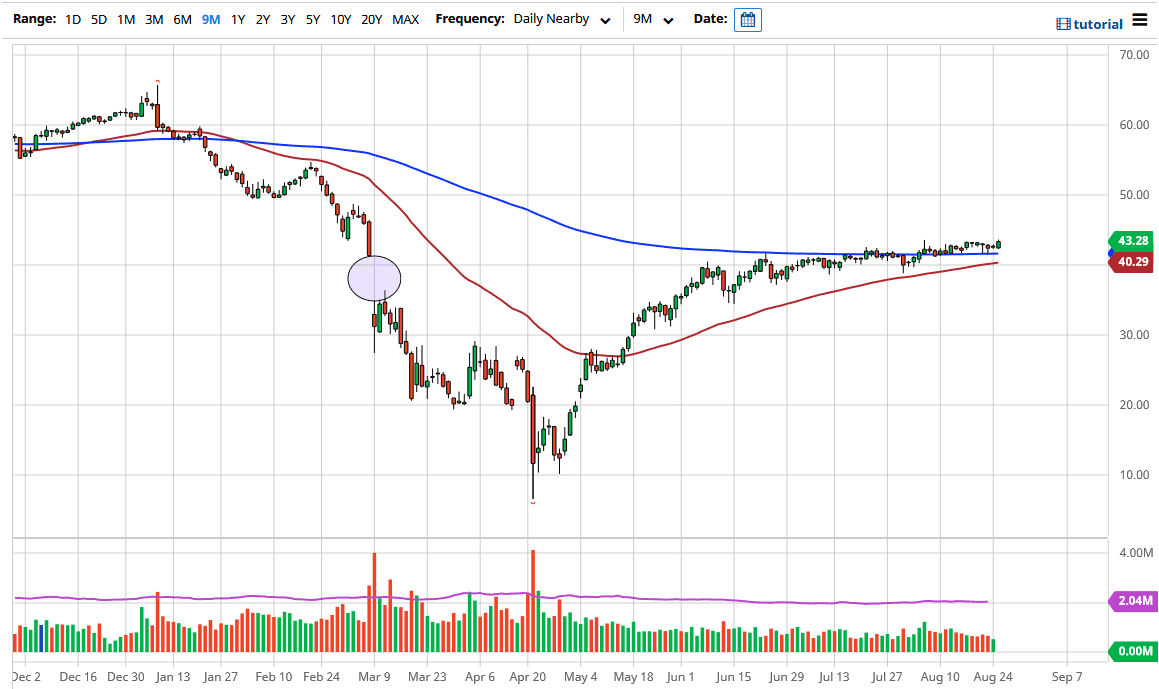

The West Texas Intermediate Crude Oil market has rallied during the course of the trading session on Tuesday, as the 200 day EMA underneath continues to offer support. Ultimately, I think that this is a market that will continue to find buyers on dips. Therefore, it is likely that we will continue to see more bullish pressure, perhaps due to the US dollar shifting a little to the negative side, or perhaps it is the idea that OPEC may actually stick to production cuts and thereby drive down supply.

Another thing that has recently come to the forefront is the fact that there are a couple of tropical storms in the Gulf of Mexico right now, threatening to shut down production, and in fact have shut down about 45% of production in that region. The market is likely to continue to favor buyers, not only because we have those positive factors, but because we are in an uptrend, to begin with. Granted, it is a very slight uptrend, but it is most certainly in an uptrend. What is interesting about the candlestick on Tuesday is that we closed towards the highs. This tells me that we may be getting close to a major breakout to the upside.

Pullbacks at this point will continue to see a lot of support at the 200 day EMA, and I would be a buyer on the first sign of a bounce in that area, assuming we even get there. The $49 level above was the scene of a major breakdown, and I think that is where we are going. There is a significant amount of supply between the $49 level and the $50 level, so it is likely that we would struggle to break above there. I think that makes a nice target, but we need some type of catalyst to really get this thing moving. Otherwise, we are just going to continue to grind higher, and eventually get to that level.

As far as selling is concerned, I have no interest in doing so unless we break down below the $40 level, which would show a major turnaround in attitude. If that is going to be the case, then it is likely that we will see this market break down quite significantly. However, as stable as this market has been it would take some type of major announcement.