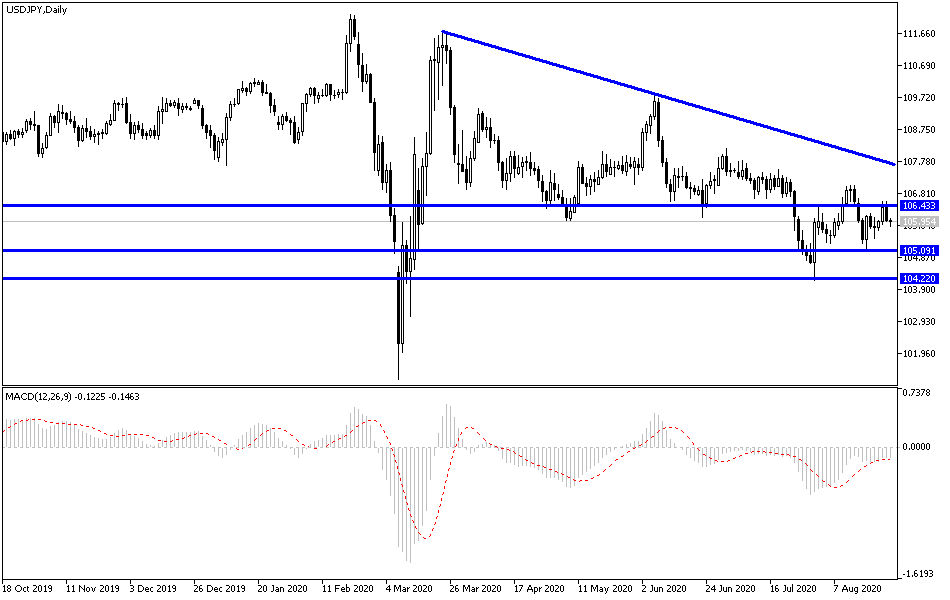

For two trading sessions in a row, the bulls failed to push the USD/JPY through the resistance line at 106.56 and settled instead around the 105.85 support at the time of writing. This performance is due to the investors’ desire to use the Japanese yen as a safe haven more than relying on the dollar, as the latter awaits important statements from Federal Reserve Governor Jerome Powell today, as his comments will include some adjustments to the bank's policy and objectives in the COVID-19 era, which plunged the world economy to its lowest level since World War II.

The greenback's reaction was limited after data showed a larger than expected increase in durable goods orders in July. The DXY dollar index fell to 92.85 after settling up at 93.36 earlier yesterday.

Data released by the US Commerce Department showed US durable goods orders increased 11.2% in July after rising by a revised 7.7% in June, the third consecutive monthly gain. Economists had expected durable goods orders to increase by 4.3% compared to the 7.6% jump reported in the previous month. The larger-than-expected jump in durable goods orders was mainly driven by a sharp increase in transportation equipment orders, which rose by 35.6%.

Excluding the large increase in transportation equipment orders, durable goods orders rose by a more modest 2.4% in July after rising 4% in June. The increase still exceeds the 2% growth estimate. While gains in durable goods orders are welcome, economists warn that this could falter if coronavirus infections spike in the fall, forcing more factory closures and a return to the near economic contraction the United States experienced last spring.

The most influencing event for the USD/JPY today: US Central Bank Governor Jerome Powell will speak Thursday on the Fed's new inflation-friendly strategy. He will explain how the central bank plans to achieve its twin goals of price stability and increased employment opportunities once the coronavirus pandemic is over. The Fed spent the past year reviewing its "new monetary policy framework."

The results were expected earlier this year, but the process was bogged down by the outbreak of the Coronavirus, which pushed the economy into its deepest recession since World War II. But Fed officials want to go ahead and legalize changes in their strategy, based on what they learned since 2012. That is when the US central bank formally adopted a 2% inflation target. Since then, inflation has remained stubbornly below target even as the economy enjoyed the longest growth ever and the unemployment rate approached its lowest level in 50 years.

Powell will deliver his remarks at the annual Jackson Hole Economic Symposium held by the Federal Reserve Board of Kansas City. His comments will be made at 9:00 AM EST today, Aug. 27.

According to the technical analysis of the pair: There is no change in my technical view of the USD/JPY, as stability below the 106.00 support will support the strength of the bears' control and warn of a stronger downward movement, the closest levels to which is 105.75, 104.90 and 104.00, respectively. On the other hand, the upward correction will not be strengthened without the pair moving around and above the 108.00 resistance. As I mentioned before, I confirm now that I still prefer to buy the pair from every lower level.

The performance of the pair will interact today with the announcement of the US GDP growth rate, jobless claims and pending home sales, and then to the most important factor, which Federal Reserve Governor Jerome Powell comments.