South Africa struggled with persistently high unemployment before the Covid-19 pandemic forced the government of President Cyril Ramaphosa to implement a crippling nationwide lockdown. The fragile healthcare system needed time to prepare, but financial resources limited the measure to several weeks before restrictions were gradually lifted. Since then, total cases have soared above 600,000, but the economy remains depressed, with unemployment a start reminder of challenges ahead. With the US Federal Reserve indirectly confirming its weak US Dollar policy, the USD/ZAR was rejected by its downward adjusted short-term resistance zone.

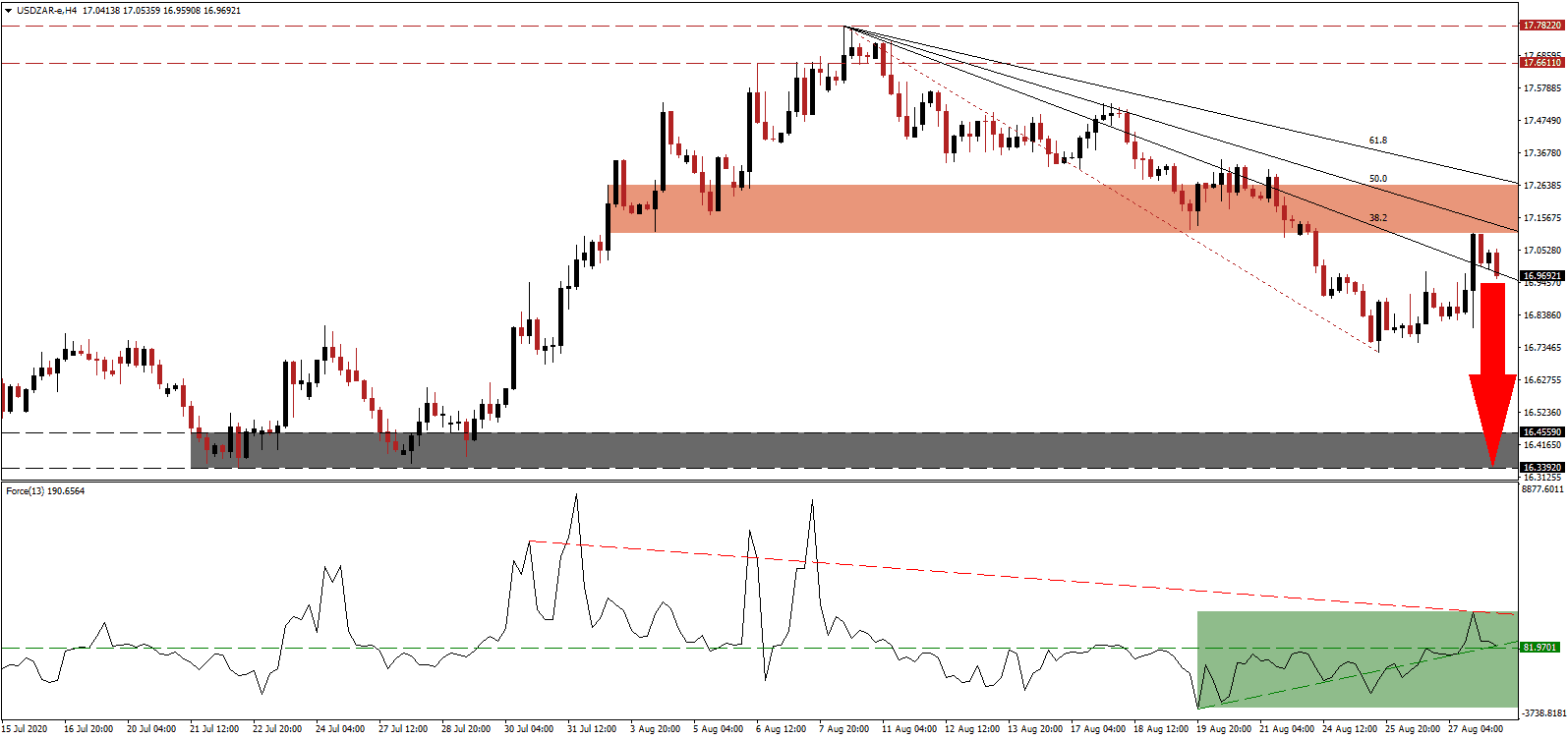

The Force Index, a next-generation technical indicator, recorded a significantly lower high, suggesting dominant bearish pressures. Intensifying downside momentum is the descending resistance level, as marked by the green rectangle, likely to push the Force Index below its ascending support level. This technical indicator is then cleared to convert its horizontal support level into resistance, before correcting into negative territory, and granting bears complete control overt the USD/ZAR.

Tensions between South African and foreign nationals working in the country increased over limited resources. President Ramaphosa reiterated that the government must create jobs for South Africans, but that it additionally depended on foreign direct investment and scarce skills from foreign workers to grow the economy. After the short-term resistance zone located between 17.1058 and 17.2632, as identified by the red rectangle, rejected the USD/ZAR, more downside is favored amid rising breakdown pressures and a weak US Dollar.

Pressure mounts to evaluate the labor market and to restrict the dominant informal economy to South Africans only while revoking work permits for jobs that can be performed by domestic workers. The United Nations Development Program (UNDP) issued a best-case economic scenario where an additional 47,000 South Africans will lose employment by the end of 2020, and extreme poverty levels may rise by 66%. The USD/ZAR is challenging its descending 38.2 Fibonacci Retracement Fan Support Level, with a breakdown clearing the path into its support zone between 16.3392 and 16.4559, as marked by the grey rectangle.

USD/ZAR Technical Trading Set-Up - Breakdown Resumption Scenario

- Short Entry @ 16.9700

- Take Profit @ 16.3400

- Stop Loss @ 17.1700

- Downside Potential: 6,300 pips

- Upside Risk: 2,000 pips

- Risk/Reward Ratio: 3.15

A breakout in the Force Index above its descending resistance level can inspire the USD/ZAR to extend its counter-trend bounce. After the US Federal Reserve confirmed interest rates would remain depressed beyond the Covid-19 recovery, bearishness in the US Dollar expanded. Forex traders should sell any rallies from present levels with the upside potential reduced to its long-term resistance zone located between 17.6611 and 17.7822.

USD/ZAR Technical Trading Set-Up - Reduced Reversal Scenario

- Long Entry @ 17.3700

- Take Profit @ 17.6700

- Stop Loss @ 17.1700

- Upside Potential: 3,000 pips

- Downside Risk: 2,000 pips

- Risk/Reward Ratio: 1.50