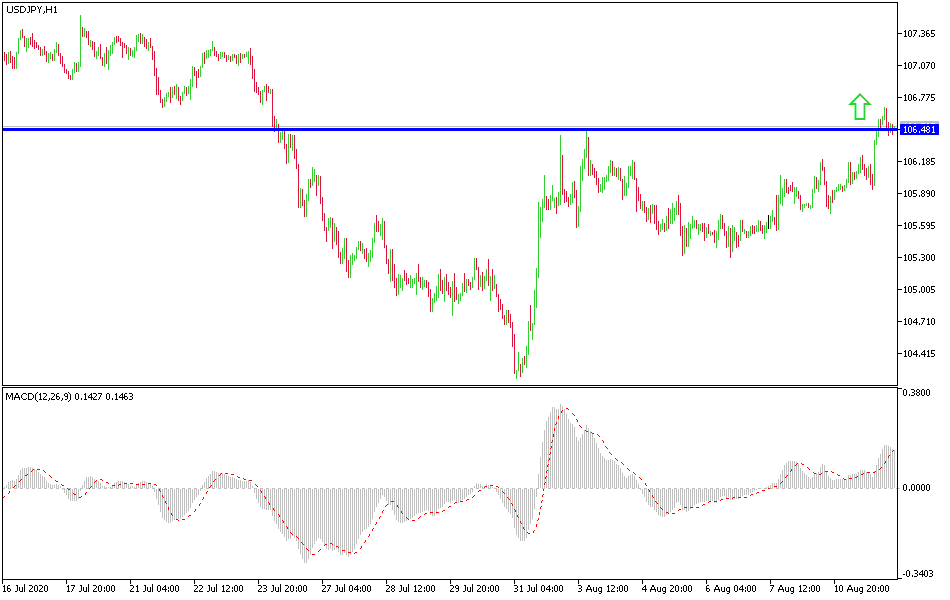

USD/JPY: Trend reversal starts.

Today’s USD/JPY Signals

- Risk 0.75%.

- Trades may only be taken between 8 am New York time and 5 pm Tokyo time today.

Short Trade Ideas

- Go short following a bearish price action reversal on the H1 time frame time immediately upon the next touch of 165.20 or 105.60.

- Put the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade Ideas

- Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 106.35 or 107.00.

- Put the stop loss 1 pip below the local swing low.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

USD/JPY Pair Analysis

As I mentioned yesterday, USD/JPY bullish correction attempts are still weak, as, after three trading sessions, the rebound gains have not crossed the 106.68 resistance. The pair had collapsed to the 104.18 support in the last trading session of last month. Japan announced a balance of payments and trade numbers for June, and Japan's Balance of Payments recorded a surplus of 167.5 billion yen, but it was much less than the May surplus of 1.18 billion yen. Nevertheless, Japan continued to run a trade deficit (on a balance of payment basis) of 77.3 billion yen in June after a deficit of 557 billion yen in May. In general, Japan's wider surplus is a function of the capital and income calculation from dividends, taxes, licensing fees, and profits.

Meanwhile, China appears to be reining in the robust lending seen earlier this year. In fact, the lending numbers for July were weaker than expected. New yuan loans, generated by the formal banking system, rose by 992.7 billion RMB, while economists were looking for something closer to RMB 1.2 trillion after RMB 1.8 trillion in June. Total financing, which includes non-bank financial institutions (shadow banking), rose by 1.69 trillion yuan, less than half of 3.5 trillion yuan in June.

From the United States, an official report showed that US producer prices rose more than expected in July. Accordingly, the Ministry of Labor announced that the producer price index for final order rose by 0.6 percent in July after declining by 0.2 percent in June. The recovery in producer prices reflected the largest increase since October 2018 and topped economists' estimates with a 0.3% increase. Energy prices showed another big increase during the month, rising 5.3 percent in July after rising 7.7 percent in June.

Meanwhile, the report said that food prices fell 0.5 percent in July after plunging 5.2 percent in the previous month. Excluding food and energy prices, primary producer prices continued to rise by 0.5% in July after declining by -0.3% in June. Economists had expected core prices to rise 0.1%.

I still advise forex traders to buy the USD/JPY currency pair from the support at 105.85 and 104.90 at the moment.

Regarding the US dollar, CPI reading will be announced. There are no important economic releases expected today. For the Japanese yen.