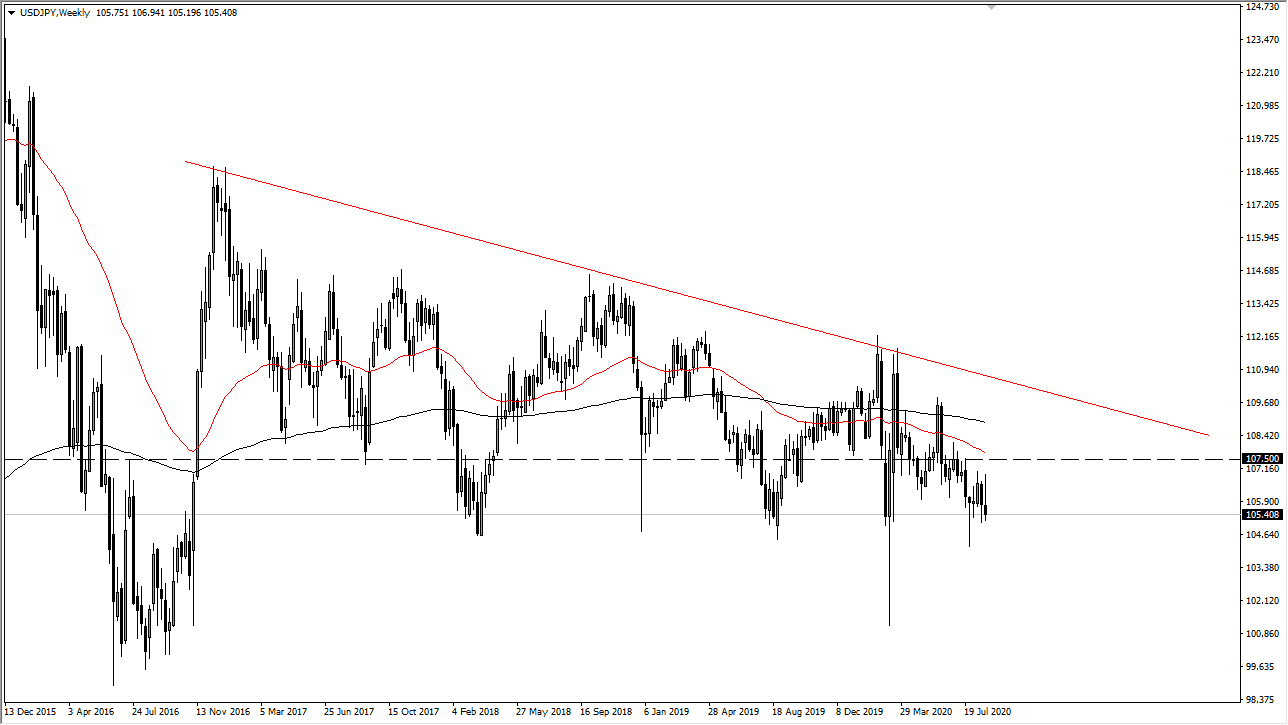

USD/JPY

The US dollar initially rallied during the week but continues to show weakness. At this point in time, the market is likely to show signs of exhaustion on short-term charts, so I like the idea of shorting on rallies, and I think that somewhere near the ¥107 level we will see a lot of exhaustion. To the downside, if we break down below the ¥105 level, then the market could unwind and drop all the way down to the ¥102 level.

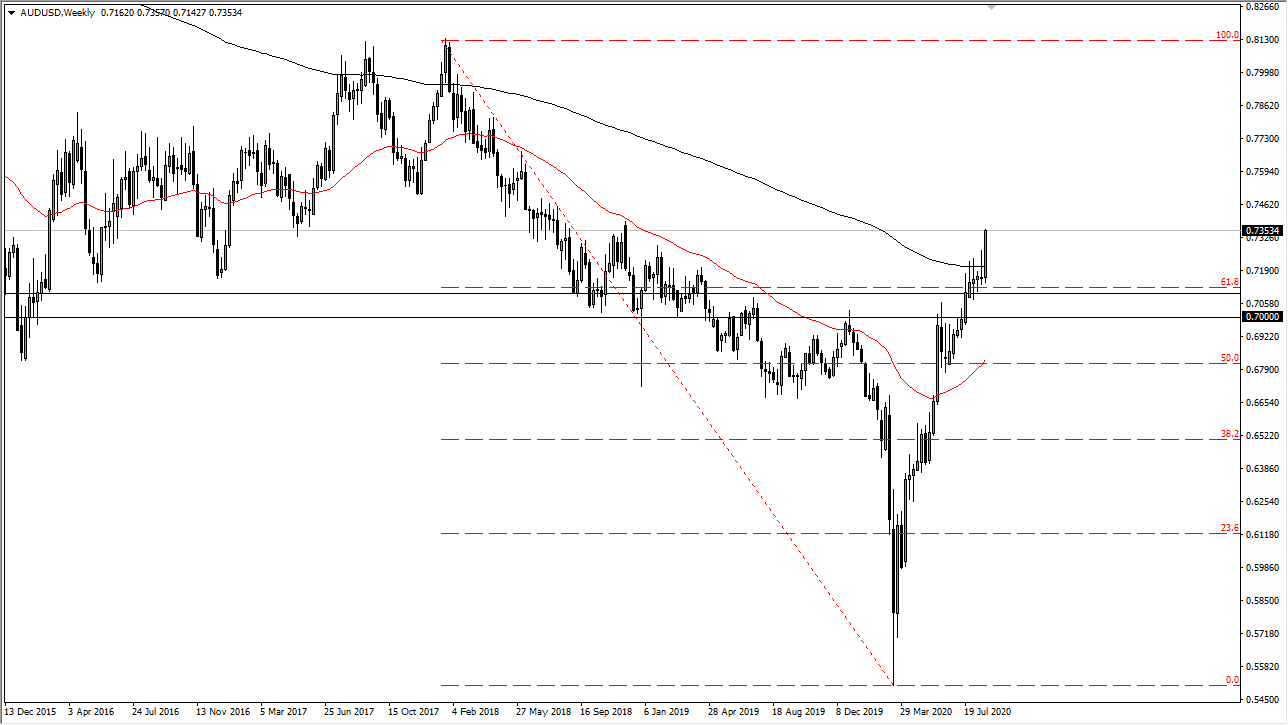

AUD/USD

The Australian dollar has rallied rather significantly during the course of the week, breaking above the 0.7350 level. A short-term pullback at this point in time should continue to offer buying opportunities as Jerome Powell has suggested that the bar to raise interest rates in the United States continues to rise, thereby giving us an idea that the US dollar will continue to struggle against most currencies, especially the Aussie as it is highly correlated to gold which is on an absolute tear these days.

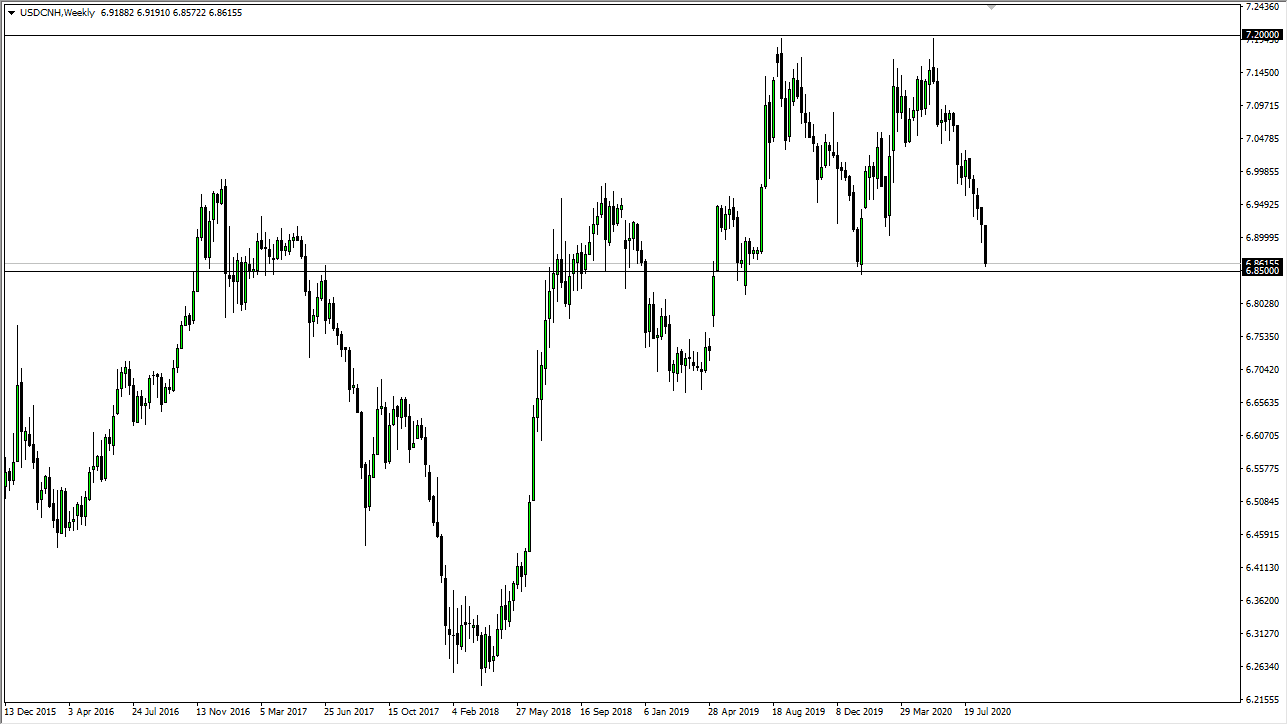

USD/CNH

The US dollar has fallen rather hard against the Chinese Yuan, in a major “risk-on” type of move. At this point, it looks as if the 6.85 level offer support, but if we break down below there we should continue to see this market drop, and while many of you will not trade this market, it will show that the US dollar should follow against most other currencies and you can apply that knowledge as a secondary indicator in other pairs such as the EUR/USD, AUD/USD, USD/CAD, and so on.

On the other hand, if this market turns around and rally significantly, then we may get a bit of a pullback in these other currency pairs. That being the case, then I will simply look for an opportunity to short the dollar from an even better spot at this point in time.

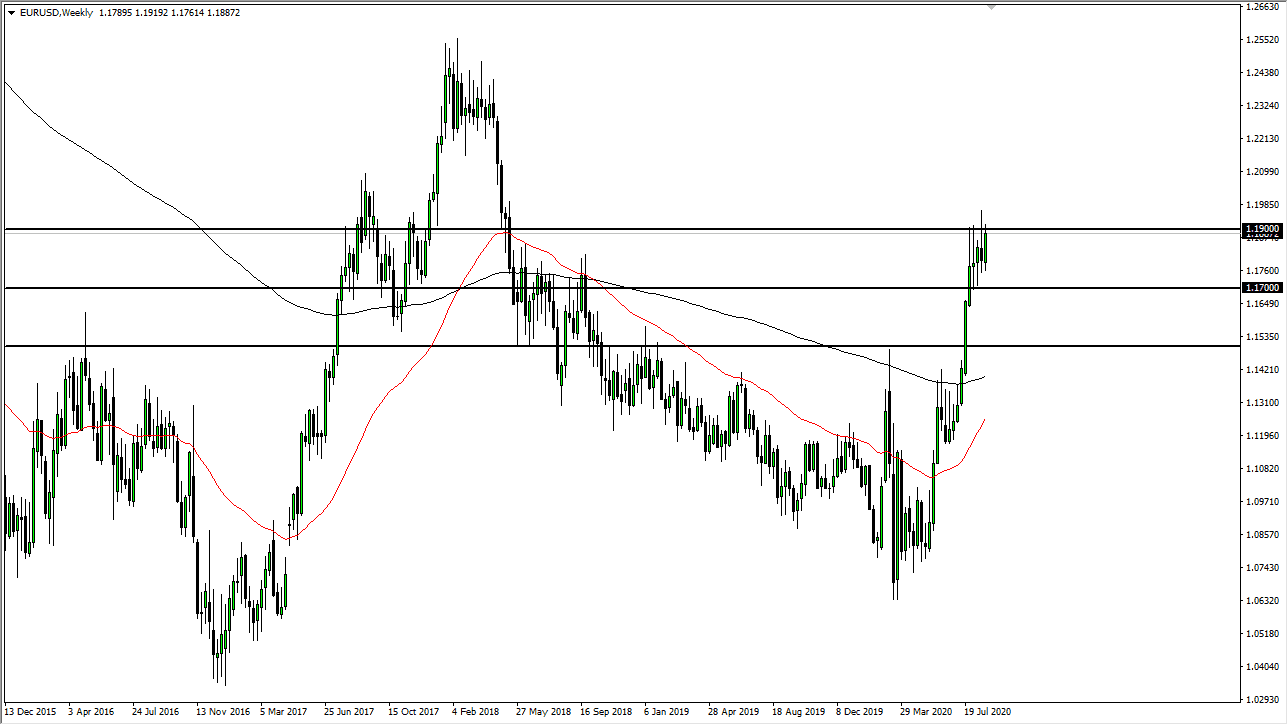

EUR/USD

The Euro has rallied during the week again, reaching towards the 1.19 level by the end of the day on Friday. Ultimately, I do think that we break out, but we have a huge amount of resistance extending towards the 1.20 level, so I think if we can break above there, then this market can really take off to the upside and go much higher. I believe that longer-term the Euro is going to go towards the 1.25 handle, but in the short term, we may get a little bit of pullback which should offer value for those looking to buy pullbacks.