The US dollar has rallied a bit during the trading session on Monday to kick off the week, but against the Japanese yen it has been extraordinarily sleepy. At this point in time, it is likely that the ¥106 level is going to continue to be an area of interest. At this point, the market is simply grinding away between these two very soft currencies. This is basically a fight between two weaklings, so therefore it is difficult to get overly excited about anything at this point.

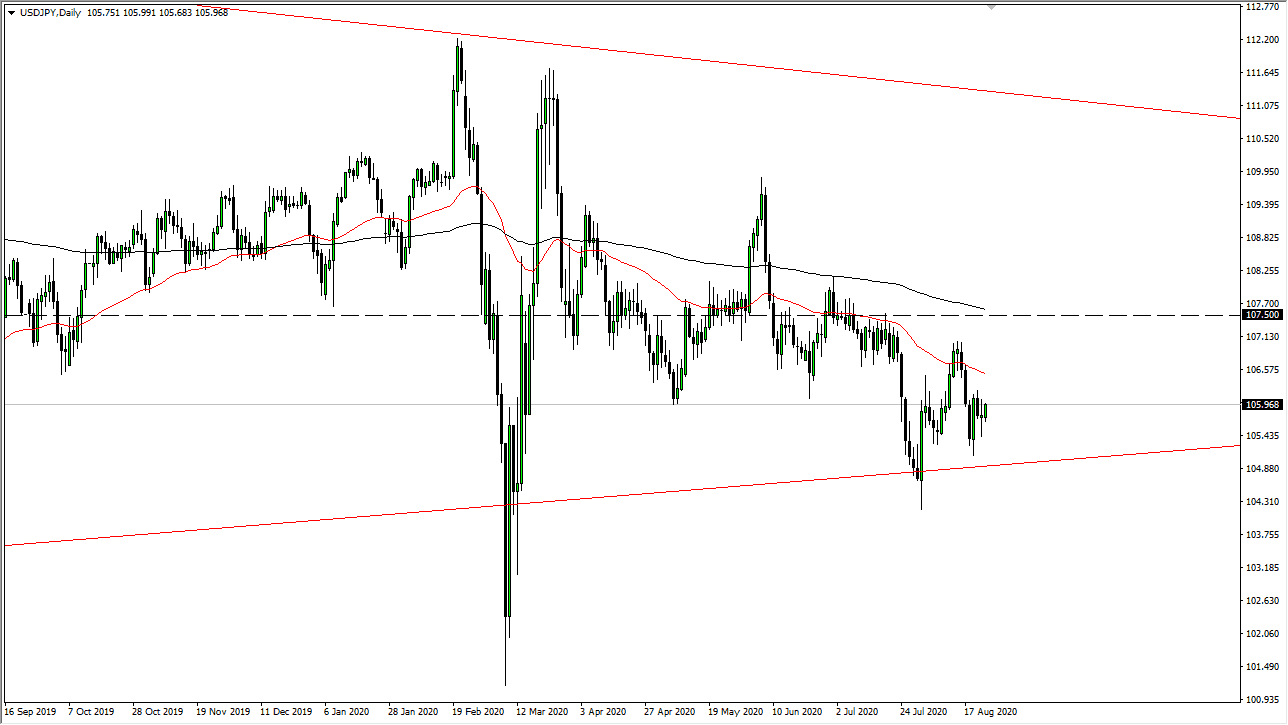

The candlestick for the day was testing the top of the neutral candlestick from the previous session, but I cannot be bothered. The 50 day above will cause some resistance, just as the ¥170 level will, followed by the ¥107.50 Area. The 200 day EMA in that area will also be in that area, so that should also offer resistance. I think this is a currency pair that has absolutely nowhere to be anytime soon, so I would not put a lot of money into it. If you want to day trade it and make quick scouts here and there, so be it. That is probably about all you are going to see in the short term, because there is no actual catalyst for this pair to go anywhere.

Having said all of that, it is possible that Jerome Powell actually says something to move the markets at Jackson Hole later this week, but really at this point I think this is an argument between two central banks that are determined to destroy their own currencies. The Federal Reserve is typically even better at doing that than other central banks, so that will probably win the day here. However, I think that there are so many different areas of interest by short-term traders in this market that it is difficult to get aggressive at any one particular level. Back-and-forth range bound trading is about as good as this is going to be and therefore you should not fight that issue. I think we are probably going to continue to see this in the short term, but if we get some type of impulsive candlestick that means something, I will let you know, but until then I think we will simply go back and forth.