Investors abandoned safe havens recently, which allowed the USD/JPY pair to push up to the 106.57 resistance. Nevertheless, the strongest downward pressure on the pair remains, which collapsed to the 105.09 support during last week’s trading. The pair is stabilizing around 106.35 at the beginning of trading on Wednesday. After announcing a drop in US consumer confidence for the second month in a row, Lynn Franco, Senior Index Manager at the Conference Board, source of the statement, said: “Consumer spending has rebounded in recent months, but growing concerns among consumers about the economic outlook and their financial well-being will likely lead to a cooling in spending in the coming months”.

The portion of the index measuring current conditions has declined sharply, as consumers indicated that working conditions and employment have deteriorated sharply over the past month. Consumers' optimism about their short-term outlook and financial outlook also declined. “Consumer confidence has now slipped two steps back, after a giant step forward in June,” said Jim Baird, chief investment officer at Planet Moran Financial Additions. "Initial hopes for a faster return to pre-pandemic normalcy have faded."

The US Consumer Confidence Index fell to a reading of 84.8 in August, the lowest level since May 2014.

US new home sales jumped again in July, rising 13.9% by 901,000 homes, the largest number of sales since 2006. This was a much larger number than analysts had expected and came after the big increases in May and June. The recent sales gains came on the heels of a sharp drop in March and April as Americans stayed home due to government restrictions aimed at slowing the spread of the Coronavirus. In a report last week, the National Association of Realtors reported that existing home sales rose by a record 24.7% in July, thanks to historically low-interest rates. This was the second major rise in several months and helped stabilize the housing market in an uncertain economic time.

On the Japanese side, the government there said that 98.6 percent of Japanese households received a one-time cash aid of 100,000 yen ($940) intended to help mitigate the economic fallout from the new coronavirus epidemic that continued to emerge, as Tokyo saw 182 new daily cases of the virus. The government has completed distributing funds to nearly 58.26 million families, equivalent to 12.55 trillion yen, or 98.5 percent of the project budget. In principle, the head of the household receives the total amount of cash assistance for family members transferred to his bank account.

Residents of Japan were able to apply for the aid for three months from the time their municipalities began accepting applications, with many reaching the deadline by the end of August. Tokyo saw triple new infection numbers in nearly the entire month, except for Monday. Although the capital saw a daily record of 472 cases on August 1, the number of cases has been declining since mid-August.

Tokyo's one-day figure of 182 new cases, which was confirmed on Tuesday, now raises the cumulative total in the capital to 19,610 cases. The number is nearly double the 95th figure reported the day before, and the lowest daily figure since July 8 when 75 injuries were reported.

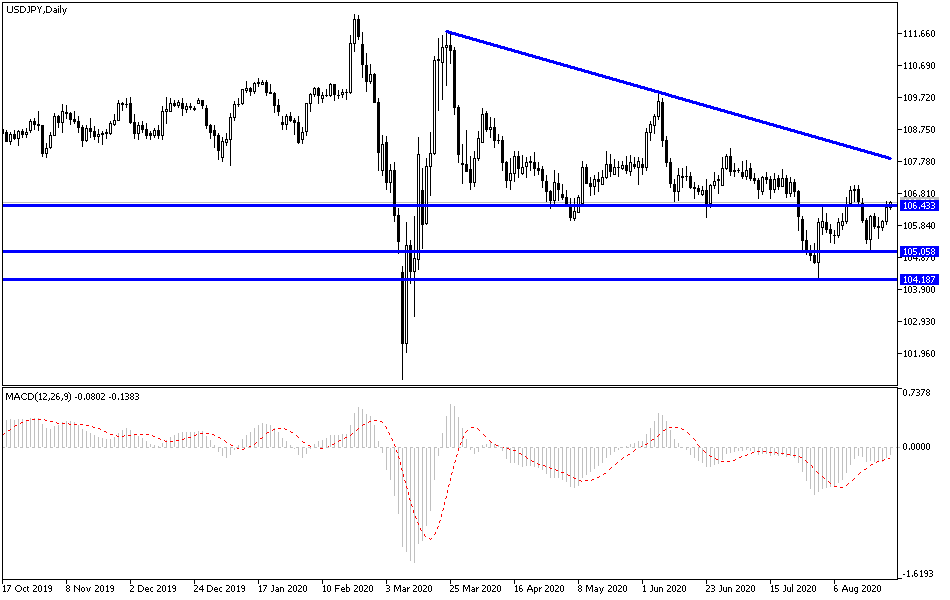

According to the pair’s technical analysis: The recent rapprochement between the United States of America and China regarding the trade agreement supported a state of risk that dominated global financial markets, the most prominent of which was the stock market. USD/JPY attempts to rebound higher was affected by that, and still needs to move towards the 108.00 resistance level to confirm the reversal of the downtrend, which is still dominating the pair on the long and medium terms. According to the current performance, the return of stability below the 106.00 support will provide the bears with enough momentum to control the pair and test stronger support levels, the closest ones currently at 105.85, 105.20 and 104.45, respectively. As I mentioned earlier, I still prefer to buy the pair from every lower level.

As for the economic calendar data today: From Japan, the Corporate Services Price Index will be announced. From the United States, durable goods orders will be announced.