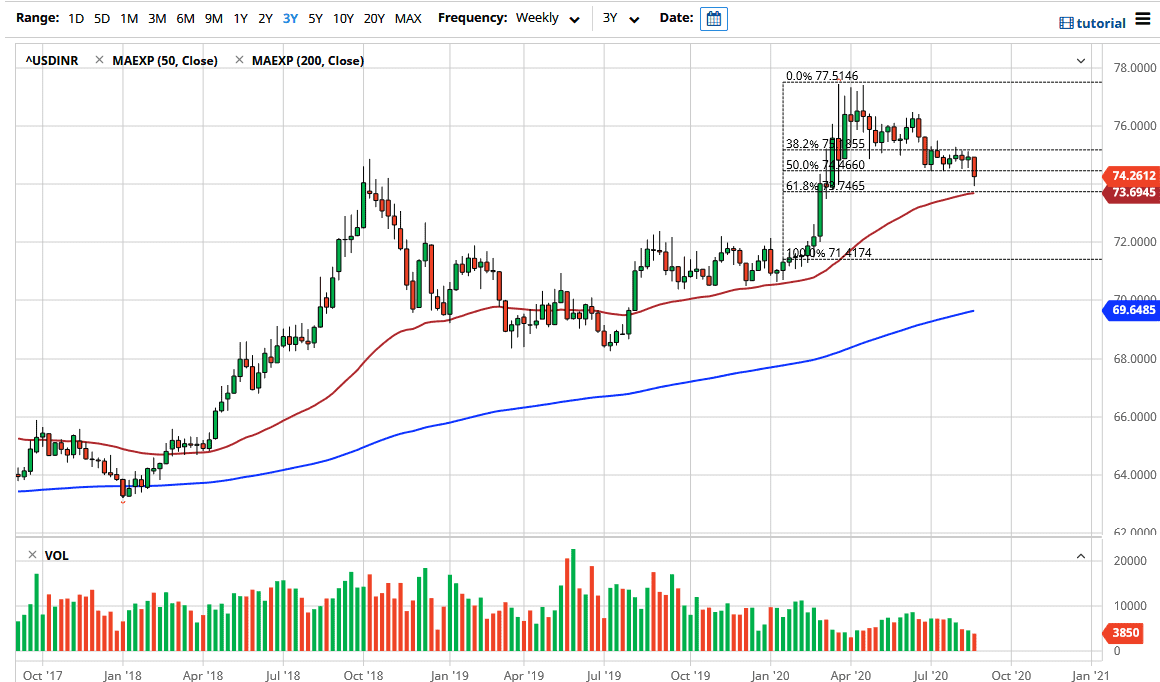

We had been in a massive uptrend previously, so a pullback to the 61.8% Fibonacci retracement level makes perfect sense. Adding more credence to that level is the fact that the 50 week EMA is sitting right there as well.

September should be a little bit more volatile than the month of August, as traders will have come back from vacation. Furthermore, we will get more headlines when it comes to the coronavirus infections coming out of India, which is now at over 3 million. That of course is one of the worst countries in the world, and with the un-even amount of medical care that is found in India, getting a handle on the infection may be a bit difficult. This could hamper the value of the Indian rupee going further, but right now I am paying more attention to the ₹73.50 level than anything else. It has offered little bit of support, and that convergence of the 50 week EMA, the 61.8% Fibonacci retracement level, and the fact that it was the top of an impulsive weekly candlestick gives me an idea that we will more than likely bounce.

The Indian rupee is perhaps one of the stronger emerging market currencies, so if money does flow back into EM, India could be one of the first places. After all, the longer-term outlook for India is very strong, and given enough time we can continue to expect quite a bit of growth in that country. However, there are a lot of concerns about global growth and of course leverage in the system, not to mention the fact there is a serious US dollar shortage still being a major problem for some of the emerging markets out there as well. This could continue to apply longer-term upward pressure, so I am more inclined to buying dips in the pair going through the month of September, and if we can break above the ₹75.25 level, I think that this market has a really good shot at reaching towards the highs again. If we broke down below the ₹72 level, that could open up the floodgates to mass selling, but we would need to see a major “risk on rally” in order to see that happen.