While the global Covid-19 pandemic dominates the headlines, rating agencies diverge on the outlook for Pakistan. Moody's Investors Service confirmed a stable outlook for the economy, leaving the B3 credit rating intact, expecting a 2021 GDP expansion between 1.0% and 2.0%. The debt-to-GDP ratio is forecast at 90%, with a fiscal deficit between 8.0% and 8.5% of GDP. Access to healthcare, education, electricity, and water remains limited, while climate change is threatening the agricultural sector and may result in social damage. S&P Global Ratings lowered its rating to one notch to B-. Following the breakdown in the USD/PKR below its resistance zone, more selling is likely.

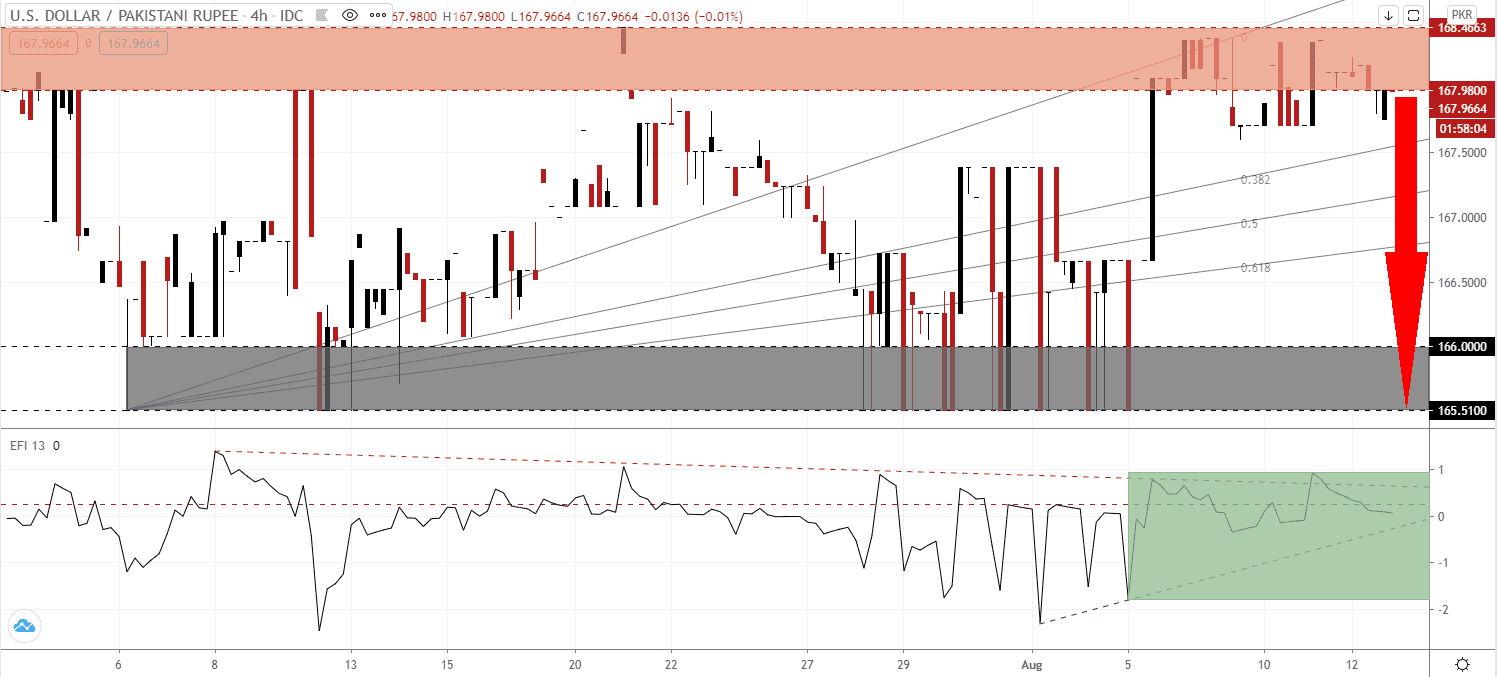

The Force Index, a next-generation technical indicator, reversed a minor spike and retreated below its horizontal resistance level. Adding to downside pressures is the descending resistance level, as marked by the green rectangle. This technical indicator is favored to collapse below its ascending support level into negative territory, granting bears complete control over the USD/PKR.

Pakistan reported a current account surplus of $344 million in May, the second in eight months, which lowered the fiscal year 2019-2020 deficit by 78% to $2.96 billion. The trade deficit dropped by 30% to $9.8 billion, while remittances rose to by 6% to $1.3 billion. Saudi Arabia remains an essential ally and employee of Pakistani migrants. Pakistani Foreign Minister Shah Mehmood Qureshi has angered the kingdom with an ultimatum for an extraordinary meeting of the Organization of Islamic Conference (OIC) on Kashmir. Bearish pressures in the USD/PKR remain elevated after the breakdown below its resistance zone located between 167.9800 and 168.4663, as identified by the red rectangle.

Saudi Arabia has demanded repayment of a $3 billion loan and deferred a decision to extend $3.2 billion worth of oil to Pakistan. The government of Prime Minister Imran Khan borrowed $1 billion from China to start settling the debt with Saudi Arabia. During his election campaign, he pledged not to borrow money. Since then, Pakistan accepted two IMF loans and borrowed from Saudi Arabia, the UAE, Qatar, and China, but the economic outlook remains cautiously optimistic amid a series of reforms. The USD/PKR is well-positioned to collapse below its ascending 38.2 Fibonacci Retracement Fan Support Level and into its support zone between 165.5100 and 166.0000, as marked by the red rectangle.

USD/PKR Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 168.0000

Take Profit @ 165.5000

Stop Loss @ 168.6000

Downside Potential: 25,000 pips

Upside Risk: 6,000 pips

Risk/Reward Ratio: 4.17

Should the Force Index accelerate above its descending resistance level, the USD/PKR may attempt a reversal. It will offer Forex traders a secondary short-selling opportunity amid a deteriorating outlook for the US Dollar. A combination of more debt, a depressed labor market, and political uncertainty add bearish pressures to price action. The upside potential remains confined to the psychological resistance level of 170.0000.

USD/PKR Technical Trading Set-Up - Confined Breakout Scenario

Long Entry @ 169.1000

Take Profit @ 170.0000

Stop Loss @ 168.6000

Upside Potential: 9,000 pips

Downside Risk: 5,000 pips

Risk/Reward Ratio: 1.80