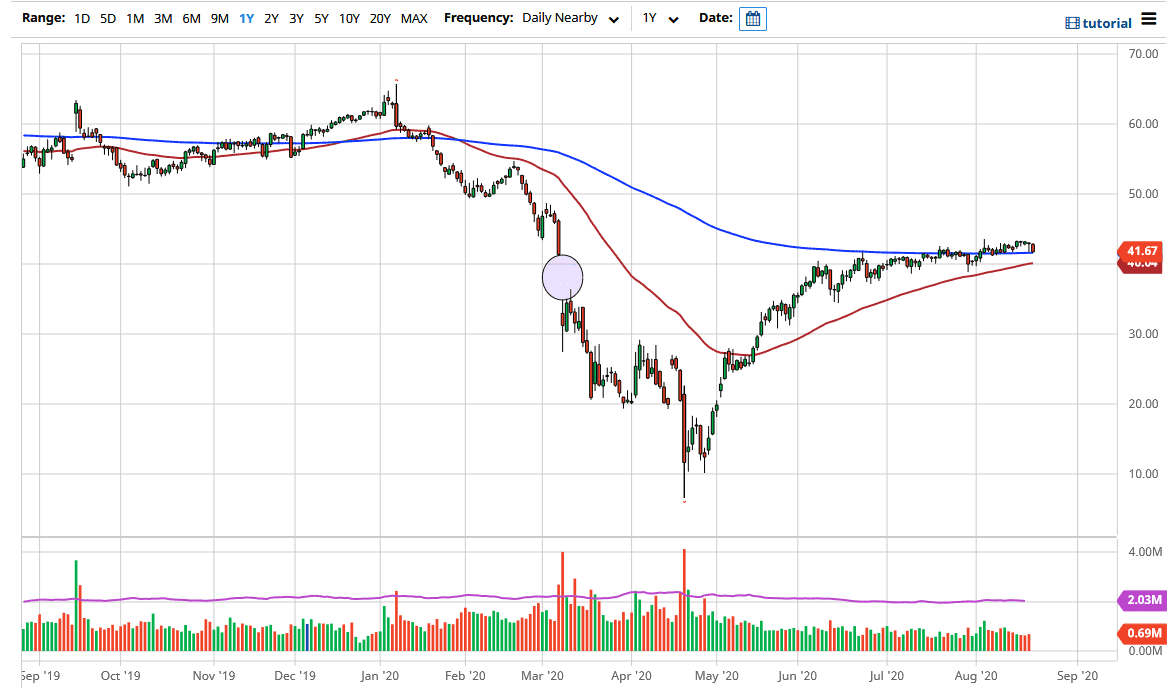

The West Texas Intermediate Crude Oil market has pulled back during the trading session on Friday, reaching down towards the 200 day EMA just below. Ultimately, this is a market that looks likely to see a lot of reaction to the US dollar. If the US dollar has strengthened, that will work against the value of the crude oil market. The 200 day EMA sitting just below will attract a certain amount of attention, but even more importantly is the fact that the 50 day EMA is underneath there, so at this point in time it is likely that the entire area is going to be a “support zone.”

If we were to break down below the 50 day EMA, then I think the market could unwind quite a bit. This would probably coincide with a strengthening US dollar, something that we have seen on Friday and are starting to see rumblings of some type of oversold bounce. The question now is whether or not we will see some type of significant bounce to cause problems in commodities in general. After all, the market has seen a lot of US dollar selling, so it does make sense that we would see a little bit of a snapback. Having said that, I think it is only a matter of time before we have to make a bigger decision when it comes to the Forex markets.

With the Federal Reserve out there pumping liquidity into the system, it is possible that the US dollar finally falls apart for a bigger move, but in the short term it does not look likely to happen as we have seen several currencies around the world pulled back against the greenback. It is simple, if the US dollar is stronger, it will take less of those greenbacks to buy a barrel of oil, if the US dollar falls, then it is possible that the commodity markets will become more expensive because it will take more of those same greenbacks to buy a barrel. Either way, I think we are sitting on top of massive support so some type of a bounce on the short-term charts should offer a nice opportunity for a short-term trade. If we break down below the 50 day EMA, then I think we go looking towards the $35 level underneath where we will see some strength.