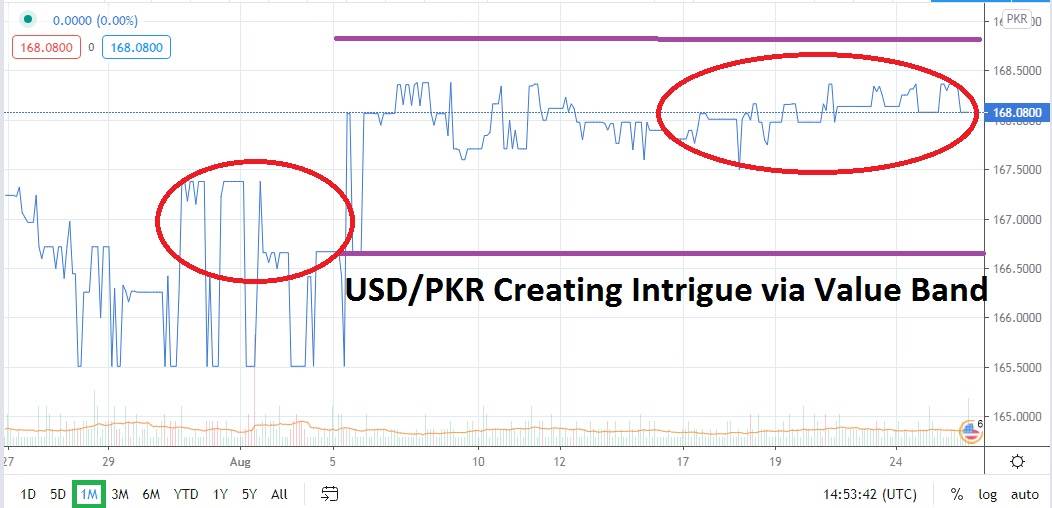

The USD/PKR continues to test long term high water marks. The last two and half weeks have produced trading which has created a tight value band which will certainly intrigue speculators but could prove tricky to create winning results. The bullish trend of the USD/PKR is evident for all to examine with nearly any long term chart. Incrementally the USD/PKR continues to see support levels increase. These are all alluring reasons to believe the trend of the USD/PKR remains bullish.

A profound increase with a stronger support level appears to have occurred on the 5th of August when the USD/PKR put in a low of approximately 166.6600. Since this date the forex pair has begun to steadily test resistance above and showed less capacity to create strong downward reversals. The lowest value the USD/PKR has traded since the 5th of August occurred on the 17th of August when a slight bearish trend took the forex pair a touch below the 167.5000 juncture.

While support has begun to prove quite strong, resistance has certainly been tested above, but interestingly the highest levels of the USD/PKR have not broken through in a devastating fashion and have actually produced what some may refer to as polite trading. Since the 6th of August resistance has proven nearly impossible to break near the 168.4000 level. A simple glance at a one month chart shows the USD/PKR’s tenacity as it has consistently tested the highest levels of its very strong bullish trend. On the 21st of July the USD/PKR actually traded slightly above the 168.4440 juncture before creating a short lived bearish trend which then consistently tested support near 165.50 from the end of July until the 5th of August.

However, the ignition of more USD/PKR bullish behavior the past two and half weeks has seen only limited downside price action. For speculators this makes trading the USD/PKR particularly tricky, because to trade this forex pair successfully it is often done by using limit orders to establish a position. The lack of strong downside momentum means traders have likely had to wait for the 167.6500 value to be touched if they are buying the USD/PKR when it hits current support levels. The fear this causes in speculators is because there is a legitimate worry a stronger selling barrage will unfold and lower support will be tested which could wipe out a trade quickly.

Speculators should have little problem acknowledging the bullish trend has remained intact for the USD/PKR. However deciding on the exact time to take advantage of the trading pair is perplexing. The Pakistani Rupee is a currency which only experienced traders should be attempting to profit. If a new trader wants adventure they will need a good forex broker to guide them through the implications of too much leverage, carry charges when holding the USD/PKR overnight and the use of proper limit orders.

Pakistan has recently said its export numbers are down compared to this time last year. This makes total sense because of coronavirus. The government is also concerned about growing unemployment among the young. Pakistan has also expressed worries regarding inflation and its direct impact on the costs of food for its population.

Pakistan has been creating a better relationship with China, but analysts do not believe this is enough to heal all of the problems facing Pakistan’s economy. Speculators may want to continue buying the USD/PKR, but they should be patient and attempt to enter the market with finely crafted limit orders which take advantage of reversals which test developing support levels.

Pakistani Rupee Outlook for September:

Speculative price range for USD/PKR is 166.5000 to 169.0000.

Support at 167.5000 is important and if broken the USD/PKR may test additional lower values near 166.5000.

Resistance at 168.4000 is important, if broken a move to 169.0000 and higher could be possible.