The West Texas Intermediate Crude Oil market has pulled back slightly during the trading session on Friday, showing signs that we are nowhere near getting ready to make a significant move. Ultimately, this is a market that has been putting traders to sleep for the last couple of weeks, as the fundamental situation continues to be very conflicting.

The US dollar continues to lose value over the longer term, and that has been lifting this crude oil market. That being said, it is going to take more of the currency to buy a barrel oil, all things being equal. This has been supportive, but then again, the production cuts coming out of OPEC has continued to lift the market a bit or at least have kept it from falling significantly. After all, there is a significant amount of demand destruction out there, and even if the economy continues to open up, it opens up very slowly. The demand destruction coming out of airlines alone is rather drastic, so the demand for crude oil is a majorly negative at this point in time.

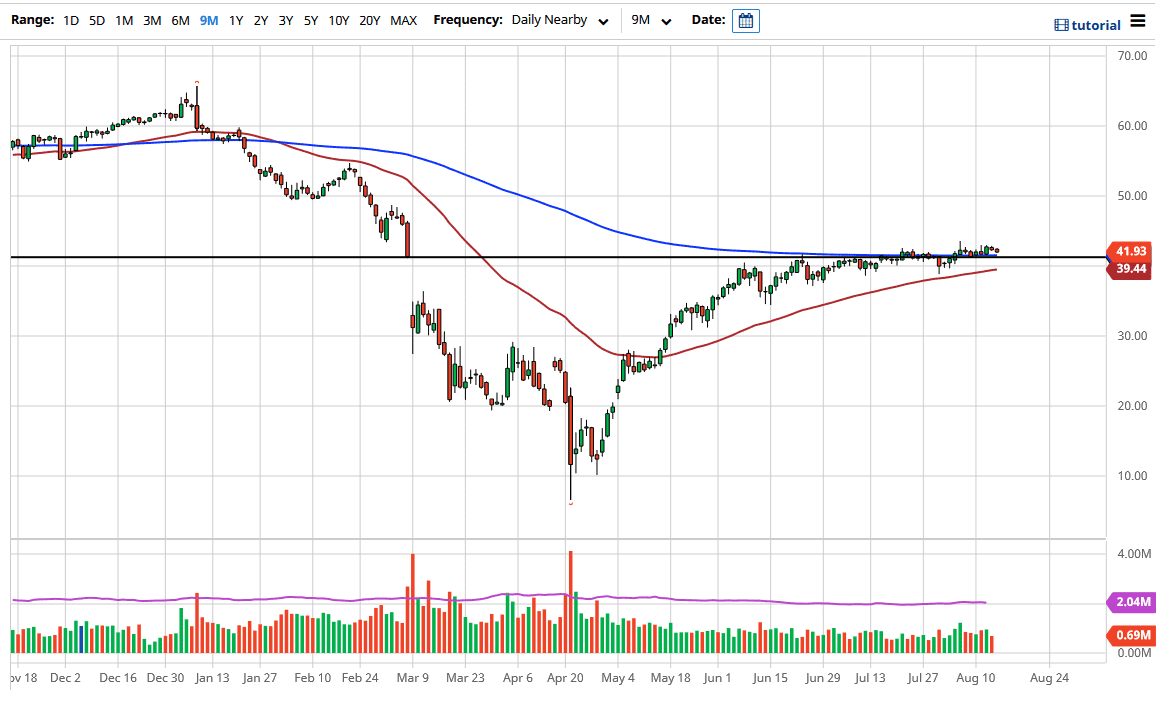

With that being said, the market is sitting on top of the gap that had been so important, so therefore one would assume that there is going to be a significant amount of support. Ultimately, I like the idea of buying dips on short-term charts, but I do not anticipate that we are going to have an explosive move anytime soon. I think that we have a continued problem here with momentum, especially as the vacation season is in full effect, meaning that a lot of the larger traders simply are not involved. To the downside, I think that we continue to find plenty of support based upon the 50 day EMA which is sitting at the $39.44 level. Short-term dips continue to offer short-term buying opportunities, and that is about it. I do not have any interest in trying to overcomplicate the situation, but I am cognizant of the fact that if we can break out to the upside and perhaps the highs of last week, then we can make a move towards the $49 level. To the downside, break down below the 50 day EMA opens up the doors to the main possibility of reaching towards the $35 level. Until then, we simply grind back and forth offering small scalping opportunities.