A Japanese panel of economists and experts for the Cabinet Office concluded the economy failed to reach a 73-month post-war record expansion, as suggested by Prime Minister Shinzo Abe. It fell two months short after ending a 71-month rise in October 2018, with the US-China tariff war delivering a blow to exports. During the boom, the middle-class vanished as real wages did not increase, and the majority of the population did not benefit from Abenomics, the monicker given to the economic plan of Prime Minister Abe. Then the Covid-19 pandemic struck, keeping safe-haven demand for the Japanese Yen elevated. The USD/JPY has ended a healthy counter-trend advance inside of its short-term resistance zone.

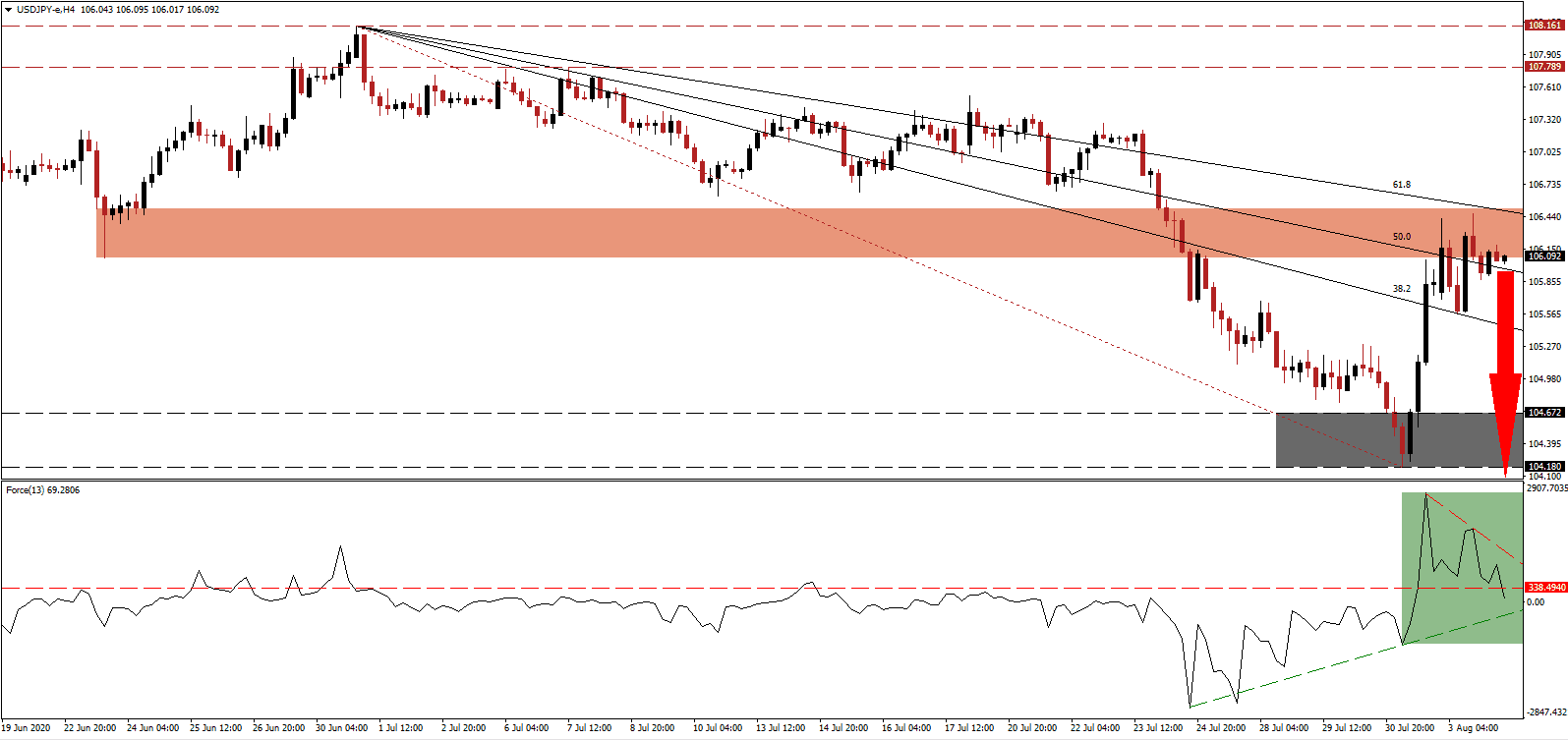

The Force Index, a next-generation technical indicator, confirmed the powerful reversal with a spike to a new multi-week peak. A bullish momentum collapse followed, taking it below its horizontal support level, converting it into resistance. Increasing downside pressures is the descending resistance level, as marked by the green rectangle, anticipated to force a breakdown below its ascending support level. Bears wait for this technical indicator to cross below the 0 center-line to regain complete control over the USD/JPY.

A fresh update by the Japanese government for the 2020 GDP forecasts a contraction of around 4.5%. On top of a global slump in export demand, the cancellation of the summer Olympic games due to the Covid-19 pandemic lowers expectations. Domestic consumption remains depressed, real wages stagnant, and deflationary pressures remain. By comparison, the 2008 global financial crisis resulted in a 3.4% GDP drop. The USD/JPY was rejected by its short-term resistance zone located between 106.070 and 106.516, as identified by the red rectangle, from where a breakdown materialized.

Japan did not implement a mandatory lockdown as it violates the constitution, but it asked citizens to voluntarily self-isolate, practice social distancing, and for companies to shut down. Fewer than 40,000 confirmed cases and just above 1,000 casualties in a population of over 125,000,0000 million represents a relatively low Covid-19 infection count and the death toll and is a statement for the highly civilized Japanese culture. Economic activity resumed gradually adding to bullish pressures on the Japanese Yen. The descending 61.8 Fibonacci Retracement Fan Resistance Level is favored to guide the USD/JPY back into its support zone located between 104.180 and 104.672, as marked by the grey rectangle. More downside cannot be excluded, driven by US Dollar weakness.

USD/JPY Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 106.050

Take Profit @ 104.050

Stop Loss @ 106.550

Downside Potential: 200 pips

Upside Risk: 50 pips

Risk/Reward Ratio: 4.00

A breakout in the Force Index above its descending resistance level may allow a temporary breakout in the USD/JPY. The upside potential remains confined to its resistance zone located between 107.789 and 108.161, proving Forex traders with an excellent secondary selling opportunity. Magnifying bearish progress is the worsening outlook for the US economy driven by a depressed labor market, unsustainable debt, and the start of what is now referred to as Cold War II, with China instead of Russia.

USD/JPY Technical Trading Set-Up - Confined Breakout Scenario

Long Entry @ 107.050

Take Profit @ 107.800

Stop Loss @ 106.550

Upside Potential: 75 pips

Downside Risk: 50 pips

Risk/Reward Ratio: 1.50