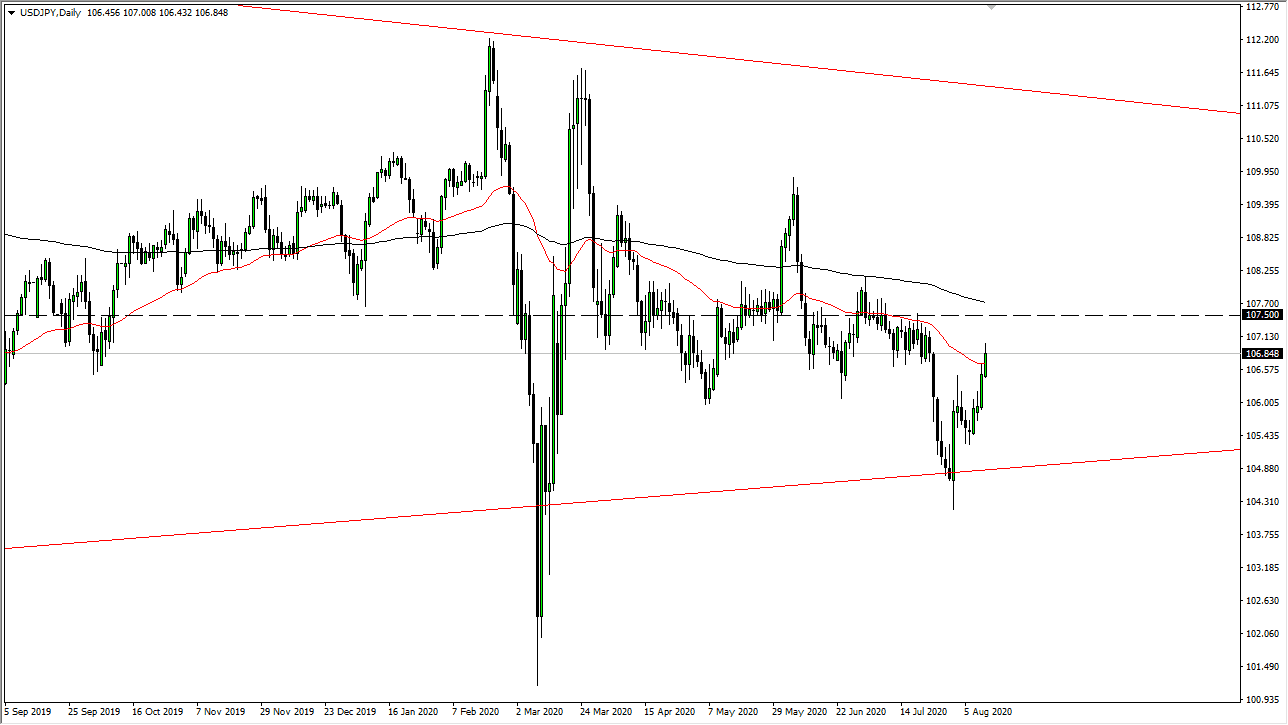

The US dollar has rallied a bit during the trading session again on Wednesday, as the Japanese yen loses a bit of its potency. The US dollar had been oversold for some time, so it makes sense that we had a bit of a relief rally. However, what the daily candlestick does not show us is that there are two shooting stars on the four-hour chart, showing that perhaps we are going to struggle in this general vicinity. I believe there is a significant amount of resistance between the ¥107 level and the ¥107.50 level, and it would not be surprising at all to see sellers jump in here. After all, we are between the 50 day EMA and the 200 day EMA, which typically means that there is a lot of interest.

It is not until we break above the 200 day EMA that I would be willing to buy this pair because it would show a significant amount of bullish pressure. At that point, the market could very well go looking towards the ¥110 level, but that would signify a major shift in the attitude of this market, one that has been extraordinarily negative. To the downside, I believe that the market probably goes looking towards the ¥105.50 level, an area that had seen buyers previously. A breakdown below there then opens up the door to the ¥104 level. All things being equal, this is a pair that features a couple of “safety currency”, and therefore it does tend to act on its own. It marches to its own beat as it were.

Expect volatility, this is typically going to be the way this pair traded anyway, but I think at this point the US dollar is likely to fall overall, and that should translate over here to a point. That does not mean that we fall apart, and this pair does tend to move a bit slower than the others when it comes US dollar weakness, but at the end of the day a falling US dollar tends to show itself against all other currencies. With that, I fully anticipate that we are getting close to the top of this most recent move. I could be wrong, and if I am it is going to take a significant shift in the attitude of the FX markets when it comes to the greenback and perhaps, more importantly, the Federal Reserve.