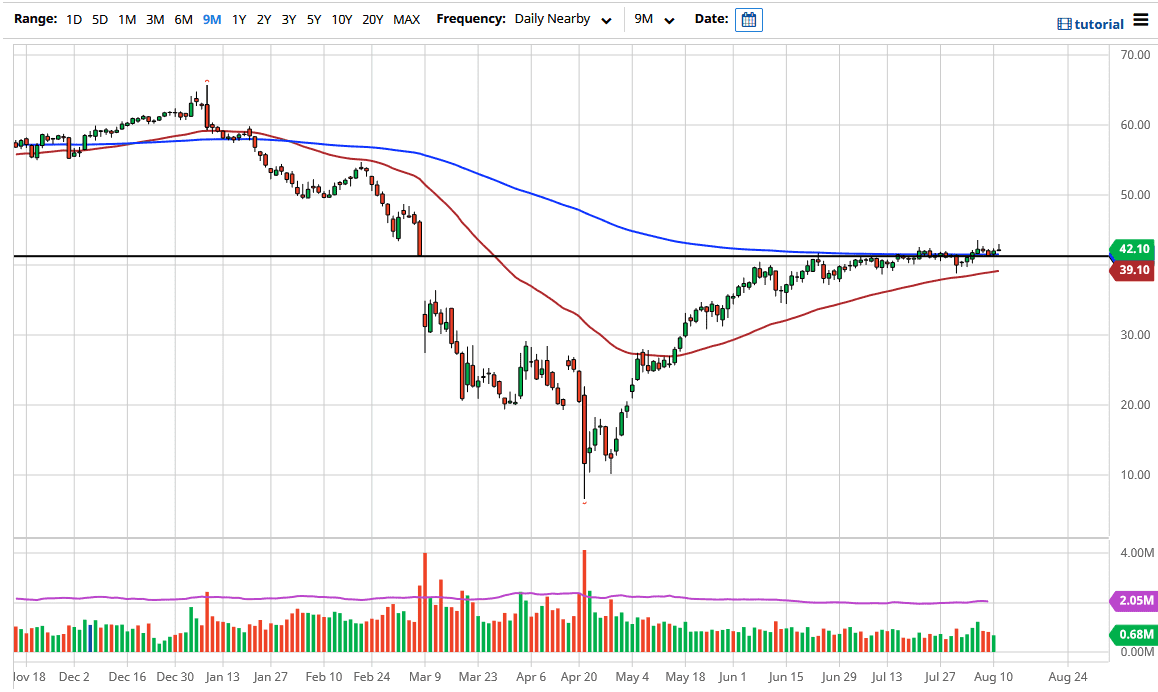

The West Texas Intermediate Crude Oil market initially rallied during the trading session on Tuesday, even gapping ever so slightly higher. However, we have given back quite a bit of the gain to show less than bullish momentum. In fact, it looks like we are essentially “stuck” in the same general vicinity that we have been in. Ultimately, the 200 day EMA is sitting right around the same area that has been for a while, so I think it makes quite a bit of sense that we simply go sideways until we get some type of catalyst.

Currently, one of the biggest catalysts for crude oil is the US dollar falling a bit. That continues to drive the market higher but is probably not enough for a longer-term breakout. I recognize that the market breaking above the shooting star from last week and perhaps even the one from the session on Tuesday could be a signal that we are going higher, and I think that is the most likely scenario. However, there are some other things going on at the same time that could help. Namely, the first thing that I think of is the fact that OPEC is actually sticking to its production cuts for once. That obviously is bullish, but the technical analysis looks good due to the fact that the 200 day EMA is sideways and the 50 day EMA is starting to shoot higher as well. Furthermore, we are sitting just above the gap that had been filled and now is broken through.

On the downside though there is a serious lack of demand out there. Yes, economies are starting to wake up a bit, but the question then will be “Is it enough to sustain a bigger move?” That seems to be very unlikely so I think that it is only a somewhat limited amount of momentum to the upside that we will see. The $49 level is a level where we had fallen from previously, so I think that could be the next target. I do think that there is a lot of psychological and structural resistance just above there near the $50 level. With this, I like the idea of buying short-term pullbacks, but it is difficult to imagine a scenario where you can buy it with any real conviction for the longer-term move. If we break down below the 50 day EMA, currently sitting at the $39 level, then things could change.