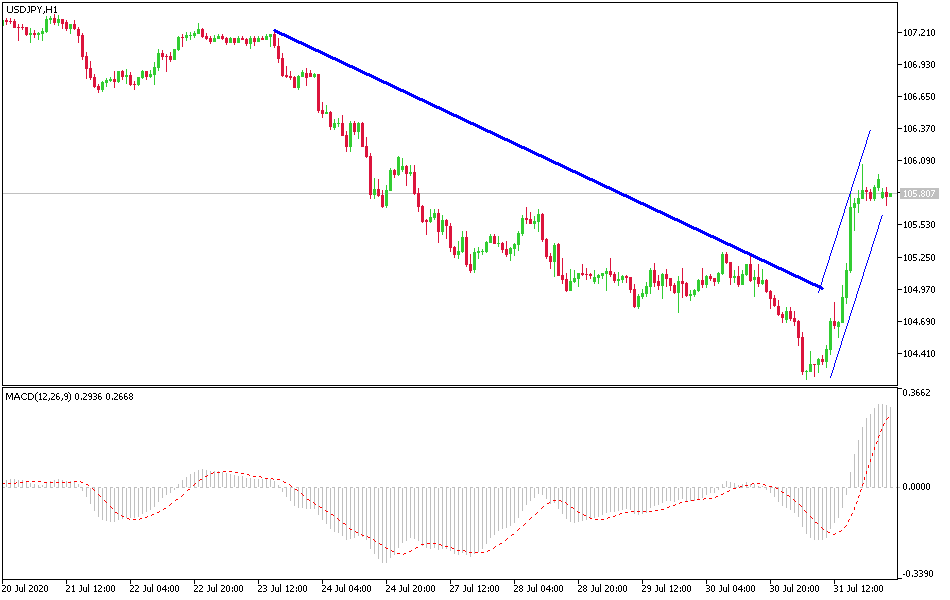

USD/JPY: The strength of the decline remains

Today’s USD/JPY Signals

- Risk 0.75%.

- Trades may only be taken between 8 am New York time Thursday and 5 pm Tokyo time today.

Short Trade Ideas

- Go short following a bearish price action reversal on the H1 time frame time immediately upon the next touch of 106.10 or 107.00.

- Put the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade Ideas

- Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 105.20 or 104.30.

- Put the stop loss 1 pip below the local swing low.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

USD/JPY Pair Analysis

Despite the best daily performance in months for the USD/JPY pair during last Friday's session, the pair has not yet emerged from its violent bearish channel. The Japanese currency confirmed that it is a strong competitor to the dollar as a safe-haven currency. I think that returning below the 105.00 support will confirm the bear's control over the performance for a longer period. At the same time, technical indicators go into strong oversold areas and may be a trigger for forex investors to consider buying the pair.

The second COVID-19 wave has also affected Japan, and although it was not as strong as in the United States, it may have an impact on the Japanese currency's gains in the coming days unless the situation there is contained.

Regarding the US dollar, the ISM Manufacturing PMI and construction spending data will be announced. As for the Japanese yen, the GDP growth reading and the Industrial Purchasing Managers' Index will be announced.