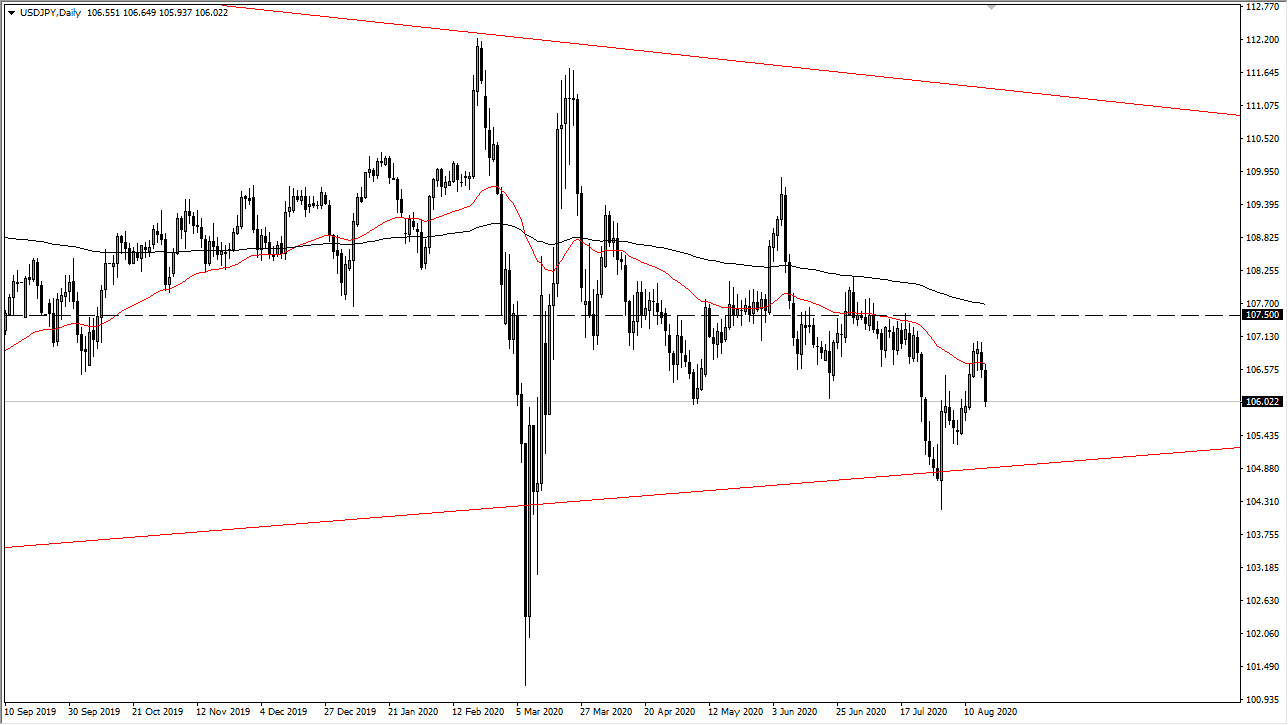

The US dollar fell hard during the Monday session to kick off the week, as the US dollar continues to lose value overall. With the dollar reaching towards the ¥106 level, it looks as if we are in an area that could see a little bit of support. I think that the market looks likely to continue dropping from here so selling short-term rallies at this point in time, but that does not necessarily mean that it is going to be that easy. Ultimately, this is a market that is sensitive to risk appetite, but we can pay attention to the stock market and see whether or not it could give us a bit of a boost, but the falling US dollar is the main story.

With the Federal Reserve flooding the markets with liquidity and taking out massive measures to continue to support the financial system, this puts downward pressure on the US dollar overall. Because of this, even if we have the “risk-on rally” that would typically kick off this pair to the upside, it may not be enough to overcome the Federal Reserve and its plans. Having said all of that, no move happens in a straight line so the occasional short-term rally could return. The fact that we pull back from the 50 day EMA is something worth paying attention to as well, as it is a nice technical signal for sellers in general.

To the upside, between the 50 day EMA and the 200 day EMA, there seems to be a significant amount of resistance as per usual, so it does make sense that we have come back from here. Ultimately, I have no interest in buying this pair until we break above the 200 day EMA, pictured in black on the chart. The market breaking above there would be a very bullish sign, but I do not see that happening anytime soon. Ultimately, it would take a major shift in attitude for this to happen and therefore I do not see that happening anytime soon. With this, I believe that we are ready to continue drafting lower, perhaps reaching towards the ¥105 level relatively soon. Below there, then the ¥102 level would be the next target from what I can see. I do not have any interest in buying in the short term, at least not unless we break above that 200 day EMA.