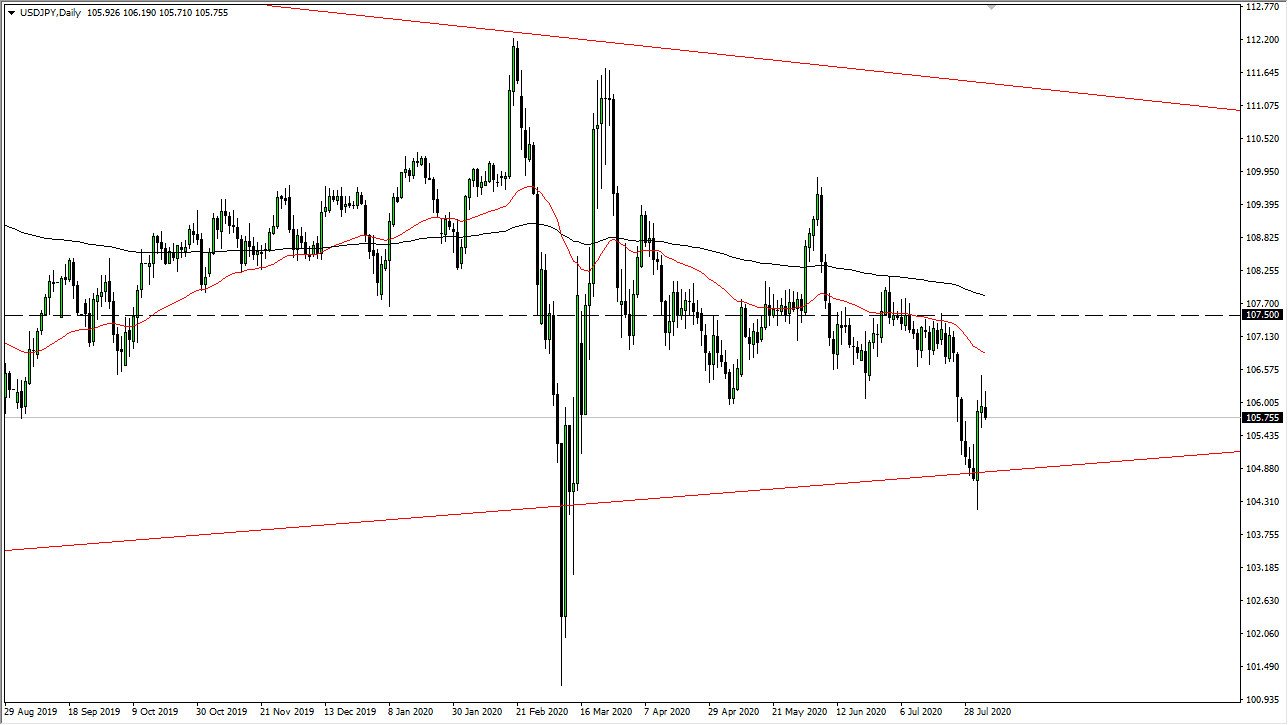

The US dollar initially tried to rally on Tuesday but gave back quite a bit of the gain to show signs of exhaustion. The market now looks likely to continue going to a bit lower, especially after forming a shooting star on Monday, and a very similar candlestick during the day on Tuesday. At this point in time, it is likely that we will continue to go lower, perhaps reaching down towards the ¥104.75 level. All things being equal, the market is likely to see more pressure due to the fact that we have seen a lot of US dollar selling against almost everything else, so the Japanese yen will not be any different.

Looking at the Federal Reserve and its actions as of late, it is obvious that the market has seen a central bank that is flooding the market with its currency. The US dollar continues to be hammered against the Euro and the Pound, not to mention gold. The Japanese yen is considered to be a safety currency, but the most important thing that the FX markets are paying attention to is the fact that it is not the greenback.

The shape of the candlestick tells me that the ¥106 level is going to continue to offer a lot of resistance, and I believe that the ¥107.50 level will continue to cause a lot of trouble. The 50 day EMA is sloping lower, and therefore could offer quite a bit of resistance. If we can break down below the bottom of the candlestick from the Friday session, then this market could unwind quite drastically. The bullish candlestick for Friday should be noted as being a potential profit-taking session as it was the last day of the month. Furthermore, the Federal Reserve and the fact that the United States is ready to do more stimulus should continue to work against the greenback. While the Bank of Japan is most certainly loose with its monetary policy, it is difficult to imagine that the Japanese yen will suddenly selloff as there is a lot of fear out there and this makes the Japanese yen an attractive currency to hold. In this scenario, we have both the Federal Reserve working against the value of the greenback and the concern out there when it comes to the overall risk appetite of traders around the world.