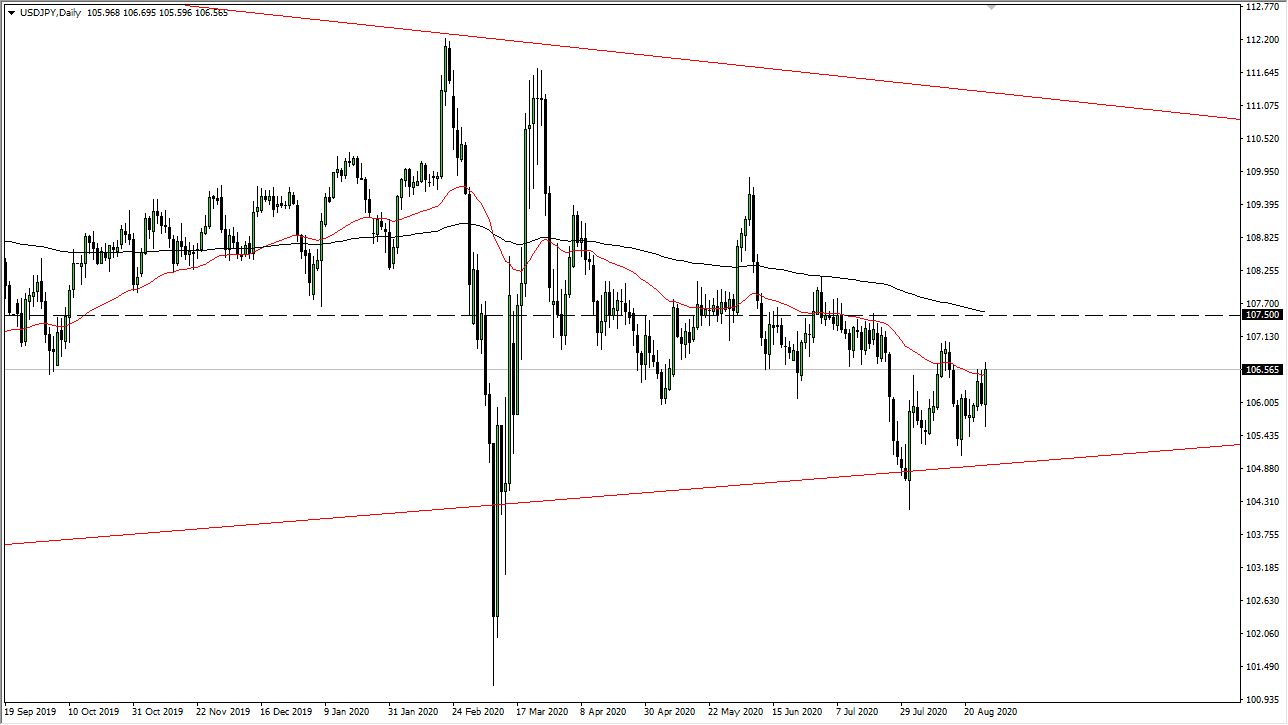

The US dollar has initially fallen during the trading session on Thursday, perhaps in anticipation of Jerome Powell speaking but the markets were hugely disappointed as the US dollar recovered quite nicely against most currencies. In fact, this market broke above the 50 day EMA again and is closing with a little bit more force than previously. After all, we are closing at the top of the candlestick, and that normally means that we will get some type of continuation. I think the market is probably going to go looking towards the ¥107 level, where we start to see sellers again.

Furthermore, you should keep in mind that the market is between the 50 day EMA and the 200 day EMA, quite often an area that will be a thick “zone” as far as support or resistance is concerned. Furthermore, the ¥107.50 level has offered significant resistance previously and is of course the scene of the 200 day EMA. With all that being said, I think we are going to go somewhere between the ¥107 and the ¥107.50 levels, and then rolled right back over.

If we rollover right away, then we will probably find support closer to the ¥106 level, as we head into the weekend and traders take profits. This is a very short term kind of scalping environment that people should be paying attention to, because eventually we will have a bigger break out. We do not have that quite yet, but it should be noted that there is the Jackson Hole Symposium going on, so we could get some type of headline that moves the markets overnight. That is not necessarily my best case is, but it does make quite a bit of sense that you should pay attention to that. Longer-term, I do believe that this market probably breaks down, but we obviously have a lot to go before we see that happen, which I think might be a story for later in the year. This is a market that will remain very choppy, so keep in mind that you need to trade this market off of short-term charts, because a bigger move is very unlikely to happen. This is especially true as we are heading into the weekend and a few traders will want to put big positions on at this point in the week.