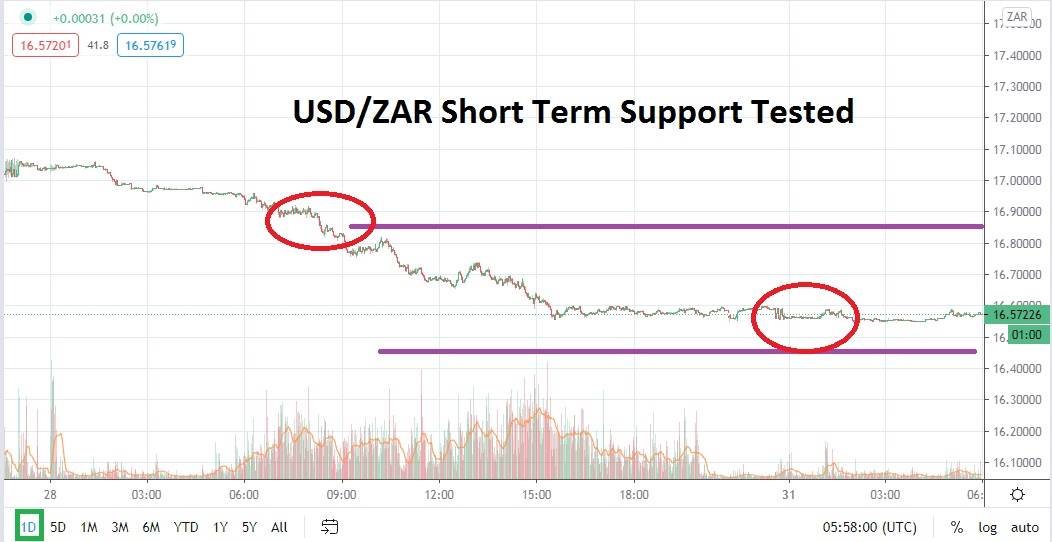

The USD/ZAR reestablished its bearish trend on Friday with a swift move downwards. The South African Rand is now trading near critical support levels which have produced two reversals upwards in the past three months. This morning’s trading vicinity for the USD/ZAR has been between the 16.54400 and 16.61000 range.

Technical traders should note in June and July of this year, the USD/ZAR exhibited a strong bearish movement too for durations. However, the junctures of 16.40000 to 16.50000 proved a launching ground for bullish climbs when these values were tested. The question speculators will obviously be asking this morning is if the third time will be the charm and if these stubborn support ratios will be broken downwards this time around?

As if to muddle trading perspectives, yes, the value of gold has seen values rise the past few trading sessions too. However, short term speculators should understand short term time correlations between the price of the precious metal and the value of the South African Rand can be hard to quantify. While keeping in mind the value of gold is certainly important while trading the USD/ZAR it can also prove dangerous to try and predict immediate reactions between the two assets.

The USD/ZAR has been proving a very capable speculative trade, but trying to take advantage of its bearish cycle since the 10th of August when it climbed to nearly 17.80000 has not been simple. Patience while selling the USD/ZAR has likely been a key ingredient for successful traders who have been pursuing the bearish trend. A look at a one month chart will show that the USD/ZAR is near values this morning which it traded late in July. Meaning the important support juncture of 16.40000 to 16.50000 has produced moves upwards which have allowed speculators to take advantage of reversals higher too.

Short term speculators need to be careful within the current price vicinity of the USD/ZAR. If the inclination to sell the forex pair dominates trading perceptions, it will be a good idea to use a capable resistance level as a stop-loss mechanism. A solid short term resistance level higher could prove to be the 16.90000 juncture. However, to use this higher value, a speculator will have to choose the amount of leverage they use carefully so they do not risk too much capital.

South African Rand Short Term Outlook:

Current Resistance: 16.85000

Current Support: 16.55000

High Target: 17.20000

Low Target: 16.44000