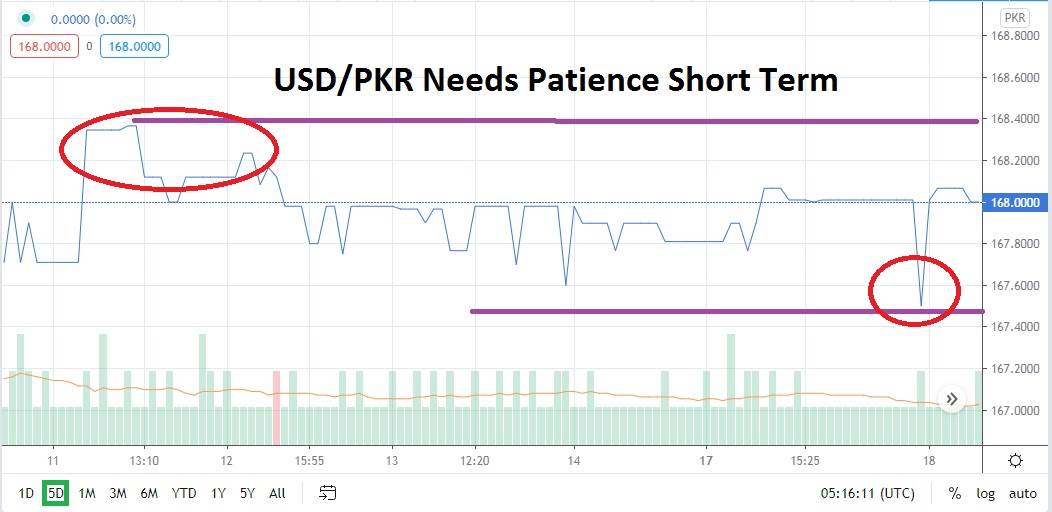

The Pakistani Rupee remains near critical resistance levels, but price action suggests an opportunity exists for brave speculators to actually sell this forex pair. As the USD/PKR continues to hover near the 168.0000, traders should realize that they must practice the art of patience. Since the 5th of August, the Pakistani Rupee has consolidated within an extremely tight range essentially between 167.5000 and 168.4000.

Besides patience, speculators also need an abundance of caution when trading the USD/PKR. This is not a forex pair that should be wagered on by inexperienced traders. The USD/PKR’s tight value band should not be mistaken for a lack of volatility. This forex pair can move abruptly and with sudden violence. The past month of trading within the USD/PKR has seen the values between 165.4800 and 168.4700.

Yesterday saw a flash of downward momentum exhibited when the 167.5000 support level was tested but then witnessed a spike upwards to nearly 168.1000. You can add the word stamina to the list including patience and caution when describing characteristics a trader must have to trade the USD/PRK successfully.

Speculators who are prepared to trade the Pakistani Rupee and have courage may look at the 168.0000 juncture as an inflection point. The consolidated range of the USD/PKR the past five trading days suggests its value range has been almost too tame. While the forex pair certainly has maintained its long term bullish stature as the US Dollar has consistently found buyers against the Pakistani Rupee it has done this with incremental steps.

The question is when the USD/PKR’s next solid breakthrough of resistance will occur? It will likely happen, but predicting the demise of resistance up above needs speculative patience and the ability to withstand overnight fees which can quickly accumulate if you are holding a long position.

Speculators may be tempted rightfully to test support levels of the USD/PKR with selling positions. Technically the USD/PKR has shown the ability to reverse downwards with quick displays of momentum. However, to benefit from these sudden tests of support levels of the USD/PKR, a trader must have limit orders in place when they try to profit from speculative positions. Selling the USD/PKR within the price range of 168.0000 to 168.1000 and looking for a test of the 167.6000 to 167.8000 junctures is certainly a speculative trade, but one which could produce a quick result.

Pakistani Rupee Short Term Outlook:

Current Resistance: 168.4000

Current Support: 167.6000

High Target: 169.0000

Low Target: 167.5000