South Africa faces near-and-long-term challenges, as Africa’s most industrialized nation and second-largest measured by GDP, trailing Nigeria, is forced by the Covid-19 pandemic to address core issues plaguing the economy. It approaches 600,000 confirmed infections, while one of the strictest global lockdowns left millions unemployed. One silver lining throughout the crisis is that the government agrees with the business sector that painful reforms are a necessity. It lends a mild bullish catalyst to the South African Rand, with the USD/ZAR in the middle of a new breakdown sequence.

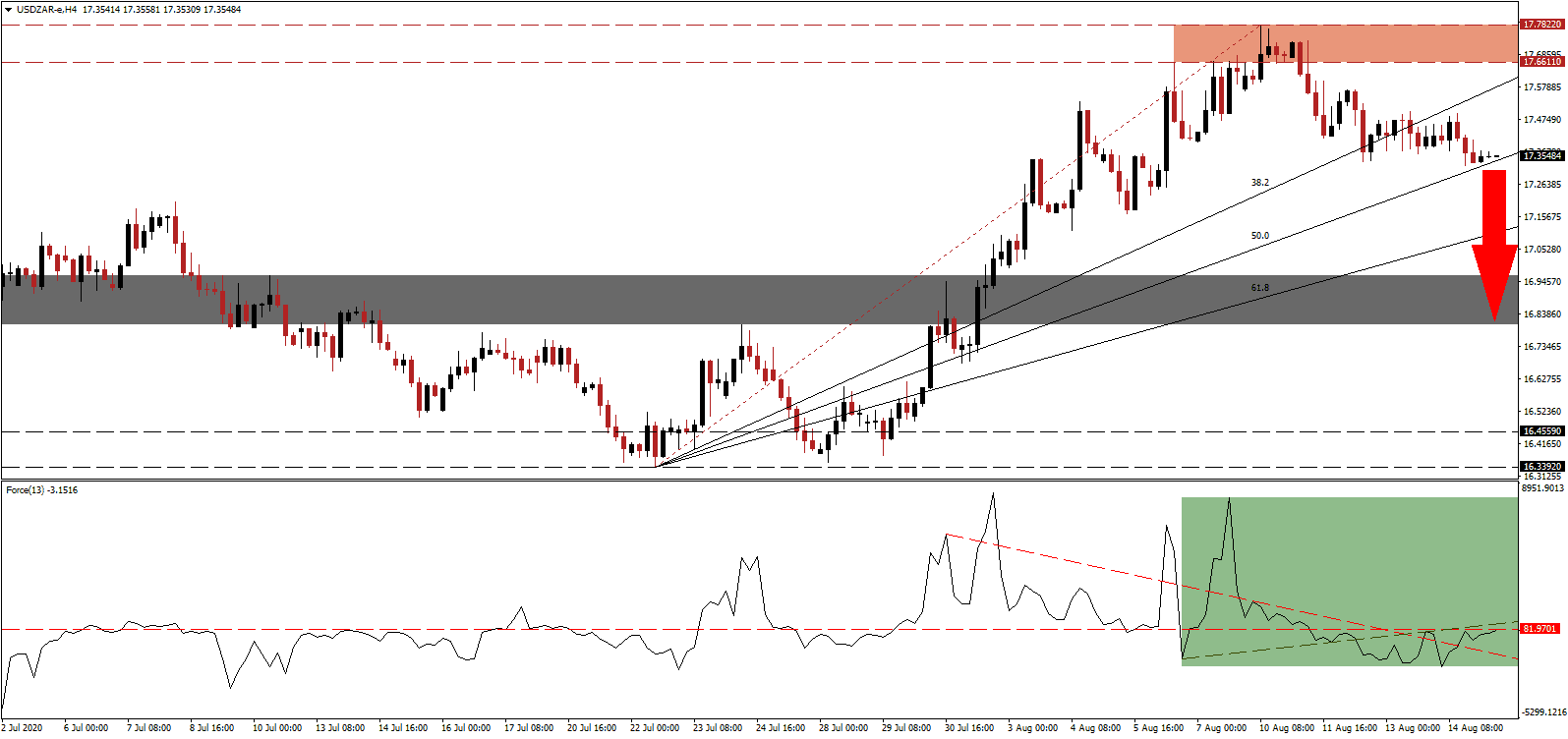

The Force Index, a next-generation technical indicator, remains below its horizontal resistance level with elevated bearish pressures intact. It is also subject to a temporary role reversal between the ascending support level and the descending resistance level, as marked by the green rectangle. Bears remain in control over the USD/ZAR with this technical indicator in negative territory.

Political pressures on the ruling ANC are mounting, as evident in the lost municipal elections in Johannesburg and Pretoria. While the government has ample plans, to-date it lacked the political will power to move from planning to implementation. A positive development emerged with the invitation of German engineers to upgrade German-owned factories and assist Eskom with the electricity grid, blamed on weak GDP due to power outages. After the USD/ZAR collapsed below its resistance zone located between 17.6611 and 17.7822, as identified by the red rectangle, more selling is expected.

Electricity generation presents a depressing problem for the economy and also delivers hope for new investments in renewable energy sources and the high-paying jobs associated with it. South Africa has an opportunity to revive the failed attempt to rely on solar and wind power from the previous administration. Corruption and powerful labor unions in favor of dated coal-fire plants need to be addressed for the economy to start healing. The breakdown in the USD/ZAR below its ascending 38.2 Fibonacci Retracement Fan Support Level increased bearish pressures. Price action is favored to accelerate into its short-term support zone located between 16.8051 and 16.9643, as marked by the grey rectangle.

USD/ZAR Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @17.3550

Take Profit @16.8200

Stop Loss @17.5100

Downside Potential: 5,150 pips

Upside Risk: 1,550 pips

Risk/Reward Ratio: 3.32

In case the Force Index reclaims its ascending support level, serving as resistance, the USD/ZAR may reverse its current breakdown with a temporary price spike. With the outlook for the US Dollar increasingly bearish, and a post-lockdown recovery losing steam, the upside potential is confined to its current resistance zone. Forex traders should sell any rallies from current levels.

USD/ZAR Technical Trading Set-Up - Confined Breakout Scenario

Long Entry @ 17.6100

Take Profit @ 17.7800

Stop Loss @ 17.5100

Upside Potential: 1,700 pips

Downside Risk: 1,000 pips

Risk/Reward Ratio: 1.70