The West Texas Intermediate Crude Oil market rallied just a bit during the trading session on Monday to kick off the week, as we continue to see the US dollar look a bit soft in general. At this point, the 200 day EMA is sitting right here where price is, albeit just below, but at this point in time it is likely that the currency markets will continue to be the main driver of this market, simply because the US dollar is so crucial when it comes to pricing this market. If the US dollar continues to lose ground, then it makes sense that it will take several more of those same dollars to buy a barrel of oil.

The OPEC nations are sticking relatively close to the production cuts that they promise, so that is bullish for crude oil, but the biggest concern that counterbalances the fact that global demand is most certainly down. At this point, it is hard to imagine a scenario where the global growth suddenly spikes, especially as the coronavirus numbers are still relatively high. There is serious concern when it comes to oversupply but eventually, there will be a turnaround. At this point, that leads me to believe that this is all about currency, and not much else. After all, the Federal Reserve is flooding the market with greenbacks, so that continues to bring inflation into commodity markets such as this one. In fact, you can see the inflation in multiple markets, not just this one.

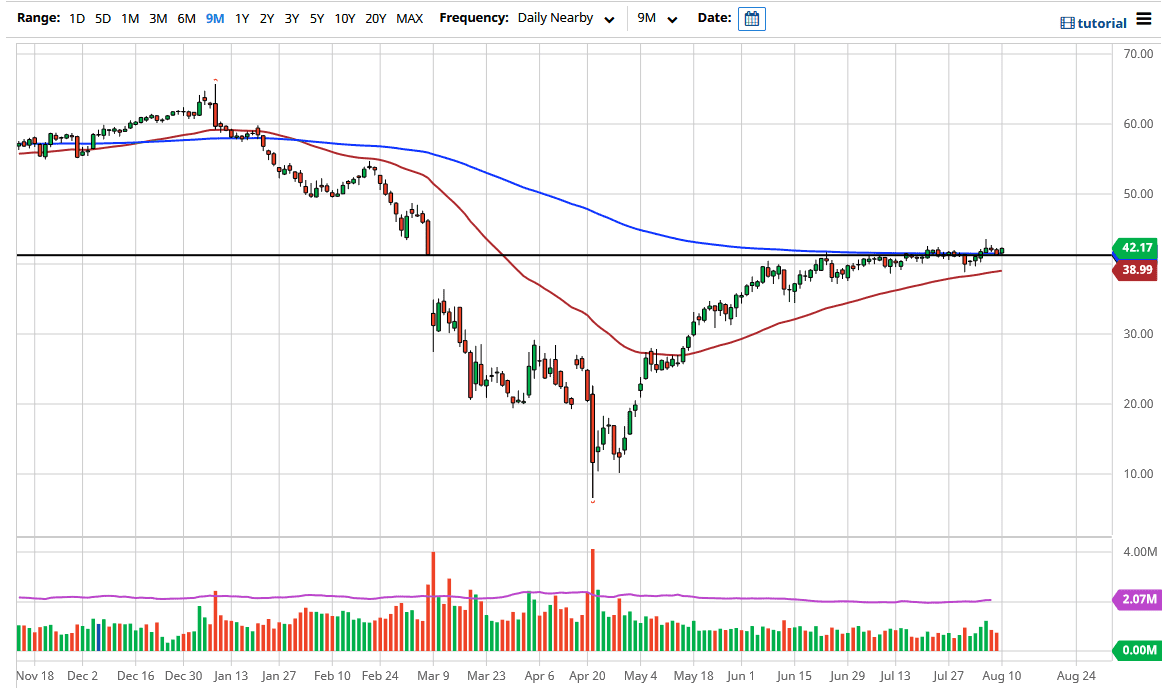

Pullbacks at this point should see plenty of support near the 50 day EMA which is right at the $39 level, so as long as we stay above there, I think you will continue to see short-term traders come in and buy the dips as they occur. If the market breaks down below the 50 day EMA, then we will probably see a return to the $35 level, possibly even lower. However, that is very difficult to imagine a scenario where the US dollar continues to fall. To the upside, I anticipate that we are going to go looking towards the $49 level once we do finally break out. The key will be getting over the highs from the last week, which ended up forming a bit of a shooting star as we pulled back from the $43.50 level. In the meantime, expect a lot of back and forth with a slightly upward bias.