The US dollar has bounced again against the Indian rupee in the same general vicinity but faces a lot of headwinds just above. One of the biggest problems with trying to buy this pair is that although there has been an uptrend previously, the Federal Reserve continues to work against the value of the greenback. At this point, this pair is probably less about India and more about Jerome Powell.

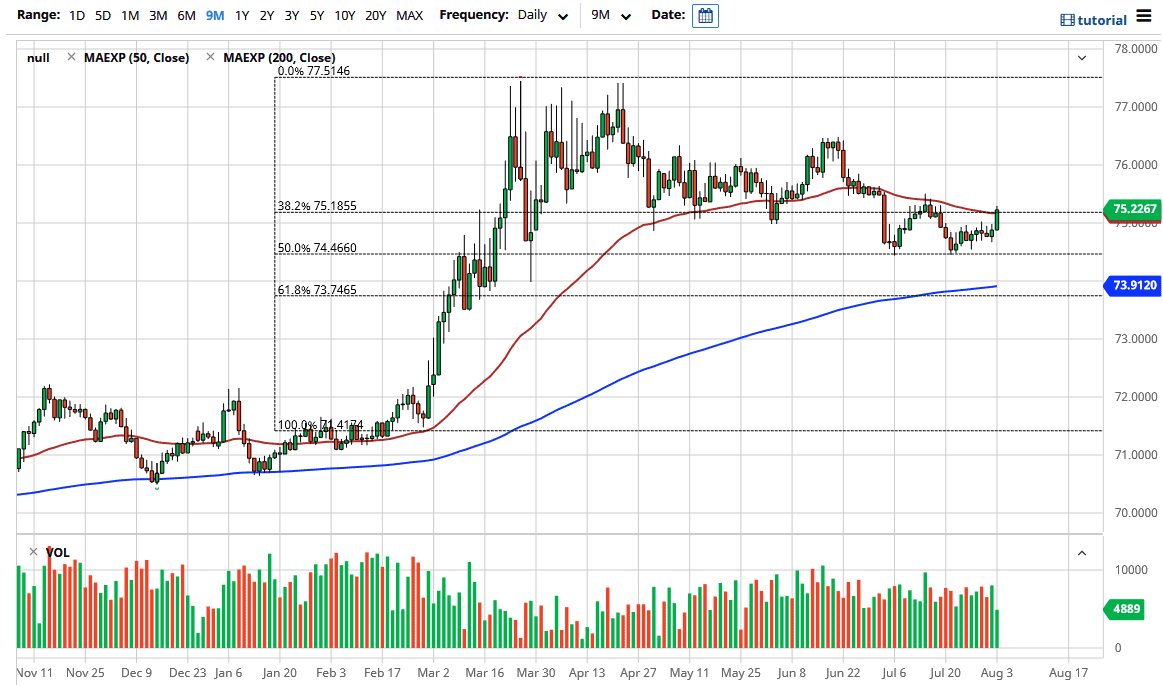

India represents a gateway to the emerging markets when it comes to the FX arena, so it will be interesting to see how this plays out. Clearly, the US dollar has had a little bit of a rally from the ₹74.50 level last week, to reach towards the ₹75.25 level, and perhaps from a technical analysis standpoint the more important 50 day EMA. That being said, I think that eventually we will try to break out in one direction or the other and I would be particularly interested in the ₹75.50 level if we break above there. At that point, we will have completed a “W pattern”, which could send the pair towards the ₹76.50 area.

On the other hand, if we get a little bit of exhaustion here on short-term charts, we could very well drop to the ₹74.50 level, where we bounce from just over a week ago. If we break down below there then the next area the market will go looking towards will be the ₹73.91 level, where the 200 day EMA currently sits. I think you can probably count on a lot of choppiness in this pair because quite frankly it is the constant “push-pull” that you get between the Federal Reserve loosening monetary policy and the emerging market growth. India has been one of the hotspots for coronavirus, so that has worked against the rupee as of late, but it seems as if FX markets are paying attention to the Federal Reserve more than anything else in other markets, so it is hard to believe that it will be any different here over the longer term. At this point, we are probably looking to play in this overall range, but those levels that I mentioned previously could be signals to go in one direction or the other. Until then, keep your position size relatively light, because this pair could see sudden jobs.