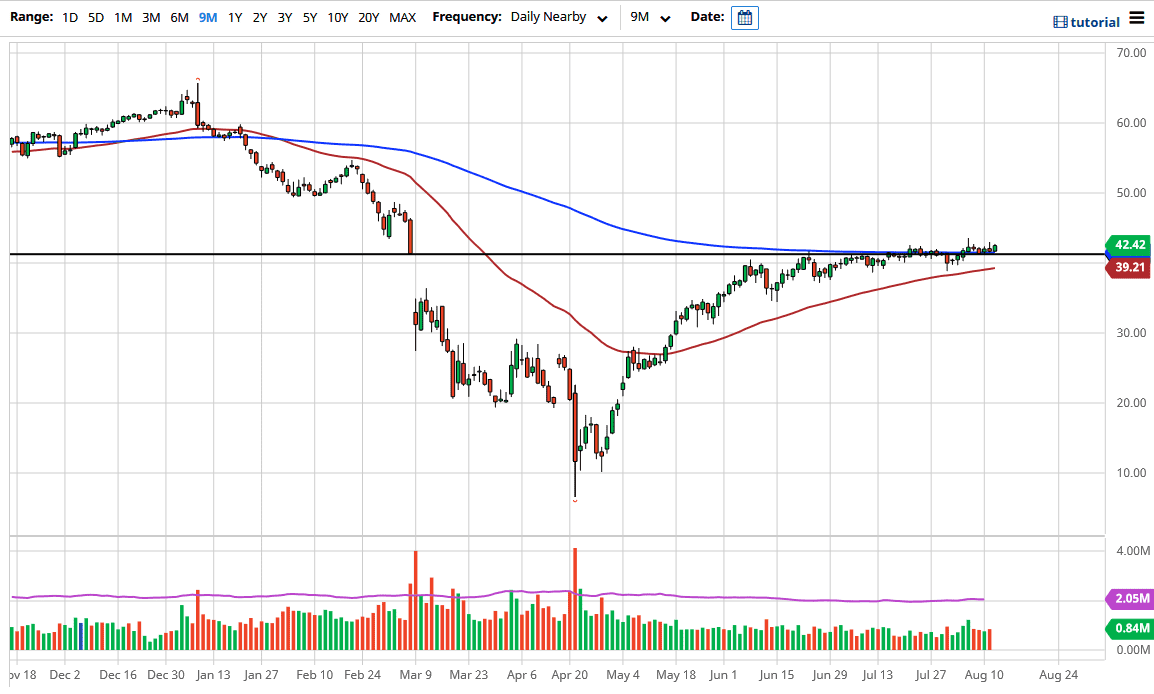

The West Texas Intermediate Crude Oil market rallied slightly during the trading session on Wednesday, as we continue to see a lot of momentum to the upside. I think it is only a matter of time before we break out much higher, but right now it suggests that we do not have enough strength to finally go to the upside. Ultimately, when I look at this chart, I recognize that if we pull back there are plenty of buyers. I think that will continue to be the case going forward, and therefore dips should show plenty of buyers jumping back in.

At this point, a look at the 200 day EMA is interesting because it is not only flat, it is at the top of the gap that we have now broken through. At this point, the area is now offering support. Furthermore, I think that there is plenty of support in the form of the 50 day EMA underneath. Buying dips in order to take advantage of this dull market right now is the only way to deal with it. If we can break above the highs of the previous week, then I think the market probably goes to the $49 level. That is where we had seen this market break down significantly from previously, and I think that there is more than likely going to be resistance all the way to the $50 level as there is a significant amount of psychological importance attached to that level anyway.

If we were to break above there, then the market could go much higher. At this point in time, the market would probably go looking towards the $60 level after that. That being said, the main reason I think this market is going higher is that the US dollar is being pummeled, and that makes commodities rise in general. With that being the case, this is simply a matter of commodity inflation, which I suspect will continue to be an issue. Ultimately, I think that we will get the breakout but as you can see over the last couple of weeks we have had nowhere to be. If we break down below the 50 day EMA, then I would be less enthusiastic, but currently, we are continuing to see short-term buying on the dips, and I do not see anything changing in the near term.