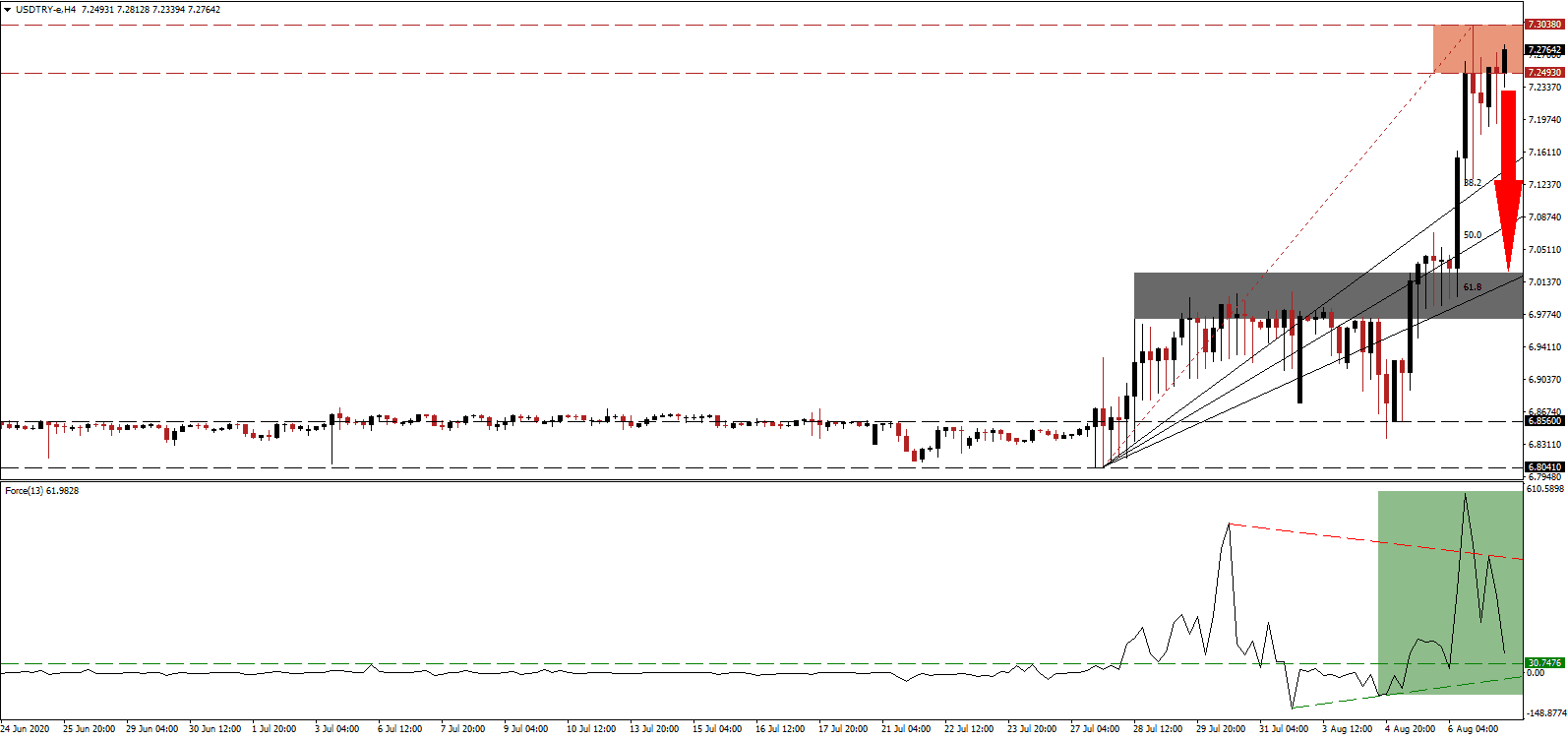

Turkey continues to feel the impacts on tourism, a pillar of its economy, and a source of cash, from the global Covid-19 pandemic. While daily domestic infection hovers just above 1,000, the seventeenth-most infected country globally struggles with a currency crisis. After the USD/TRY plunged to an all-time low, the Türkiye Cumhuriyet Merkez Bankası (TCMB), Turkey’s central bank, vowed to deploy all available tools to ensure price stability and the reduction of excessive volatility. Price action presently challenges the strength of its new-formed resistance zone, after bullish momentum deteriorated.

The Force Index, a next-generation technical indicator, confirmed the all-time high in this currency pair with a spike to a multi-month peak, before swiftly collapsing below its descending resistance level. It is now in the process of pressuring its horizontal support level, as marked by the green rectangle, and a negative divergence exists. The magnitude of the momentum reversal is favored to take this technical indicator below its ascending support level into negative territory, allowing bears to regain complete control over the USD/TRY.

President Erdogan has ordered the TCMB to sell US Dollars, while real interest rates, adjusted for the 12.6% annualized inflation figure, are negative. Foreign currency reserves, net of liabilities, have also turned negative. It highlights a dangerous position for the Turkish financial system. A bailout form the US-based International Monetary Fund (IMF) was ruled out by President Erdogan, who blames outside forces for an attack on his policies, economy, and currency. The USD/TRY, following a brief breakdown, has moved back into its resistance zone located between 7.2493 and 7.3038, as identified by the red rectangle.

Desmond Lachman, a former IMF official and current resident fellow at the American Enterprise Institute, warned that a full-blown currency crisis in Turkey would send a ripple effect across the global financial system, which is unprepared for such a shock. Turkey’s external debt of $450 billion and corporate debt of $300 billion are adding concern. The country also sits on over $300 billion in household gold reserves, slowly being brought into the economy. Volatility is favored to remain elevated, but a profit-taking sell-off cannot be excluded. The USD/TRY is well-positioned to correct below its ascending 38.2 Fibonacci Retracement Fan Support Level and into its short-term support zone located between 6.9715 and 7.0240, as marked by the grey rectangle.

USD/TRY Technical Trading Set-Up - Profit-Taking Scenario

- Short Entry @ 7.2750

- Take Profit @ 7.0250

- Stop Loss @ 7.3500

- Downside Potential: 2,500 pips

- Upside Risk: 750 pips

- Risk/Reward Ratio: 3.33

A reversal in the Force Index above its descending resistance level could lead the USD/TRY into a breakout. Forex traders are urged to caution, as the US economic outlook and labor market are deteriorating. This week’s July ADP data came in well below estimates for 1,500K job additions, clocking in at 167K. June’s data was revised significantly higher, but the Challenger Job Cuts indicator surged by over 575% in July to almost 263K. Price action will face a potential new resistance zone between 7.4498 and 7.5616.

USD/TRY Technical Trading Set-Up - Breakout Scenario

- Long Entry @ 7.4100

- Take Profit @ 7.5600

- Stop Loss @ 7.3500

- Upside Potential: 1,500 pips

- Downside Risk: 600 pips

- Risk/Reward Ratio: 2.50