While the global economy remains under growing stress from the Covid-19 pandemic, South Africa is set to benefit from the massive stimulus packages implemented by developed countries. Demand for raw materials is forecast to increase, while production remains constrained, pushing prices higher. It will boost exports and profits for the dominant South African commodity sector, granting the economy a much-needed catalyst. The USD/ZAR completed a breakdown below its resistance zone, which is well-positioned to extend.

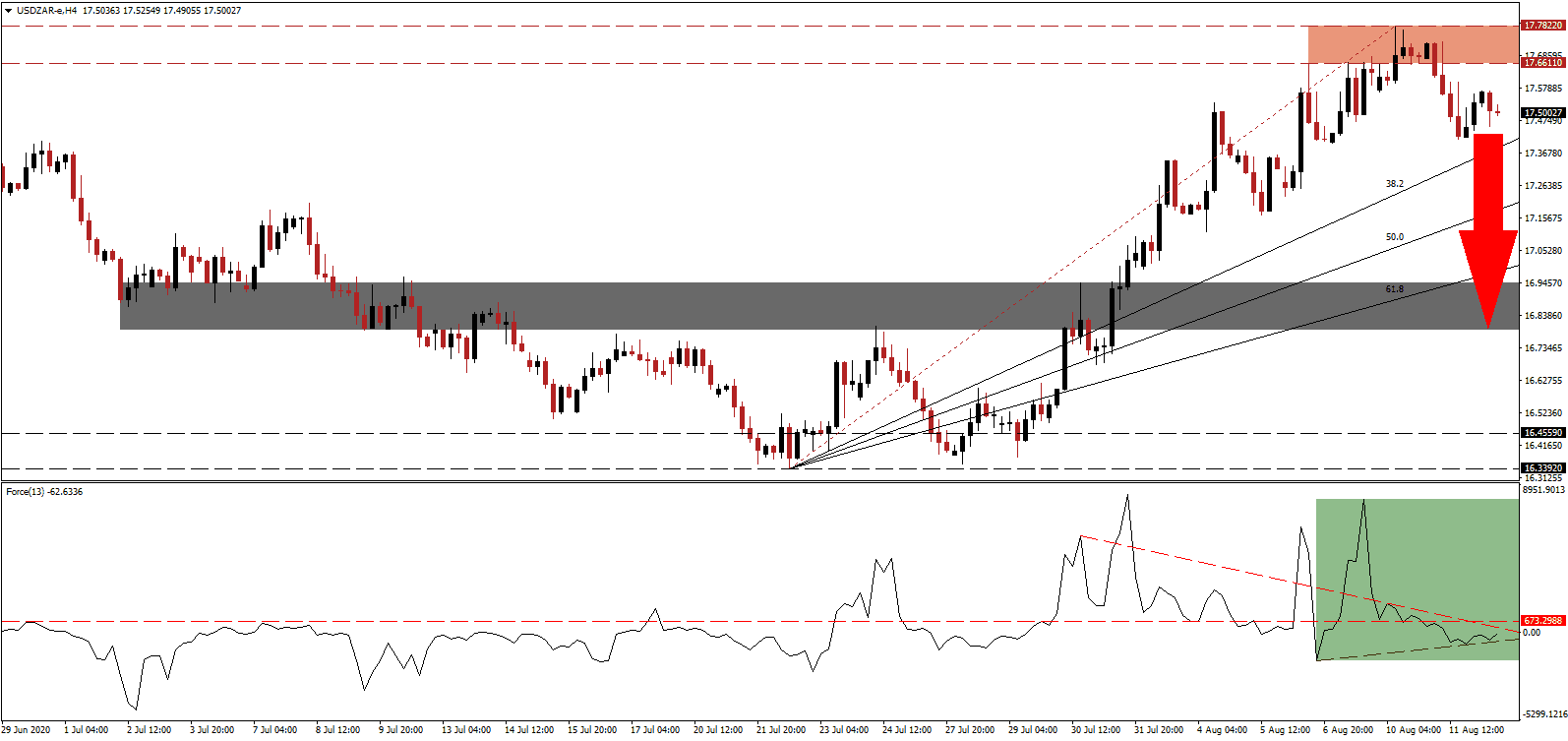

The Force Index, a next-generation technical indicator, maintains its position below its horizontal resistance level, confirming dominant bearish momentum. Increasing downside pressures is the descending resistance level, as marked by the green rectangle, favored to guide this technical indicator, already in negative territory, into a breakdown below its ascending support level. It will grant bears complete control over the USD/ZAR.

Over the first six months of 2020, the South African Rand lost over 19% of its value compared to the US Dollar. While it makes imports and overseas travel more expensive for South Africans, exports are priced significantly more competitive. Investors fled emerging markets as the Covid-19 pandemic unfolded, but the USD/ZAR embarked on a massive reversal since the end of April. Following the breakdown below its resistance zone located between 17.6611 and 17.7822, as marked by the red rectangle, selling pressure intensified.

Inflationary pressures are tame, and the South African Reserve Bank (SARB) slashed its repo rate to a multi-decade low between 3.0% and 3.5%. It improved the business environment, while the pandemic is forcing the government to address critical challenges with permanent solutions. It adds a distinct bullish catalyst to the South African Rand moving forward. A breakdown in the USD/ZAR below its ascending 61.8 Fibonacci Retracement Fan Support Level will clear the path for a contraction into its short-term support zone located between 16.7913 and 16.9456, as identified by the grey rectangle.

USD/ZAR Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 17.5200

Take Profit @ 16.8200

Stop Loss @ 17.6700

Downside Potential: 7,000 pips

Upside Risk: 1,500 pips

Risk/Reward Ratio: 4.67

Should the ascending support level guide the Force Index higher, the USD/ZAR may reverse its breakdown and temporarily spike higher. The upside potential remains limited to its next resistance zone located between 17.8759 and 18.0100. Given the deteriorating outlook for the US Dollar, plagued by excessive debt and a depressed labor market, Forex traders should consider any advance as a secondary selling opportunity.

USD/ZAR Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 17.8200

Take Profit @ 18.0000

Stop Loss @ 17.6700

Upside Potential: 1,800 pips

Downside Risk: 1,500 pips

Risk/Reward Ratio: 1.20