India has taken a leadership position in new daily confirmed Covid-19 infections, surpassing both the US and Brazil. It remains the third-most infected country globally but is on course to display Brazil as number two unless significant changes materialize. Prime Minister Narendra Modi announced a digital health plan, aimed at delivering a new national ID card to every citizen, containing all health-related information. The USD/INR recovered into its short-term resistance zone, from where breakdown pressures are expanding.

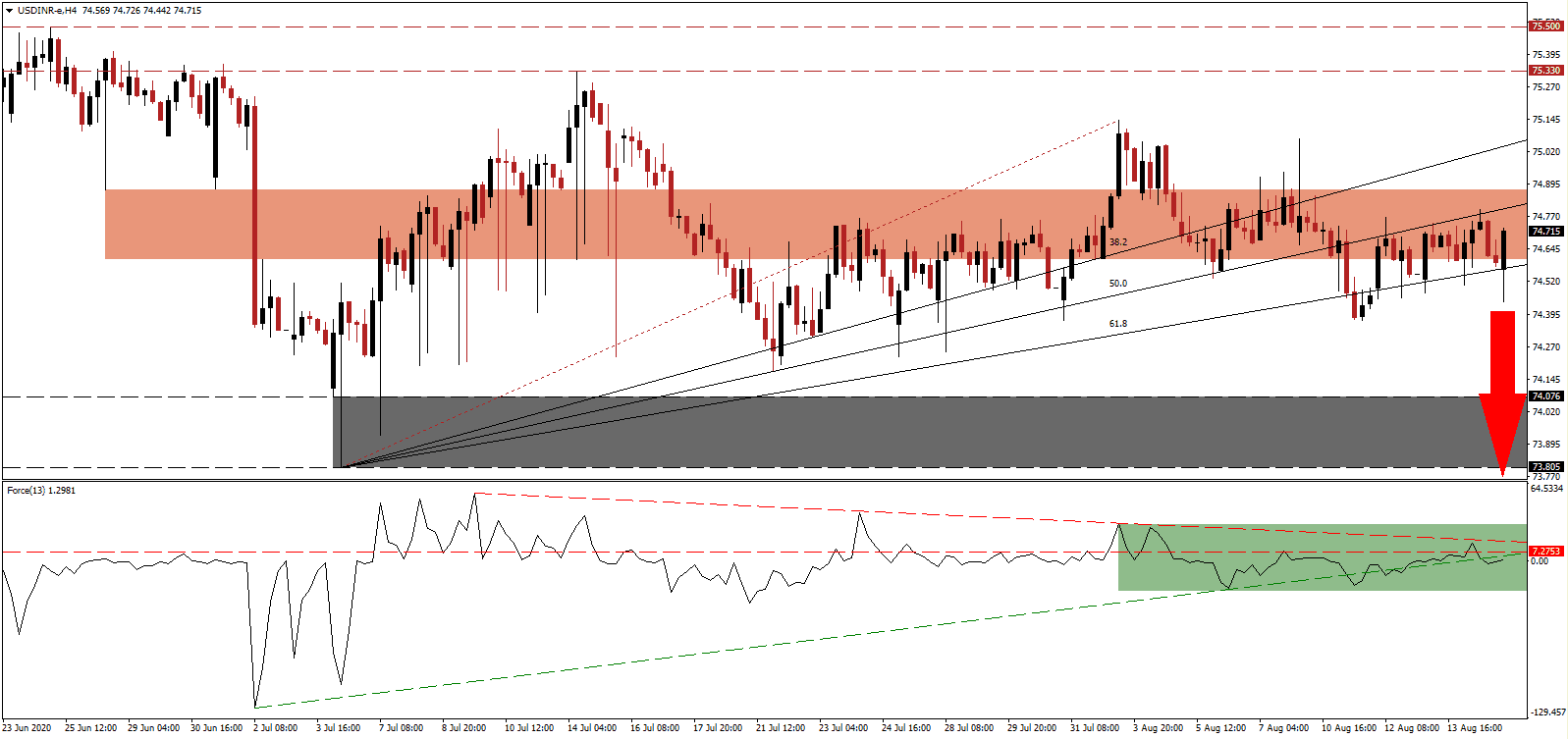

The Force Index, a next-generation technical indicator, confirms the dominance of bearish momentum and maintains its position below the horizontal resistance level. A brief spike above it resulted in a collapse below its ascending support level, as marked by the green rectangle, while the descending resistance level is adding to downside pressures. Bears wait for this technical indicator to cross below the 0 center-line to regain control of the USD/INR.

Prime Minister Modi added that over 7,000 infrastructure projects were identified to support the digital health plan, for which his government plans to invest $1.46 trillion. It will form the core element of a job recovery for India, expected to lift the economy. He added that three vaccines are presently under development in India. Positive long-term catalysts are likely to result in the short-term resistance zone located between 74.605 and 74.872, as identified by the red rectangle, rejecting price action in the USD/INR.

Per his remarks during the celebrations marking 74 years of independence from the UK, he stressed that one lesson learned from the pandemic was the need to become a self-sustained manufacturing base and essential supply-chain destination for international firms. A breakdown in the USD/INR below its ascending 38.2 Fibonacci Retracement Fan Support Level will clear the path for price action to drop into its support zone located between 73.805 and 74.076, as marked by the grey rectangle. More downside cannot be excluded, and the next support zone awaits between 72.433 and 73.214.

USD/INR Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 74.720

Take Profit @ 73.000

Stop Loss @ 75.100

Downside Potential: 17,200 pips

Upside Risk: 3,800 pips

Risk/Reward Ratio: 4.53

An accelerated advance in the Force Index above its descending resistance level could lead the USD/INR into a short-term price spike. Forex traders should view any upside from present levels as a secondary selling opportunity, due to the persistent and worsening outlook for the US Dollar. The upside potential remains limited to its downward revised resistance zone between 75.330 and 75.500.

USD/INR Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 75.250

Take Profit @ 75.500

Stop Loss @ 75.100

Upside Potential: 2,500 pips

Downside Risk: 1,500 pips

Risk/Reward Ratio: 1.67