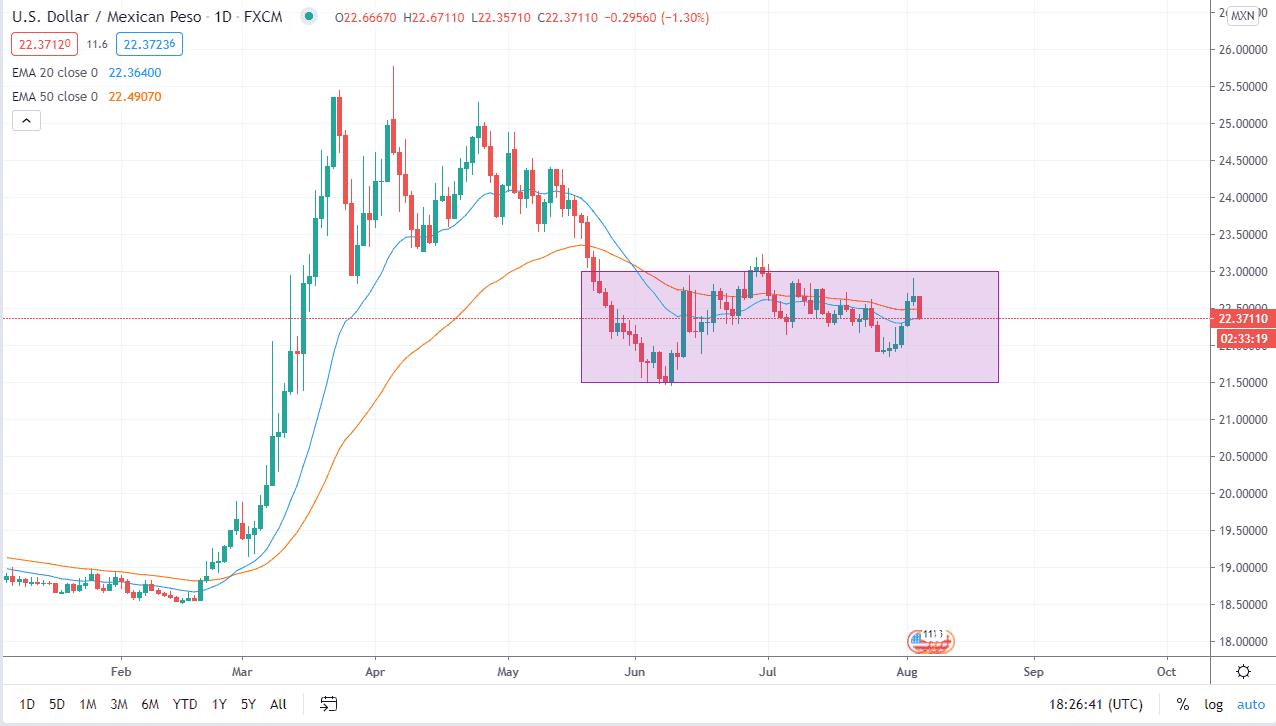

The US dollar has dropped a bit against the Mexican peso during the trading session on Tuesday as we continue to bounce around in the same rectangle. The 23 pesos level is at the top resistance, and the 21.50 pesos level being supported. This is crucial to recognize, as this pair does tend to go sideways for quite some time on occasion. It is also worth noting that the Mexican peso is considered to be a gateway currency for Latin America, so it is a way to play the entire region, perhaps right along with the Brazilian real.

The 50 day EMA has flattened out, suggesting that perhaps we do not have anywhere to be in the short term. This is a great set up for those who are looking to play short-term trade, although it is worth noting that this is an exotic pair, so a short-term play might be three or four days, not three or four hours. Having said that, we will eventually break out of this rectangle, and when we do it gives us a heads up as to where we are going next. If we can break above the 23 pesos level, then it is likely that we go looking towards the 25 pesos level. On the other hand, if we turn around and break down below the 21.50 pesos level, then it is likely that we could go down to the 20 pesos level.

I would expect a lot of choppiness in the meantime, but you can take advantage of that if you have the ability to trade this pair on short-term charts. Once we do break out of this range, then it becomes a little bit more of a swing trade. The Federal Reserve continues to flood the market with US dollars, so that is part of what has worked against the US dollar against the Mexican Peso, but we also have a lot of concerns when it comes to coronavirus infections in Mexico, and the potential effect on the economy. The Mexican economy is highly dependent on the US economy as well, and obviously that is under pressure. The more “good economic news” that we get out there, the better off the Mexican peso will do and vice versa. Currently, it looks like the market is trying to figure out where we are going next as far as all of that is concerned.