Besides the Covid-19 pandemic, where South Africa is the fifth-most infected country globally, the country has to deal with ongoing protests. The reasons differ from informal settlements lacking electricity through demolitions of illegal structures to joblessness, but until the pandemic is under control and receding, it is unlikely they will stop. Several have turned violent, and numerous arrests made. Testing remains an issue, with just over 3.1 million tests carried out in a country with a population above 59.3 million. The USD/ZAR counter-trend advance currently faces rejection by its resistance zone.

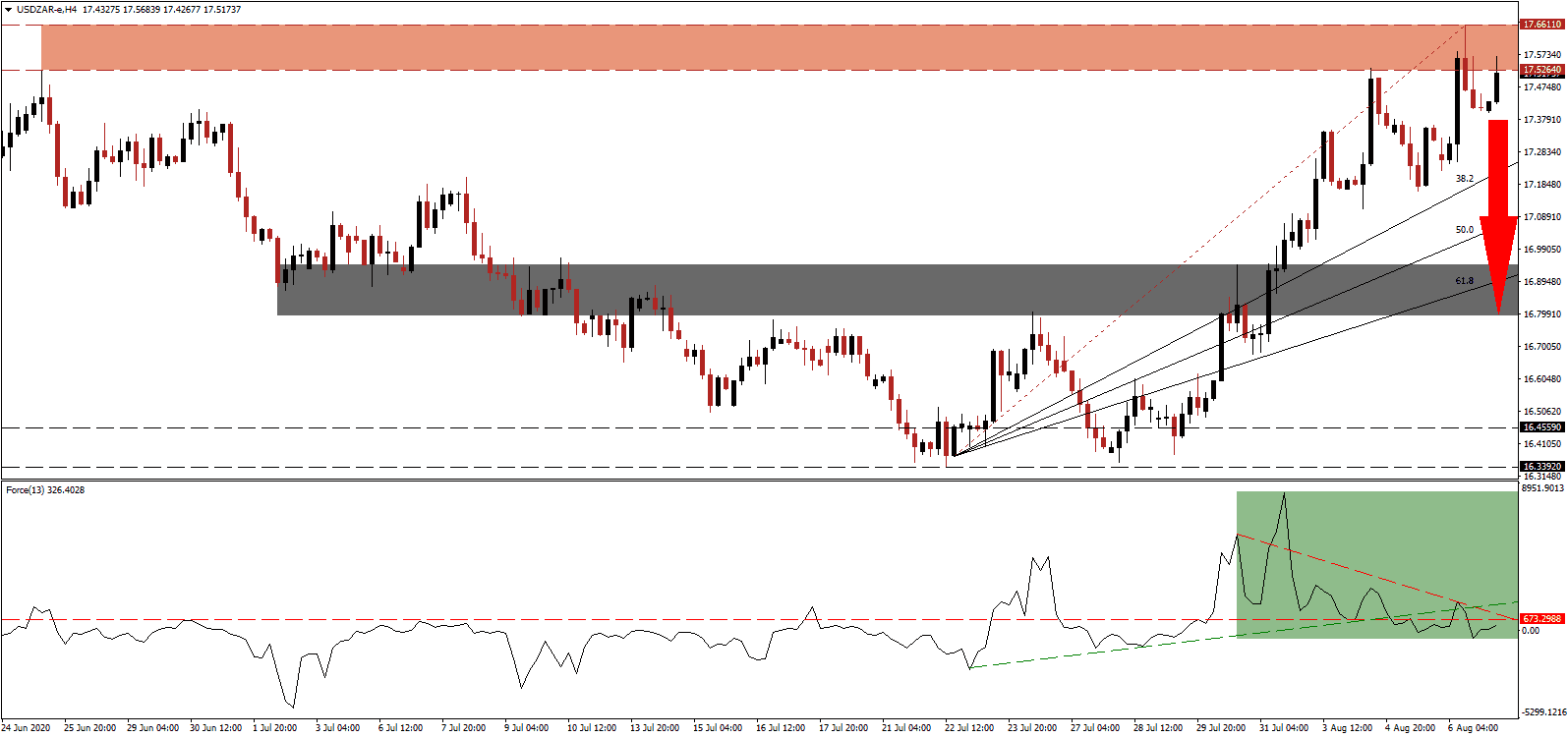

The Force Index, a next-generation technical indicator, points towards growing breakdown pressures after it retreated while this currency pair pushed higher. A negative divergence formed, indicating a price action reversal is imminent. After the drop below its ascending support level, as marked by the green rectangle, the descending resistance level is increasing bearish momentum. It led to a conversion of the horizontal support level into resistance. Bears wait for a collapse into negative territory to regain full control over the USD/ZAR.

Nkosazana Dlamini-Zuma, the Minister of Co-Operative Governance and Traditional Affairs of South Africa confirmed the government’s knowledge of the economic harm caused by the ban on tobacco and alcohol. He stressed it is not safe to lift it, while the alcohol ban caused SAB to cancel R2.5 billion in investments. Several tobacco companies, led by BATSA, are suing the government over the ban. The USD/ZAR extended its advance and is now at risk of a breakdown after moving int its resistance zone located between 17.5264 and 17.6611, as marked by the red rectangle, with bullish momentum fading.

In response to the record joblessness across South Africa, which was an issue before the Covid-19 pandemic deteriorated the labor market condition, the government launched the R350 grant. It distributes R350 per month to the unemployed and recently received an additional R6 billion in government funding. Social Development Minister Lindiwe Zulu confirmed total funds for the period between May and October were initially R3,457,696,700. The USD/ZAR is positioned to collapse below its ascending 38.2 Fibonacci Retracement Fan Support level and into its short-term support zone located between 16.7913 and 16.9456, as identified by the grey rectangle.

USD/ZAR Technical Trading Set-Up - Breakdown Scenario

- Short Entry @ 17.5200

- Take Profit @ 16.7900

- Stop Loss @ 16.6700

- Downside Potential: 7,300 pips

- Upside Risk: 1,500 pips

- Risk/Reward Ratio: 4.87

Should the Force Index reclaim its ascending support level, serving as resistance, the USD/ZAR is likely to attempt a breakout extension. The upside potential is confined to its next resistance zone located between 17.8759 and 18.0115 due to the worsening economic outlook for the US. Job cuts in July surged over 575%, while the expiration of the weekly $600 government subsidy to the unemployed resulted in a drop in initial jobless claims. Forex traders should consider any advance price action as a selling opportunity.

USD/ZAR Technical Trading Set-Up - Confined Breakout Scenario

- Long Entry @ 17.7900

- Take Profit @ 17.9900

- Stop Loss @ 17.6700

- Upside Potential: 2,000 pips

- Downside Risk: 1,200 pips

- Risk/Reward Ratio: 1.67