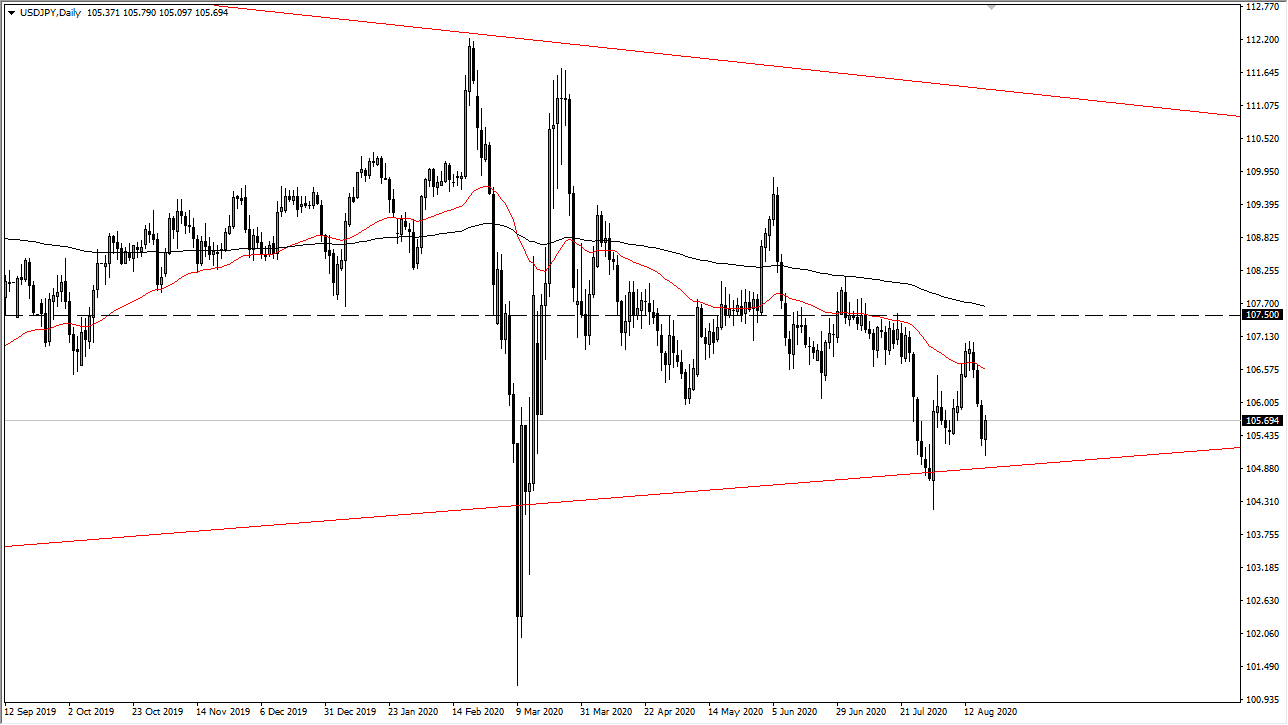

The US dollar has initially fallen against the Japanese yen to continue the downtrend during the trading session on Wednesday but has reversed course to reach towards the ¥105.75 level. At this point in time, we are getting relatively close to some resistance and the fact that we have stabilized should not be a huge surprise, because we had three brutal days in a row. The US dollar had gotten oversold against most currencies, not just this one so it is worth paying attention to the idea that perhaps a little bit of profit-taking may be coming into the marketplace.

Just above, I see the 50 day EMA offering significant resistance, currently near the ¥106.50 level. That is an area where I would expect to see selling pressure, and perhaps more value hunters as far as the Japanese yen is concerned. After all, not much has changed in the valuation of the US dollar or the outlook for the US dollar other than the fact that we may have gotten far too ahead of ourselves. At this point, I do not have any desire in trying to buy this pair, although I recognize that we could go a bit further. It is a matter of waiting for some type of decent set up in the trend that has been forming and then placing the trade.

To the downside, if we can break down below the lows of the trading session for Thursday, I anticipate that we will go looking towards the ¥104 level, followed by the ¥102 level, and finally the ¥100 level. I do not have any interest in trying to buy this pair until we break above the 200 day EMA, which is currently sitting just above the 107.50 again level, an area that has been like a magnet for price in the past. If we did break above that level, it would show a significant amount of bullish pressure and a major shift in the attitude of traders. However, as the Federal Reserve continues to flood the markets with US dollars, it is difficult to imagine a scenario where dollars suddenly gets bought hand over fist and the attitude of traders around the world changes. Granted, this could be more of a grind lower over here as the Bank of Japan is also notoriously loose with its monetary policy.