Heng Swee Keat, the Deputy Prime Minister and Finance Minister of Singapore, announced a fresh S$8 billion economic stimuli to combat the ongoing negative impact of the Covid-19 pandemic. He referred to the global economy as very weak after reporting a second-quarter plunge of 13.2% year-over-year, the worst on record for the Southeast Asian financial and trading hub. The additional S$8 billion will mostly extend existing support measures, buying time for a sustained recovery to materialize. After the USD/SGD reached its support zone, breakdown pressures continue to accumulate, suggesting more downside.

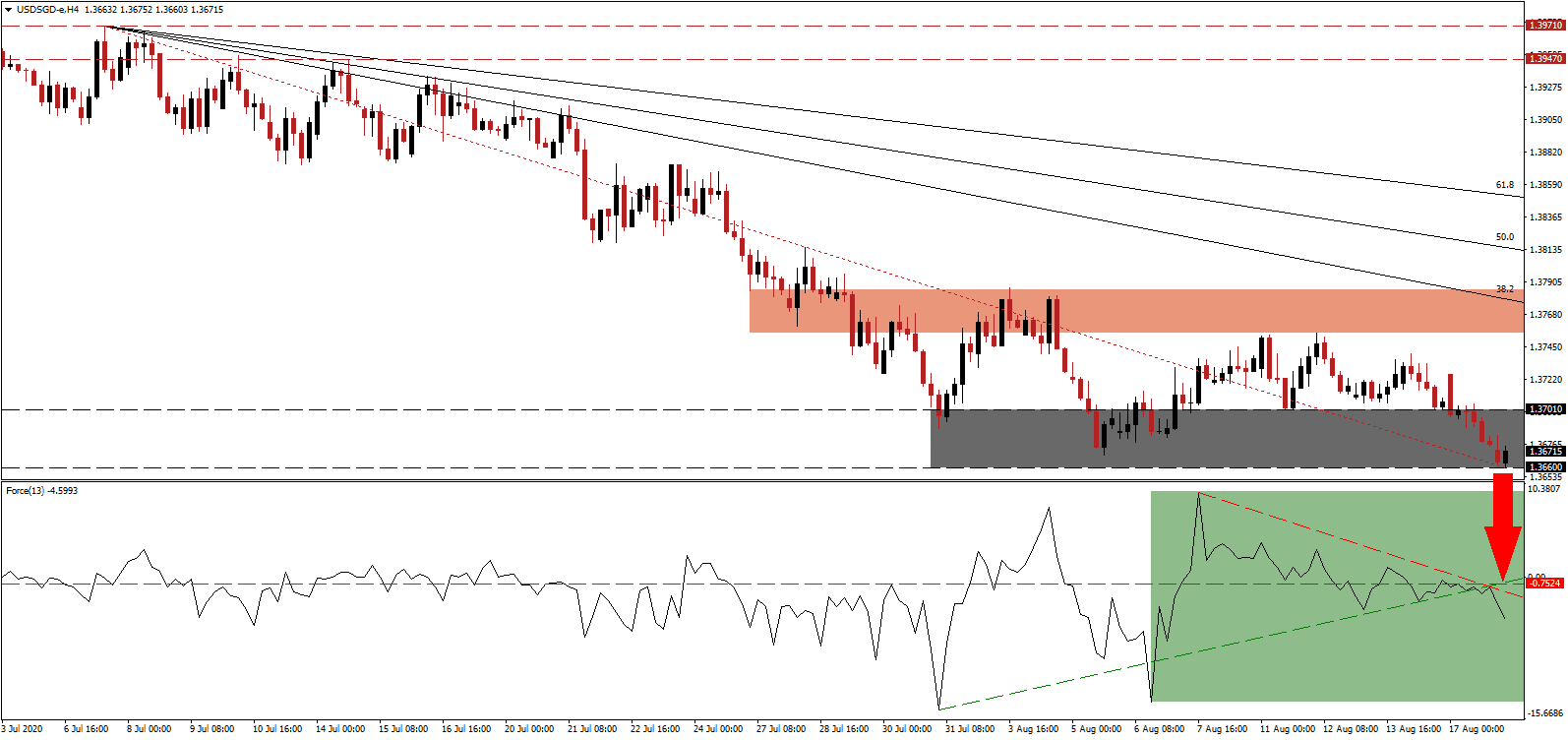

The Force Index, a next-generation technical indicator, confirms the dominance of bearish momentum after being rejected by its horizontal resistance level. Adding to downside pressures was the breakdown below its ascending support level, as marked by the green rectangle, while the descending resistance level maintains the downtrend. With this technical indicator in negative territory, bears are in complete control of the USD/SGD.

One new support measure includes S$320 million in tourism credits to promote domestic tourism. The government will not draw on currency reserves to fund the additional assistance package but reallocate capital from projects delayed due to the virus. Bright spots for Singapore remain precision engineering, electronics, and biomedical manufacturing. After the USD/SGD was rejected by its resistance zone located between 1.3755 and 1.3785, as identified by the red rectangle, breakdown pressures have increased.

US President Donald Trump signed an executive order granting $300 in weekly unemployment subsidies after Congress failed to reach an agreement following the expiration of the $600-per-week measure. The $300 may only be available for three weeks, if at all, and the Federal Emergency Management Agency (FEMA) will distribute funds. It adds distinct bearish pressures on the US Dollar, and the descending 38.2 Fibonacci Retracement Fan Resistance Level is favored to force a breakdown in the USD/SGD below its support zone located between 1.3660 and 1.3701, as marked by the grey rectangle. The next support zone awaits between 1.3567 and 1.3597.

USD/SGD Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 1.3670

Take Profit @ 1.3570

Stop Loss @ 1.3700

Downside Potential: 100 pips

Upside Risk: 30 pips

Risk/Reward Ratio: 3.33

Should the Force Index reclaims its ascending support level, serving as resistance, the USD/SGD could embark on a temporary reversal. Forex traders should consider any upside from present levels as an excellent buying opportunity, due to the uncertainty over the US economy and breakdown pressures in the US Dollar. The upside potential remains confined to its 50.0 Fibonacci Retracement Fan Resistance Level.

USD/SGD Technical Trading Set-Up - Confined Reversal Scenario

Long Entry @ 1.3725

Take Profit @ 1.3770

Stop Loss @ 1.3700

Upside Potential: 45 pips

Downside Risk: 25 pips

Risk/Reward Ratio: 1.80'