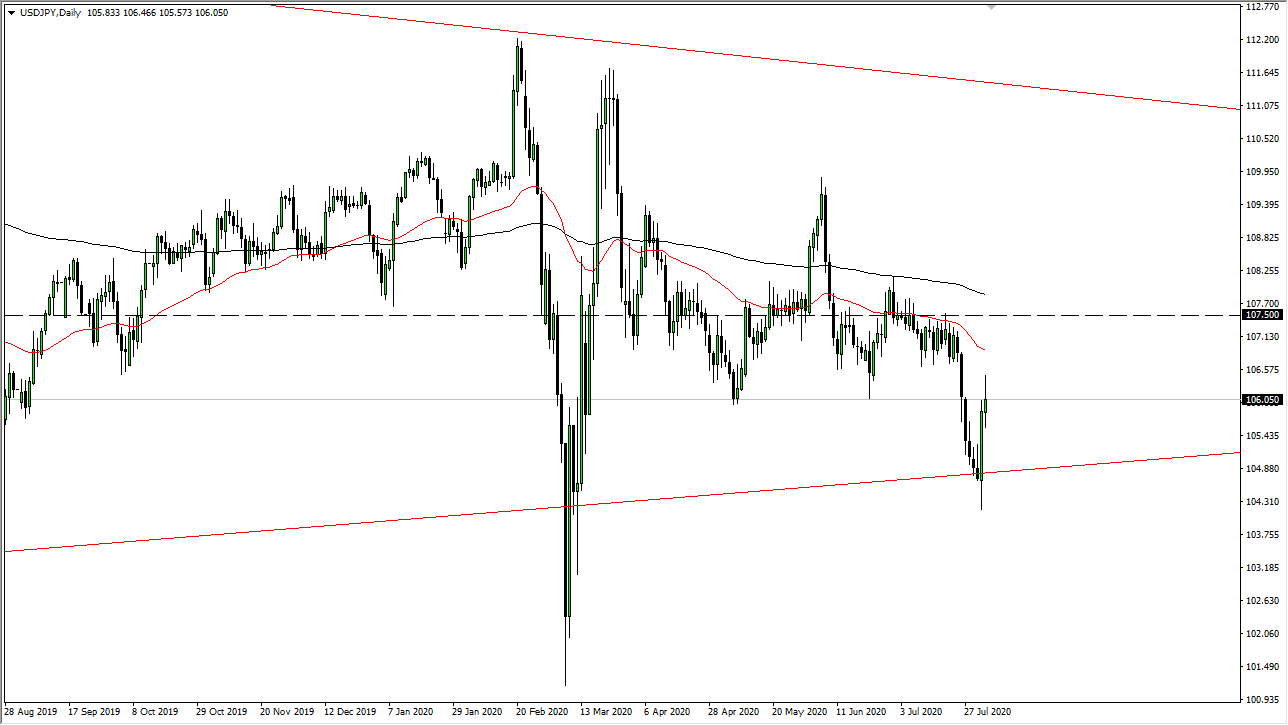

The US dollar rallied significantly during the trading session on Monday but continues to see selling pressure just above as the market hit a bit of a “brick wall” at the ¥106.50 level. By forming the shape of the candlestick, we have, it suggests that we could very well pull back from here and go looking towards lower levels. The US dollar is being worked against by the Federal Reserve, as they liquefy the markets and loosen monetary policy as much as humanly possible. Furthermore, Chairman Jerome Powell has recently stated that the “Federal Reserve was thinking about tightening monetary policy.” That is about as loose a monetary policy statement that you can imagine. In other words, there is no sign of rates rising in the United States anytime soon.

With that being the case, it is likely that the dollar continues to lose ground against almost every currency out there, not just the Japanese yen. While this pair can move on risk appetite, going up and down with stock markets, at this point, it is all about the US dollar and more precisely about the Federal Reserve. As long as the Federal Reserve stays in the same monetary policy stance, it is hard to imagine a scenario where this market suddenly reverses course. Even if we were to break above here, I believe that the 50 day EMA comes into play as resistance, and then most certainly the ¥107.50 level, an area that has been a site of serious contention.

To the downside, I think we will probably go looking towards the bottom of the candlestick from Friday which was so impressive. After all, Friday was an attempt at breaking things down but ran into a lot of buying pressure. It is worth noting that Friday’s candlestick was the last candlestick of the month, so there might have been profit-taking and position squaring ahead of options expiration skewing the market a bit. With that, we are most decidedly negative overall, so I think selling is probably going to continue to be the best way to play this market. Fading short-term signs of exhaustion probably will work out best, but if we can break down below the lows of the Friday session, I think it opens up the door to the ¥102 level.