The West Texas Intermediate Crude Oil market broke higher during the trading session again on Wednesday, as we continue to see more of a grind to the upside. At this point in time, it looks to me like we are going to see a lot of choppy and sideways trading, but one thing that is worth keeping in mind is that the Thursday session is featuring the speech by Jerome Powell which could move the value of the US dollar. This of course could move the value of commodities, especially crude oil.

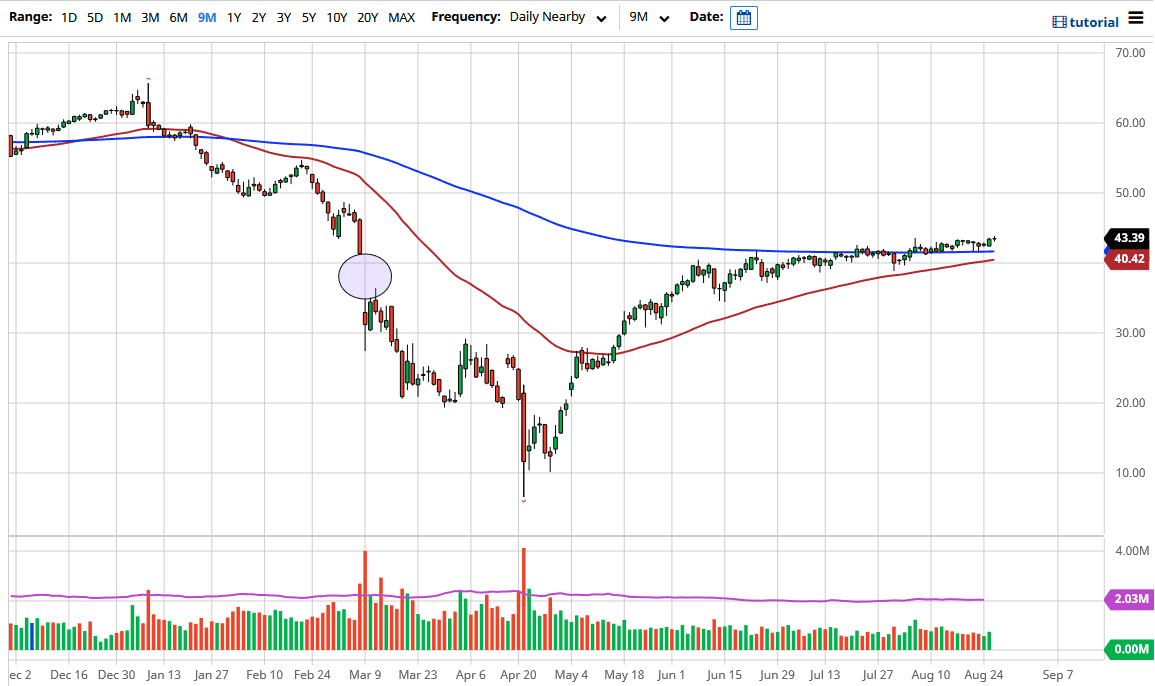

Looking at this chart, it appears to me that the 200 day EMA will continue to be supported, and it also appears that we are eventually going to go looking towards the massive supply point at the $49 level that extends towards the $50 level. Ultimately, the area will be a massive barrier to overcome, not only because of the massive amount of selling there, but the fact that the area is a large, round, psychologically significant figure as well. Because of this, I do think that we would see a significant amount of resistance in that general vicinity.

The 50 day EMA is underneath the 200 day EMA as well, and it is starting to rise also. That shows a potential “golden cross” coming, and that of course will attract a lot of attention as well. I do believe that given enough time we will see this market rally, but whether or not we can break above the 50 day EMA would of course be a completely different scenario. Underneath, if we were to break down below the $40 level, it could open up significant selling, perhaps reaching towards the $35 level. Between the 200 day and the 50 day EMA indicators, I think there is a “zone of support” that comes into play and is probably the most important technical part of this market. Ironically, even though massive amounts of oil production in the United States are currently shuttered due to the hurricane, we have seen only the most subtle of reactions to that news. This is probably more or less going to react to whether or not the US dollar rises or falls more than anything else. For a couple of months now, simply buying short-term dips has worked, and I do not think that changes anytime soon.