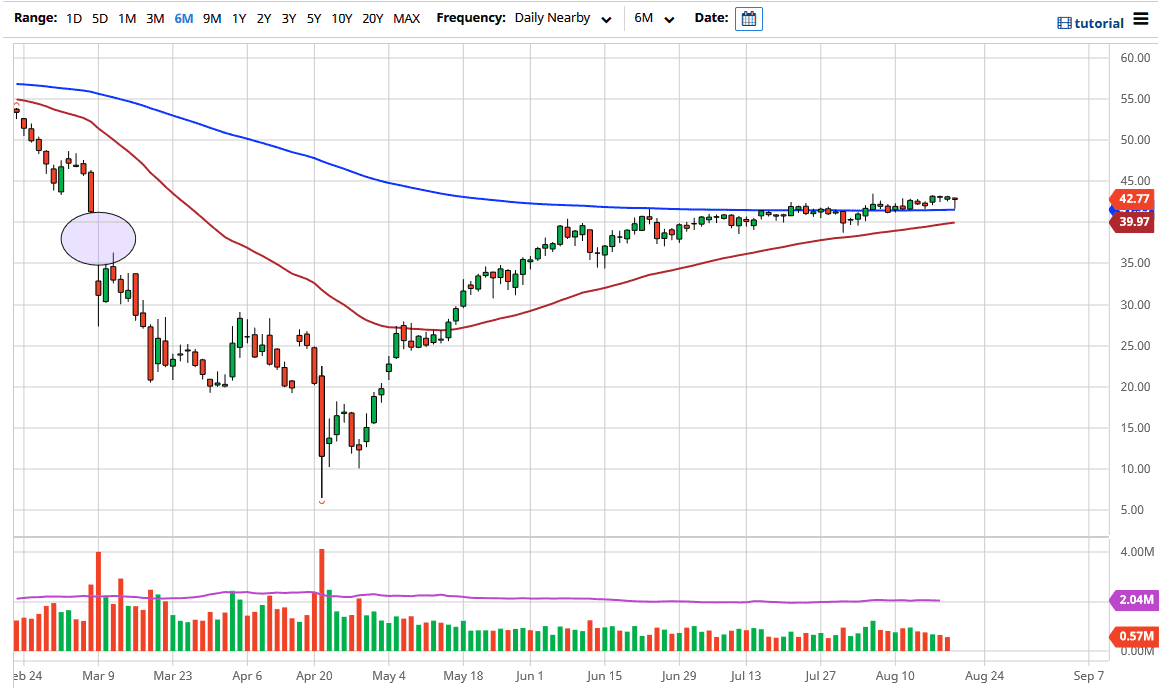

The West Texas Intermediate Crude Oil market has pulled back initially during the trading session on Thursday on a stronger US dollar and of course there are a lot of concerns out there about the spike in coronavirus cases in the European Union. In other words, it is not just the Americans that are seeing more infections, and this of course has a massive effect on the possibility of demand. That being said, we have seen the US dollar fall a bit during the end of the session, thereby allowing the market to form a bit of a hammer. The hammer sits right on top of the 200 day EMA, so that is yet another reason to think that we may continue to rally.

There are a lot of concerns out there when it comes to demand and of course the increase in coronavirus numbers will not do anything to dissuade that type of fear. All things being equal though, this is a market that continues to grind higher and I have been saying for days now that short-term dips continue to offer short-term buying opportunities. We have seen that play out quite handily during the trading session on Thursday, but you can see that about multiple days going back a couple of weeks now. Crude oil is being supported by the OPEC plus meeting that has had the members cutting production, and so far, they have stuck to that plan. Furthermore, it is the US dollar falling that has continued to help. All things being equal, I think the market is trying to grind its way towards the $49 level, which is where we had seen a major breakdown previously.

To the downside, it is not until we break down below the 50 day EMA that I would be worried about the grind higher, which happens to sit at the $40 level as well. That is a large, round, psychologically significant figure and it should be noted that the West Texas Intermediate Crude Oil market tends to move in $10 increments anyway. With this, I like buying short-term dips and picking up short-term gains. That has worked out quite nicely over the last several weeks and until we get through vacation season, which could be another couple of weeks, it is very likely we just grind higher in a very slow and methodical manner.