Turkey has relative control over the Covid-19 pandemic, but the Turkish Lira continues to reach all-time lows versus the US Dollar, despite intensifying bearish pressures on it. The Türkiye Cumhuriyet Merkez Bankası (TCMB), the country’s central bank, left interest rates unchanged at 8.25%, the third consecutive month of no action. It leaves Turkey with negative real interest rates if the 11.8% inflation rate is considered. Some economists draw comparisons to the 2018 currency crisis, but while capital flight remains a concern, domestic gold deposits must not be ignored. Bearish pressures rise inside of the resistance zone, leaving the USD/TRY vulnerable to a profit-taking sell-off.

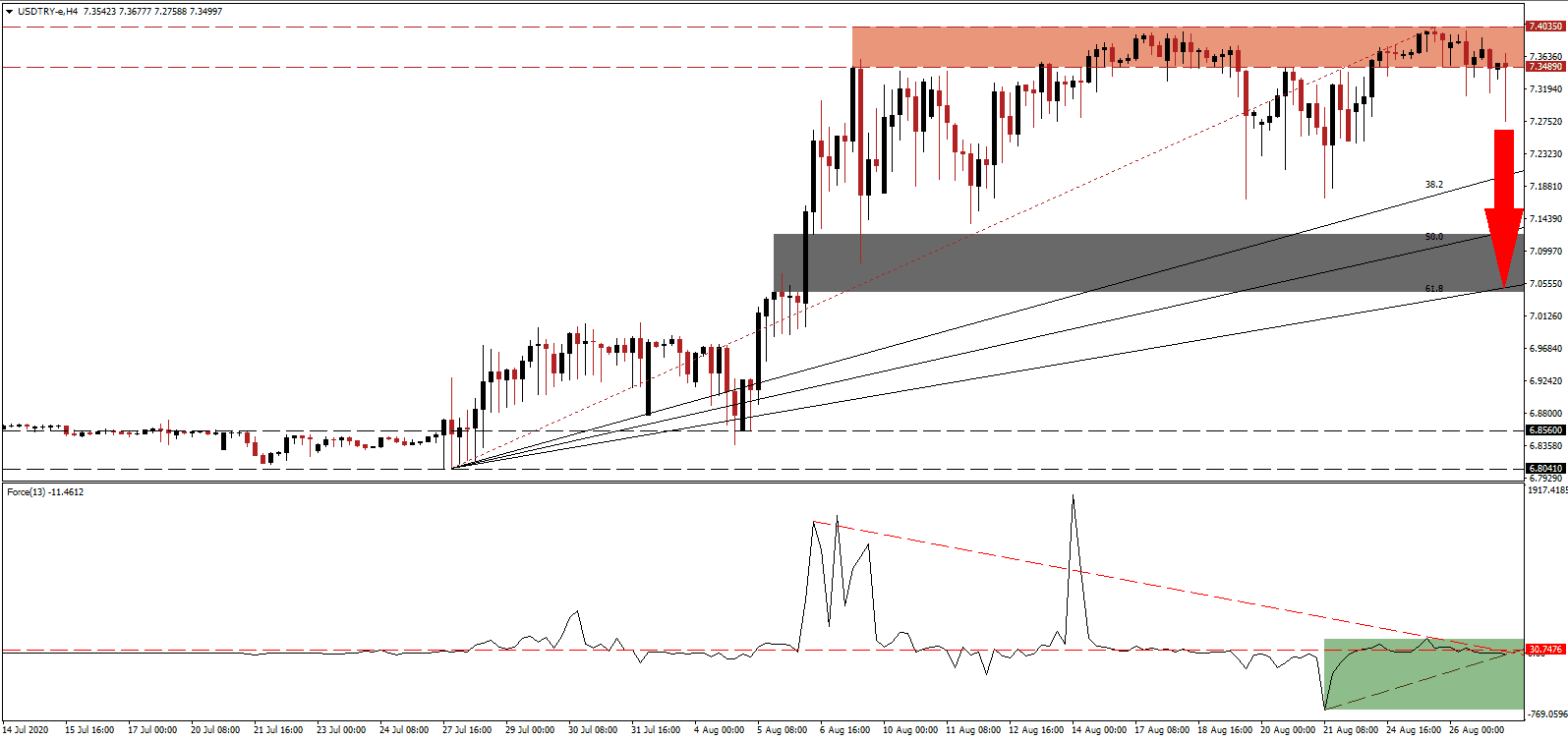

The Force Index, a next-generation technical indicator, recovered from a new multi-week low but remains below its horizontal resistance level, as marked by the green rectangle. With the descending resistance level exercising more dominant downside pressure than the ascending support level can counter, a breakdown is favored to emerge. This technical indicator crossed below the 0 center-line, and bears have control over the USD/TRY.

With $171.4 billion in foreign debt set to mature over the next twelve months, the government of President Erdogan considers more asset swaps to extend the maturity of loans. Qatar is one source of potential funding for Turkey, interested in acquiring real assets amid a strengthening regional partnership between the two. While the present condition appears dire, Turkey is not without viable options. The USD/TRY is well-positioned for a breakdown below its resistance zone located between 7.3489 and 7.4035, as identified by the red rectangle.

One area of rising tension, depressing confidence in Turkey over the short-term, is the situation with Greece. The EU is considering sanctions against Turkey, while Germany attempts to ease tensions between EU-member Greece and non-member Turkey. Sanctions are likely to increase support from Qatar and may yield positive results for the Turkish economy long-term. A breakdown in the USD/TRY is anticipated to drive price action into its short-term resistance zone located between 7.0437 and 7.1232, as marked by the grey rectangle. The ascending 61.8 Fibonacci Retracement Fan Support Level enforces this zone.

USD/TRY Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 7.3500

Take Profit @ 7.0500

Stop Loss @ 7.4200

Downside Potential: 3,000 pips

Upside Risk: 700 pips

Risk/Reward Ratio: 4.29

Should the ascending support level pressure the Force Index higher, the USD/TRY may attempt a new all-time high. The upside potential remains limited to 7.6256 and 7.7019, presenting Forex traders a secondary short-selling opportunity. Long-term bearish pressures on the US Dollar trump medium-term stress in the Turkish Lira, while short-term risks remain elevated. Patient traders have an ideal currency pair to build a short position.

USD/TRY Technical Trading Set-Up - Limited Breakout Extension Scenario

Long Entry @ 7.5200

Take Profit @ 7.7000

Stop Loss @ 7.4200

Upside Potential: 1,800 pips

Downside Risk: 1,000 pips

Risk/Reward Ratio: 1.80