Prior to announcing a record and historical slowdown in the Japanese economy for the second quarter of 2020, the USD/JPY stabilized around the 106.50 support, and did not care about the announcement of the influential US economic releases at the end of the week. A report from the Ministry of Commerce showed that US retail purchases rose by 1.2%, seasonally adjusted, last month. Gains in the past three months have now brought retail purchases back to levels seen before falling in March and April when the pandemic shut down businesses and crippled the US economy.

But with the overall income of Americans now likely to shrink, economists are expecting spending to slow further. The sales increase in July was well below the May gain of 18.3% and an increase of 8.4% in June, when shoppers flocked to the newly reopened businesses. And in July, the virus re-emerged in most parts of the country, forcing some companies to close again. Sales in restaurants and bars grew 5% last month after much stronger increases of more than 30% in May and 27% in June. In general, revenues for restaurants and bars are still about a fifth below last year's level. Strong sales gains were reported last month in electronics and appliance stores, reflecting the needs of high-income people who now work from home. Purchases also increased at clothing stores, gas stations and pharmacies. Furniture sales were flat after huge gains in June.

The problem now is that nearly 28 million laid-off workers no longer receive the $600 weekly federal unemployment check they had received in addition to their government benefits, which have elapsed last month. In addition, the $1,200 stimulus check sent to many Americans in April and May will likely not be repeated. Negotiations in the Congress for a new economic relief package have collapsed and there has been no sign of resuming anytime soon.

In the April-June quarter, consumer spending collapsed by a record amount, causing the US economy to contract at an unprecedented annual rate of 32.9%. Economists have expected growth in the July-September quarter to recover at an annual rate of nearly 20%, although this pace will keep the economy well below pre-epidemic levels. The government figures mask a major shake-up in the retail industry, as Americans sharply cut back on personal shopping and spend more online. Therefore, more than 40 retailers have filed for bankruptcy protection this year, half of them since the epidemic. That is twice the number for the whole of 2019.

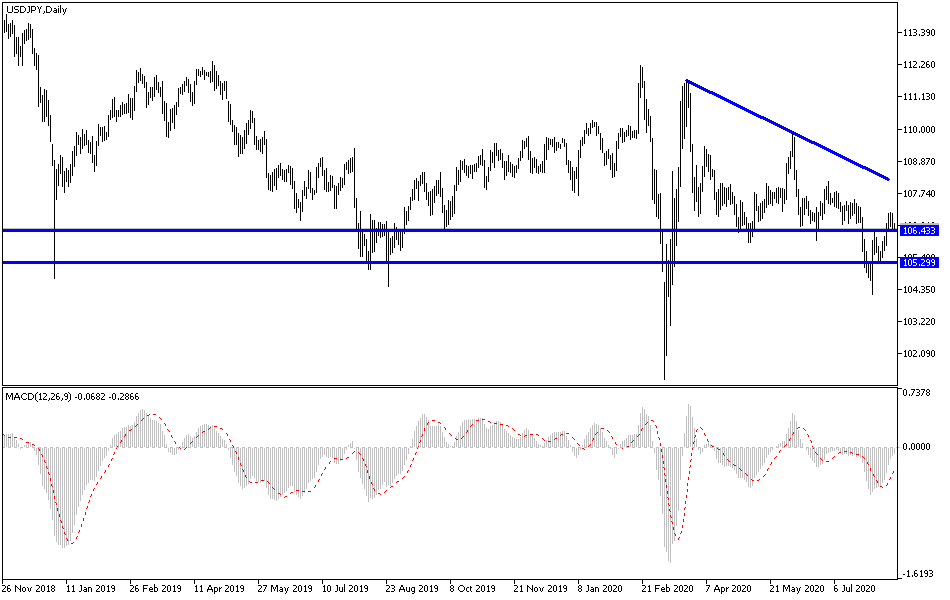

According to the technical analysis of the pair: For three consecutive trading sessions, the USD/JPY was unable to cross the 107.00 resistance, which confirms the extent of the bears' control over the performance, and currently the support levels at 106.40, 105.80 and 104.90, will be the closest targets. As I mentioned before, the resistance levels at 108.00 and 110.00 will remain the most important for the extent of bulls controlling the performance and breaking out of the current descending channel. Overall, I would still prefer buying the pair from every lower level.

As for the economic calendar data today: From Japan, the GDP growth rate will be announced along with the industrial production rate. From the United States, the Empire State Manufacturing Index and the NAHB Housing Market Index will be announced.