Despite the strength of the US dollar against other major currencies, the bounce gains for the USD/JPY did not exceed the 106.21 level around the time of writing. The pace of the recent losses of the pair pushed it towards the 105.09 support. The US currency returned to the upward correction despite the pessimistic tone that dominated the contents of the Federal Reserve Bank’s latest MoM. On the Japanese side, government data showed that Japan's exports fell by 19.2% in July compared to the previous year, as the Coronavirus pandemic led to a decline in global demand for goods from the third-largest economy in the world.

The interim figures from Japan's Finance Ministry showed Japan's imports dropping down 22.3% in July. Exports to the US were particularly hard-hit, dropping 19.5%. Due to weak shipments of plastic, iron and steel goods and computer parts.

Japan recorded its first trade surplus in four months on the back of the recovery in China, where the outbreak of the Coronavirus began. Exports to China, including metals, paper products, and machinery, grew by 8.2% in July. The Japanese economy relies heavily on exports, so weak demand in major overseas markets limits their growth. The COVID-19 pandemic has caused some plant production to stop temporarily, crushed tourism, and hurt economic activity overall.

The Japanese economy has been in recession throughout 2020 so far, although it has not experienced any complete shutdowns. Instead, authorities have encouraged people to work from home, wear masks, and practice social distancing. Some stores have closed or cut back their hours. Japan has reported about 1,100 deaths attributed to COVID-19 so far, which is fewer than hard-hit countries such as the United States and Brazil. Concerns are growing about the recent spike in cases, especially in Tokyo and other urban areas.

On the US side, Fed officials noted that there has been an increase in uncertainty about the economic outlook since their last meeting in mid-June. According to the minutes, “several” Fed officials said that additional monetary easing steps may be required to strengthen the economy. And “some,” said strong financial support would be necessary. Going forward, “a number” of Fed officials believed that the central bank should rewrite its forward guidance. Officials spoke of their pledge to keep interest rates low until one or more economic outcomes are achieved.

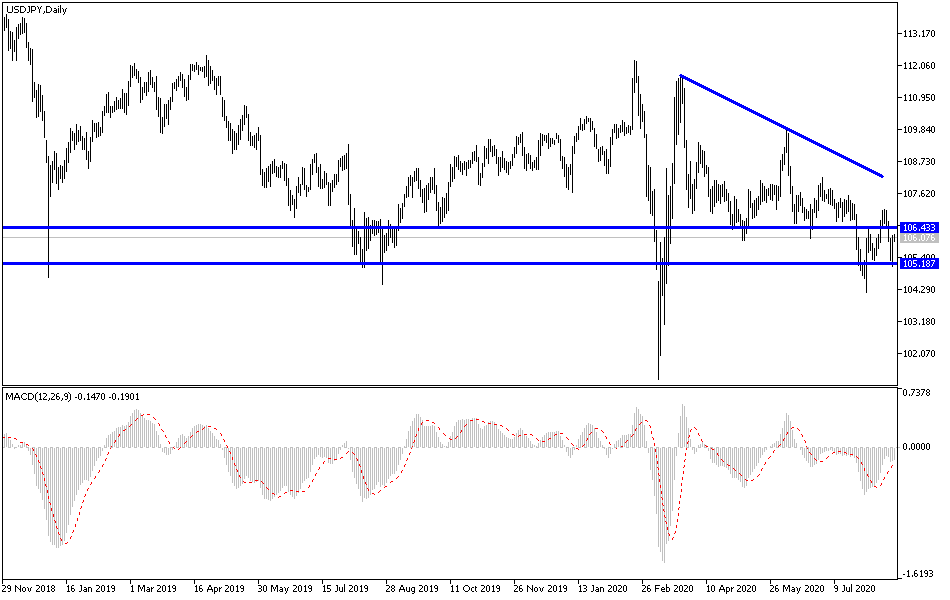

According to the technical analysis of the pair: On the daily timeframe chart, the price of the USD/JPY is still under downward pressure, and the movement around and below the 106.00 support symbolizes the bears' strong control over the performance, and as I mentioned before, no real shift in the direction will occur without breaking below the 108.00 resistance. Otherwise, the general trend will remain to the downside. The buying levels of the pair will form the support levels at 105.65 and 104.80, and on the long-term, targets that may reach the 110.00 psychological resistance. The pair will react today to the announcement of the US data; jobless claims and the reading of the Philadelphia Industrial Index.