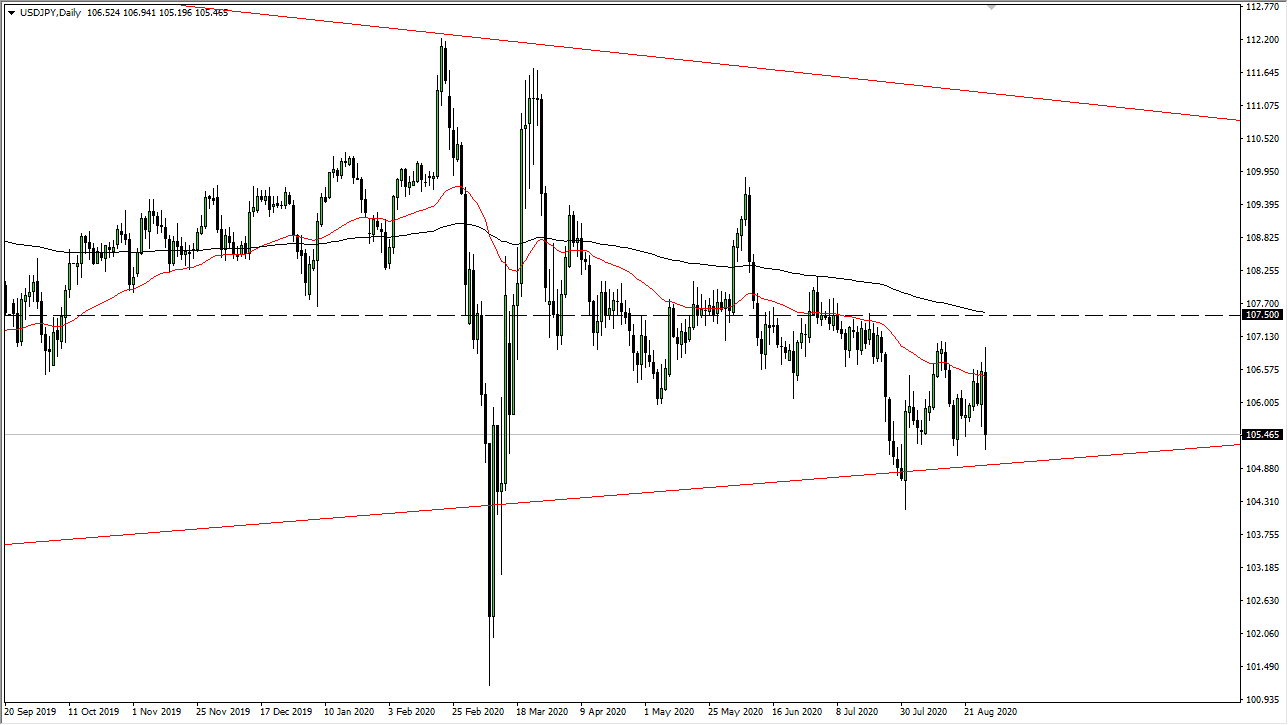

USD/JPY: Price is stuck in a very unclear area below 106.00

Last Thursday’s signals produced a profitable long trade from the strong bullish bounce from the support level I had identified at 105.87.

Today’s USD/JPY Signals

Risk 0.75%.

Trades must be taken between 8 am New York time Monday and 5 pm Tokyo time Tuesday.

Short Trade Ideas

- Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 106.21, 106.41, or 107.07.

- Place the stop loss 1 pip above the local swing high.

- Move the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade Ideas

- Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 105.69 or 104.87.

- Place the stop loss 1 pip below the local swing low.

- Move the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

USD/JPY Analysis

I wrote last Thursday that the level at 105.87 was very likely to be a very pivotal point.

I really wanted to take a long trade from a bullish bounce at that level.

This worked out well as the bounce off that level came as the market spang into life following remarks from the Chair of the Fed which impacted the market, which were bullish for risk and as such pushed the price of this pair up.

This rise was, however, short-lived, and we saw a strong fall to new lows, followed by a recovery.

The technical picture, as shown in the price chart below, looks very uncertain. It just feels wrong to call any direction, so I would stand aside from trading this pair today.

The most I can say is that between 104.87 and 107.07, the price action looks unpredictable, so it may be wise to wait for the price to break out of this range one side or another.

There is nothing of high importance due today regarding either the JPY or the USD.