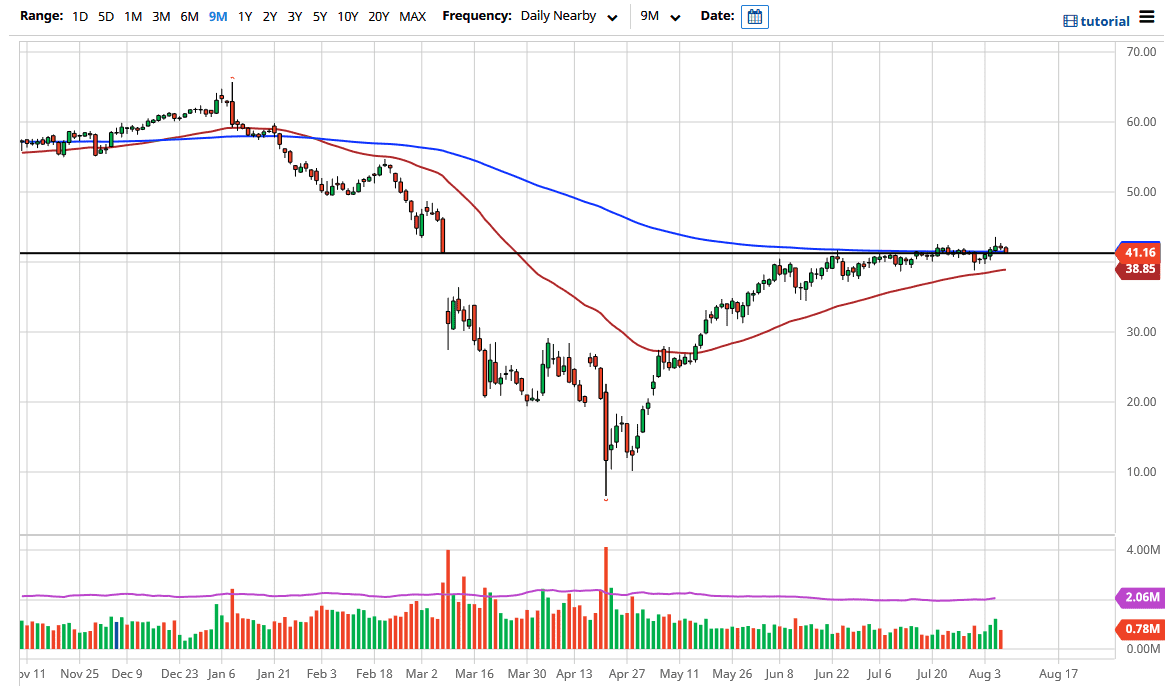

The West Texas Intermediate Crude Oil market has fallen slightly during the trading session on Friday, as the 200 day EMA continues to attract a lot of attention. The biggest problem we have here is that there are multiple crosswinds when it comes to the crude oil market, so therefore it is worth paying attention to various issues. For example, the US dollar falling has been bullish for the crude oil market as it makes commodities go up in general, and this one is not going to be any different. As you can see from the chart, we have been grinding higher slowly, but that is the problem here, we simply do not have momentum.

The following US dollar course has helped but there is also been a lot of production cuts that OPEC has managed to stick to so far, and that brings down supply. Ultimately, that should press the oil market to the upside, but there are serious concerns about demand so that something to pay attention to as well. After all, if people do not need oil, it cannot go much higher.

The 200 day EMA is causing some technical issues, just as the 50 day EMA underneath will cause the same. At this point, the market has nowhere to go so you will need to wait until some type of impulsive candlestick to put serious money to work. However, if you are a scalper you might find this a suitable market to go back and forth in that type of environment. You would need to pay attention to short-term charts obviously, but if you are comfortable doing that then you could have plenty of opportunity with the understanding that eventually this will, and then we will get more of a trend following opportunity.

The US dollar looks like it may try to strengthen in the short term, so that could put a little bit more bearish pressure on the crude oil market, but until we break down below the 50 day EMA I do not worry too much about a significant pullback in this market. To the upside, if we can clear the Wednesday candlestick, that could send this market towards $45, and then possibly even the $50 level after that. Either way, make sure you pay attention to your position size as volatility continues to remain very choppy.