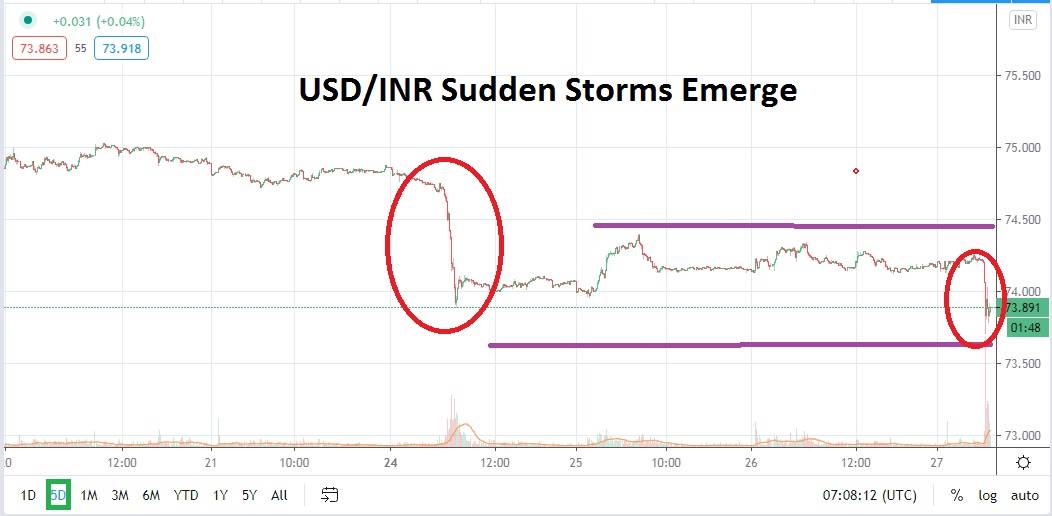

After demonstrating a sudden selling spike downwards early this week and reestablishing its bearish trend the USD/INR traded with plenty of sideways price action. Short term resistance and support levels were not technically challenged very much in the past two days. However, a sudden burst down again this morning has emerged in early trading and sets the tone for the likelihood of volatility to be rampant.

While the bearish trend mid-term for the USD/INR has remained intact, speculators may believe a reversal upwards could develop short term if they are courageous enough to fight against the brisk waters which have created another selling surge this morning. Risk appetite in the global markets has been strong and investor optimism has certainly been on full display, even as long term questions remain daunting regarding the total economic implications of coronavirus and its impact.

Selling may remain the dominant theme and the USD/INR trend has shown the ability to challenge support levels. A look at mid-term charts shows the Indian Rupee is beginning to challenge and traverse values which were seen before concerns about the global pandemic reached India. However, the fast-selling which emerged earlier this week and this morning should also make speculators nervous.

Yes, the USD/INR may begin to challenge its March values in a strong manner, but short term the Indian Rupee may see skepticism about this week’s spikes which have been downward. Support levels appear vulnerable as trading remains fast, but speculators should also keep their eyes open for sudden higher reversals to appear. The 73.7000 may be targeted next if bearish momentum continues to be generated in the USD/INR. These are fast trading conditions ladies and gentlemen so be prepared for the potential of whipsaw movements.

The mid-term trend for the USD/INR has been bearish, but speculators who want to participate in the coming two days should also keep in mind news which can develop from afar. The US is about to be potentially clobbered by a hurricane that could impact global short term trading sentiment and cause a sudden desire for safe-haven trading. While the USD/INR remains solidly bearish, traders should acknowledge that risk appetite may soften depending on the scale of the storm in the United States and its effects before going into the weekend.

The USD/INR should be looked at carefully today; its quick selling spurt this morning has highlighted its bearish trend. However, speculators may be skeptical of the move and believe it is happening too fast and that reversals could develop short term.

Indian Rupee Short Term Outlook:

Current Resistance: 74.4000

Current Support: 73.7000

High Target: 74.6000

Low Target: 73.5000