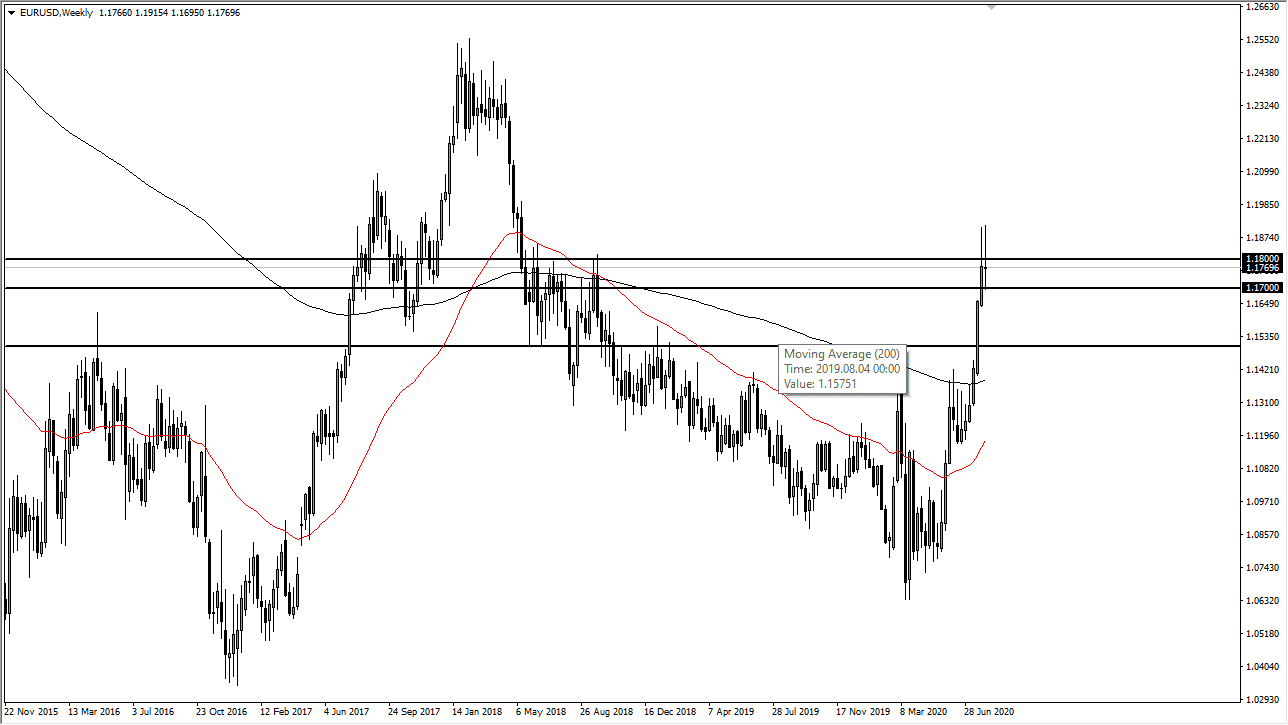

EUR/USD

The Euro had a volatile week over the previous five trading sessions, but at this point, it is obvious that we are getting a bit exhausted. I think that we could see a short-term pullback over the next several days, retesting the 1.17 level, and then possibly breaking through there. If we do, I will anticipate seeing a lot of support near the 1.16 level, and even more so at the 1.15 level. It is likely that we will find value on a pullback because the market cannot go in one direction forever. I am still bullish, but I recognize we have gotten ahead of ourselves.

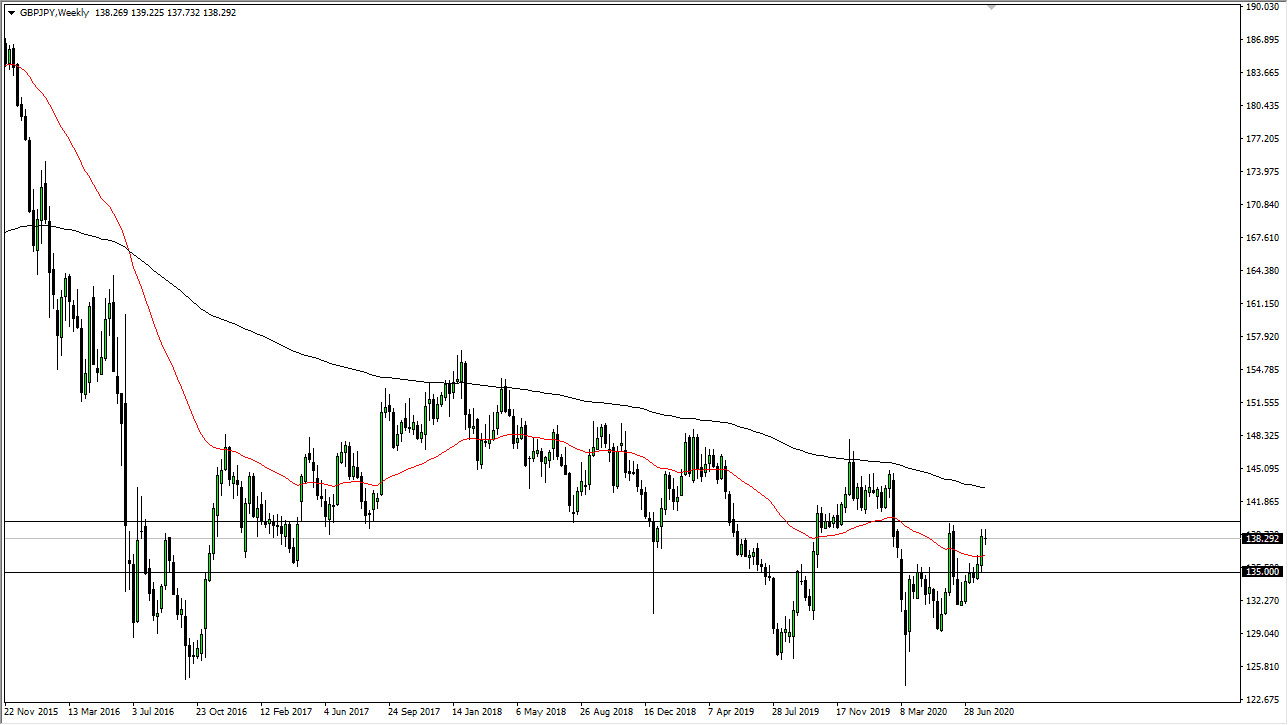

GBP/JPY

The British pound went back and forth during the course of the week, showing signs of indecision. Ultimately this is a market that is perhaps a bit stretched, and I see a lot of resistance between the ¥139 level and the ¥140 level. A pullback towards the ¥136 level it is likely, but I would expect to see buyers just underneath that general vicinity. Keep in mind that this pair is also highly sensitive to risk appetite so that is worth paying attention to as well.

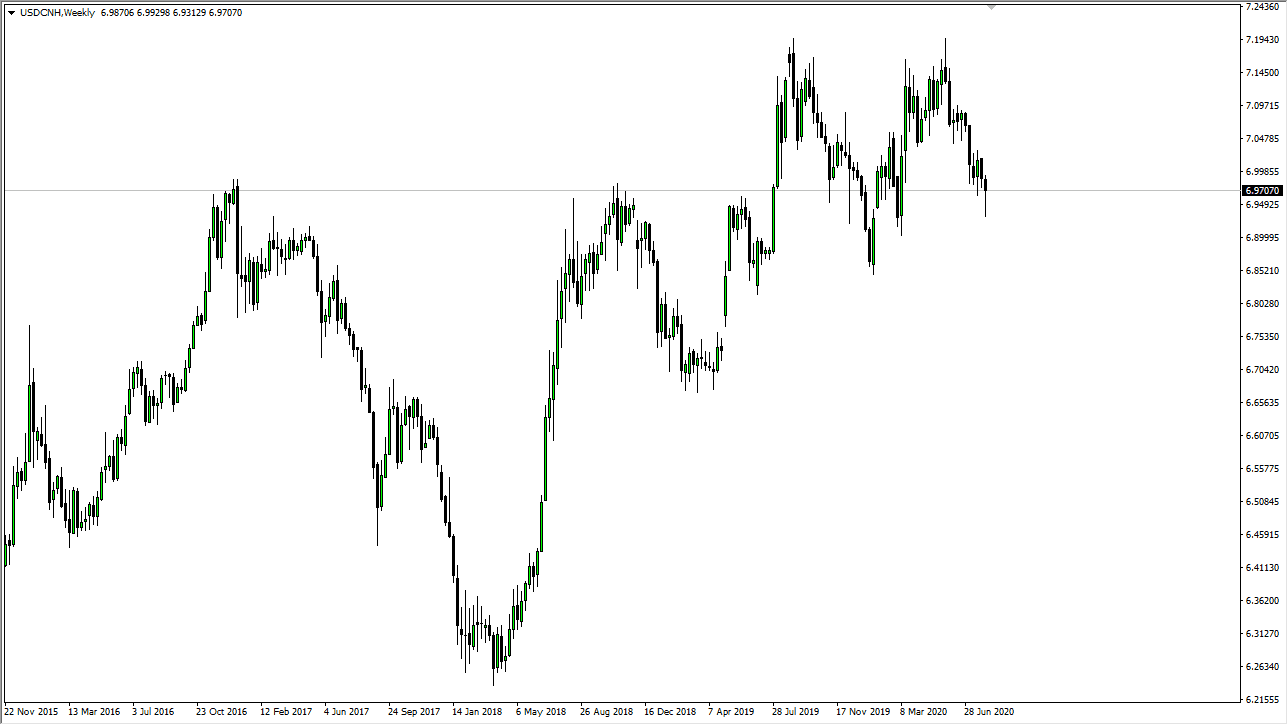

USD/CNH

The US dollar has formed a massive hammer against the Chinese Yuan, which to me is a signal that perhaps we are going to have a little bit of “risk-off” trading in the short term. While many of you will not trade this currency pair, it is most certainly worth paying attention to because it is a reflection of the state of the US/China trade situation and relations, which can have a detrimental effect on risk appetite and a lot of risk appetite related assets are a bit overdone at this point. This also tells me that there is a good chance that the US dollar strengthens over the next week or two.

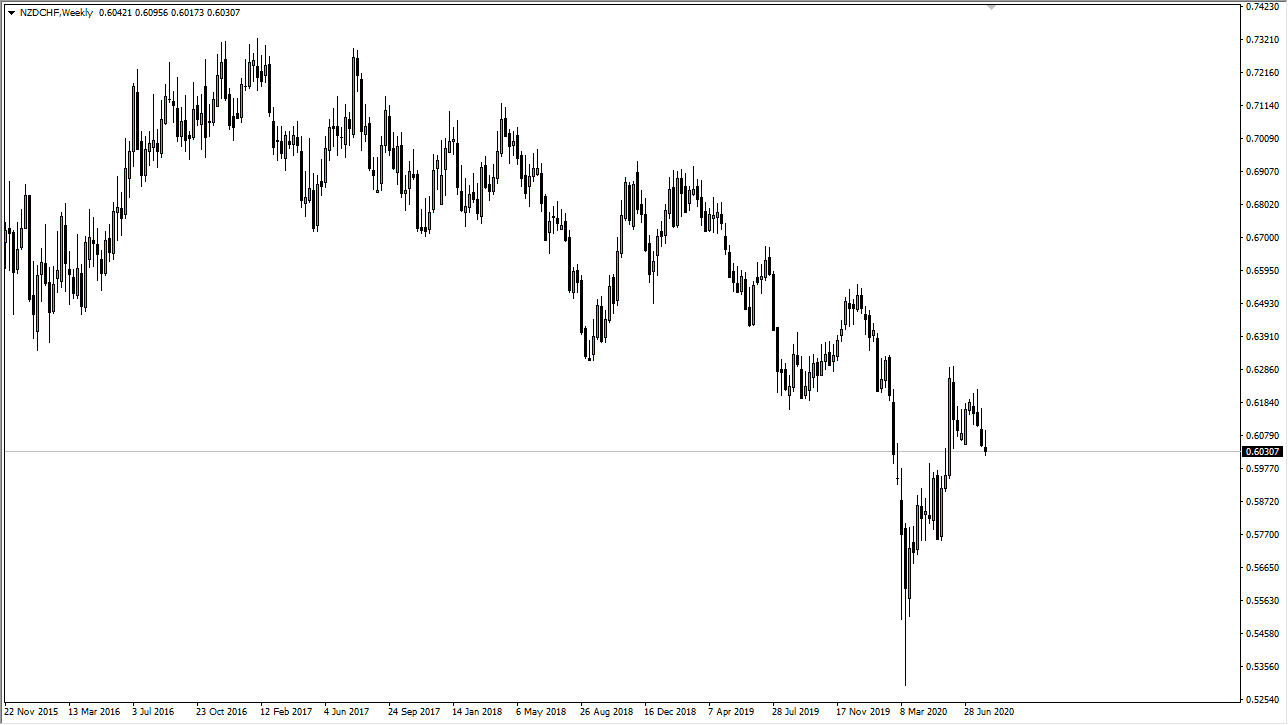

NZD/CHF

The New Zealand dollar initially shot higher against the Swiss franc during the trading week but gave back the gains near the 0.61 handle. We are currently sitting on the 0.60 region, and a breakdown below the bottom of the weekly candlestick would be a continuation of the pullback. This would also suggest that there might be a bit of a “risk-off” in the ensuing week or two. That means that risk appetite is going to suffer in general, even if you do not trade this particular pair.